Amid DeepSeek Disruption, Meta Soars While Microsoft Slumps

Amid DeepSeek Disruption, Meta Soars While Microsoft Slumps

New AI from China shook up the markets this week, heightening scrutiny of big tech earnings reports

- DeepSeek has disrupted AI, sparking concern about spending by tech giants like Microsoft and Meta.

- After yesterday’s earnings report, Microsoft shares dipped because of slower growth in the use of the cloud.

- Meta's stock rose on strong AI-driven Q4 results despite a cautious 2025 outlook.

- Other stocks suffering from the DeepSeek disruption, such as Broadcom and Nvidia, look more appealing.

Meta (META) and Microsoft (MSFT) still plan to spend tens of billions of dollars on artificial intelligence in the coming year despite this week’s DeepSeek disruption. That’s the upshot from yesterday’s earnings reports, which also touched off a rally for shares in Meta and caused a dip for stock in Microsoft.

DeepSeek-R1, the unexpectedly good large language model from China, is generating skepticism about the U.S. tech sector’s power to continue its dominance in AI. But other factors also affected stock prices overnight after the earnings calls. Meta’s AI investments paid off, while Microsoft’s shares took a hit after the growth of its cloud business slowed.

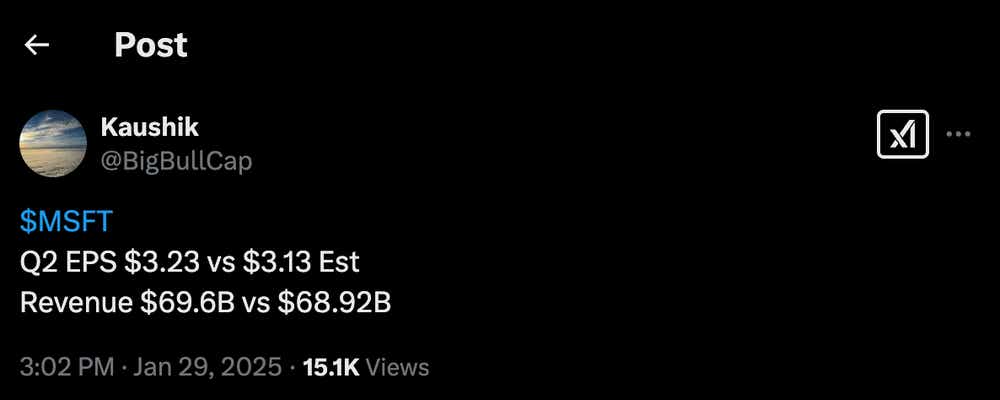

Despite that slowdown, Microsoft ’s earnings surpassed Wall Street’s expectations for second-quarter 2025. The tech giant posted earnings per share (EPS) of $3.23, beating the consensus estimate of $3.11. Revenue of $69.6 billion exceeded analysts' expectations of $68.7 billion. But the stock declined sharply in after-hours trading because ofr weaker-than-anticipated performance in the company’s crucial Azure cloud business.

Parsing the details, Microsoft’s revenue increased by 12.3% year-over-year—its slowest growth rate since mid-2023. Azure’s revenue grew by 31% year-over-year but fell short of the 32% that analysts expected. This miss triggered a negative reaction in the market because the cloud plays a central role in Microsoft’s business strategy.

The company’s Intelligent Cloud division, which includes Azure, posted $25.5 billion in revenue, up 19% year-over-year, but missed consensus expectations of $25.8 billion. The slower-than-expected growth suggests Microsoft may face challenges in its cloud business, given intense competition from rivals such as AWS from Amazon (AMZN) and Google Cloud from Alphabet (GOOG). What’s more, the growth rate for the maturing Azure business decelerated from 33% in the previous quarter.

On a more positive note, Microsoft’s other business segments performed well. The Productivity and Business Processes division, which includes Office software subscriptions and LinkedIn, generated $29.44 billion in revenue, a 13.9% increase that exceeded the consensus estimate of $28.9 billion. The More Personal Computing segment, which includes Windows, Surface and Xbox, brought in $14.7 billion, slightly more than the expected $14.3 billion. However, the flat year-over-year growth in the More Personal Computing division raises questions about the prospects for Microsoft’s legacy businesses, especially as the cloud and AI continue to take center stage in the company’s broader strategy.

