More Than 9% Stock Price Move Expected for Micron Earnings

More Than 9% Stock Price Move Expected for Micron Earnings

By:Mike Butler

With high implied volatility and expectations for a large move, investors should not ignore this stock

- Micron is set to report quarterly earnings after the stock market closes on Wednesday.

- Leading up to this week's announcement, Micron has exceeded earnings expectations four quarters in a row.

- The earnings-per-share estimate is more than double that of last quarter.

- Micron is expected to report earnings per share of $1.11 on $7.64 billion in revenue.

Micron earnings preview

Micron Technology (MU) is set to report quarterly earnings on Wednesday. The American tech company has surged onto the scene the past few years with the AI and tech boom we've seen in the broader market, and MU stock has been a direct beneficiary.

Micron started the year at $84 and currently sits up around $93.50, up over 11% on the year. But that doesn't tell the whole story because the stock saw a recent high of $157.53 before the recent summer sell-off. With such volatility around the stock price this year, it's no surprise to see high implied volatility before earnings announcement.

A very positive sentiment can be seen in the previous earnings call release from Micron: ”As we look ahead to 2025, demand for AI PCs and AI smartphones, and continued growth of AI in the data center, create a favorable set up that gives us confidence that we can deliver a substantial revenue record in FY25, with significantly improved profitability underpinned by our ongoing portfolio shift to higher margin products."

As you might image, AI is the main driver of Micron's success, and that trend seems to just be getting started.

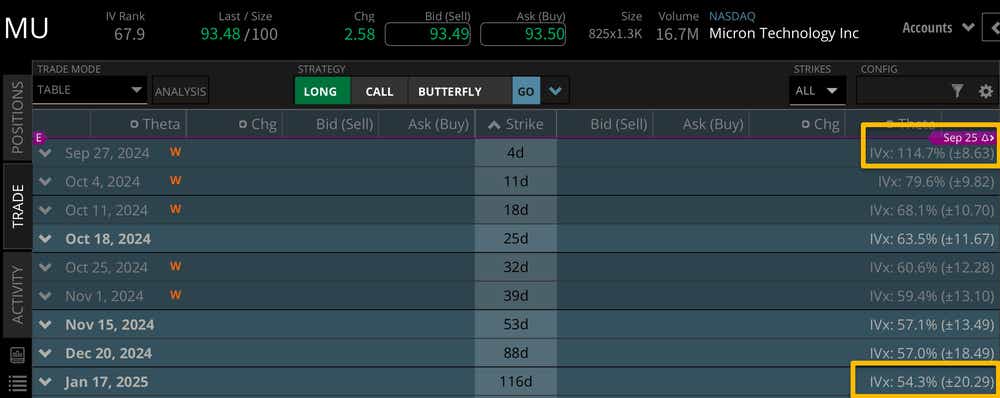

Looking at the implied volatility for this week's options expiration, which contains the earnings announcement, we can see the market is pricing in a +/- $8.63 stock price move. This is a large expected move of just over 9% of the notional value of the stock price—most earnings reports fall within the 5%-10% range.

Looking ahead, we see a stock price move of +/- $20.29 through the January 2025 options expiration cycle. That means this week accounts for nearly half of the expected move through the end of the year, which is certainly notable.

Bullish on Micron stock for earnings

Investors who are bullish on Micron for earnings are looking for an outperformance from an earnings per share (EPS) and revenue standpoint, and strong sentiment moving forward.

Given that MU beat earnings estimates last quarter and the stock still sold off solidifies this sentiment. It could be boom or bust for MU earnings this week, which may be why the implied volatility is so high.

Still, if Micron can blow the estimates out of the water and paint a great picture for the rest of the year, we could see the stock open higher on Thursday.

Bearish on Micron stock for earnings

Bearish traders for MU earnings are definitely looking for a weak earnings report. Consider the fact MU stock sold off last quarter on an earnings beat, and it seems like a small probability that the stock would rally on an earnings miss.

Any sort of slowdown or pull-back in estimates through the end of the year, and we could see the stock lower on Thursday.

Either way you slice it, MU earnings cannot be ignored this week with such a high implied volatility and expected move in the stock price. Tune in to Options Trading Concepts Live at 11 a.m. CDT on Wednesday for a deeper look at options strategies ahead of the announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.