Meta earnings well-received

Meta’s fiscal fourth-quarter earnings for 2024 exceeded Wall Street’s expectations, prompting the stock to rise by about 5%. The company reported EPS of $8.02, well above the anticipated $6.75, and revenue of $48.4 billion, compared to analysts' projections of $47.0 billion. That represents a 21% year-over-year increase in revenue, thanks partly to Meta’s successful pivot toward AI.

While the results were strong, the company issued mixed guidance for the upcoming quarters. For the first quarter of 2025, the company anticipates revenue of $39.5 billion to $41.8 billion for a more-moderate growth rate of 8% to 15% year-over-year. That’s a notable slowdown from the 21% growth posted in Q4. This cautious outlook suggests Meta expects momentum to slow as it absorbs the higher costs of investing in AI infrastructure.

That guidance aside, the market seemed reassured by Meta’s overall performance and its aggressive plans to develop AI in 2025. The company want to build a massive data center and expand its AI teams. It also aims to strengthen its position in the AI race with its Llama 4 model and initiatives in augmented reality and smart glasses.

However, Meta warns that expenditures will grow faster this year than last. It expects capital expenditures to fall between $114 billion and $119 billion this year, up from $95 billion in 2024. Contributing factors include new AI infrastructure and an expanded AI workforce.

AI expenditures continue despite DeepSeek

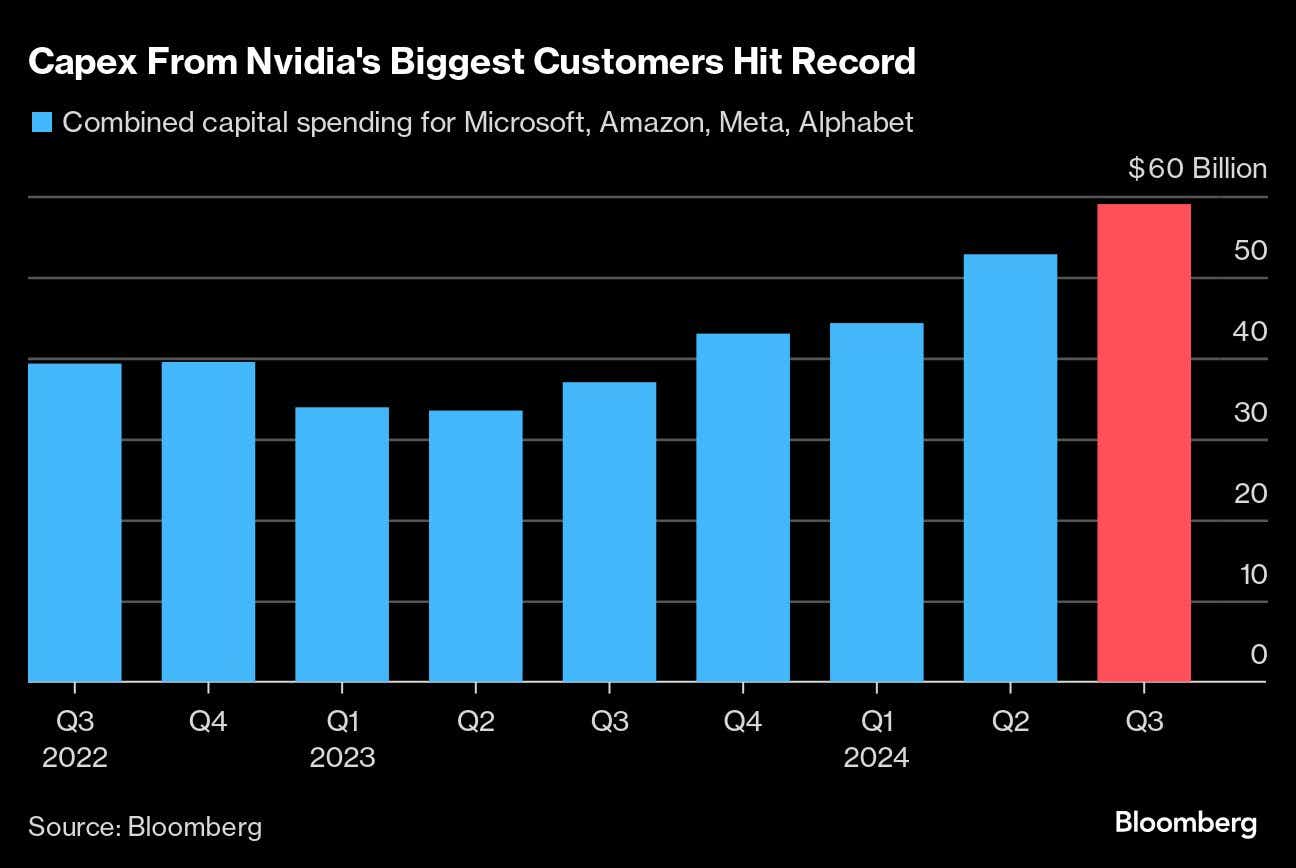

In the wake of DeepSeek-R1, which was reportedly developed and trained for a fraction of the cost of U.S. AI, speculation has been growing this week that the gigantic capital expenditures (capex) driving the AI boom could slow down. Some were wondering whether companies like Meta and Microsoft might reconsider their massive capex commitments for 2025.

However, both companies confirmed in their earnings reports that this year’s ambitious spending plans for AI infrastructure—$60 billion to $65 billion at Meta and $80 billion at Microsoft—suggest the AI investment trajectory remains unchanged at least for now. Meta’s forecasted increase in expenses and its focus on expanding its AI teams and infrastructure speaks to its ongoing commitment to these initiatives, while Microsoft has similarly doubled down on its AI investments despite competition from lower-cost alternatives.

But these earnings reports were probably prepared before the DeepSeek-induced sell-off on Monday, when the market’s fears about rising AI costs became more pronounced. These companies had already committed to huge capex spending, making it difficult to pivot their messaging in the immediate aftermath of what happened Monday.

Besides, Meta and Microsoft’s tone on AI spending likely reflects more than just optimism about their own capabilities—it’s also a strategic move to maintain their positions as VIP customers with AI chip makers and other suppliers. If these companies were to signal a reduction in their investment plans, they would risk causing a shift in the priorities of the suppliers they rely on for cutting-edge AI hardware and services.

Their stances suggest Silicon Valley isn't shying away from the future of AI. Instead, they’re leaning into it. On Microsoft’s earnings call, Satya Nadella, the company’s CEO, noted that “DeepSeek's R1 launched today via the model catalog on Foundry and GitHub, featuring automated red teaming, content safety integration and security scanning.” Yes, she made sure to mention Microsoft’s Foundry and its GitHub.

Meta CEO Mark Zuckerberg also seemed to allude to possible cooperation or even collaboration with DeepSeek. “There are a number of novel things that they did that I think we're still digesting,” he said. “And there are a number of things that they have advances in that we will hope to implement in our systems.”

TikTok decision remains a catalyst

Meta's fourth-quarter earnings were impressive, and the stock has surged beyond $700 per share as Luckbox anticipated in our bullish Dec. 9 analysis of the stock. The company’s solid financial performance, bolstered by strong growth in revenue and ambitious AI investment, point to a promising future. But while near-term prospects remain favorable, there are now some reasons for caution.

The company’s guidance for upcoming quarters was less robust than many expected, particularly its forecast of a slowdown in revenue growth for Q1 2025. Less momentum, given the maturing of the social media market and competition from platforms like TikTok, has tempered bullish sentiment. While Meta has continued to pivot successfully toward AI and immersive technology, TikTok’s continued presence threatens its dominance, especially among younger audiences. TikTok may avoid a ban, meaning Meta’s path isn’t without barriers.

For now, we maintain a “hold” rating on Meta shares. However, if the TikTok ban is enacted, we’d adjust our stance to a “buy.” Free of that competitor, Meta could increase its advertising revenue and improve user engagement.

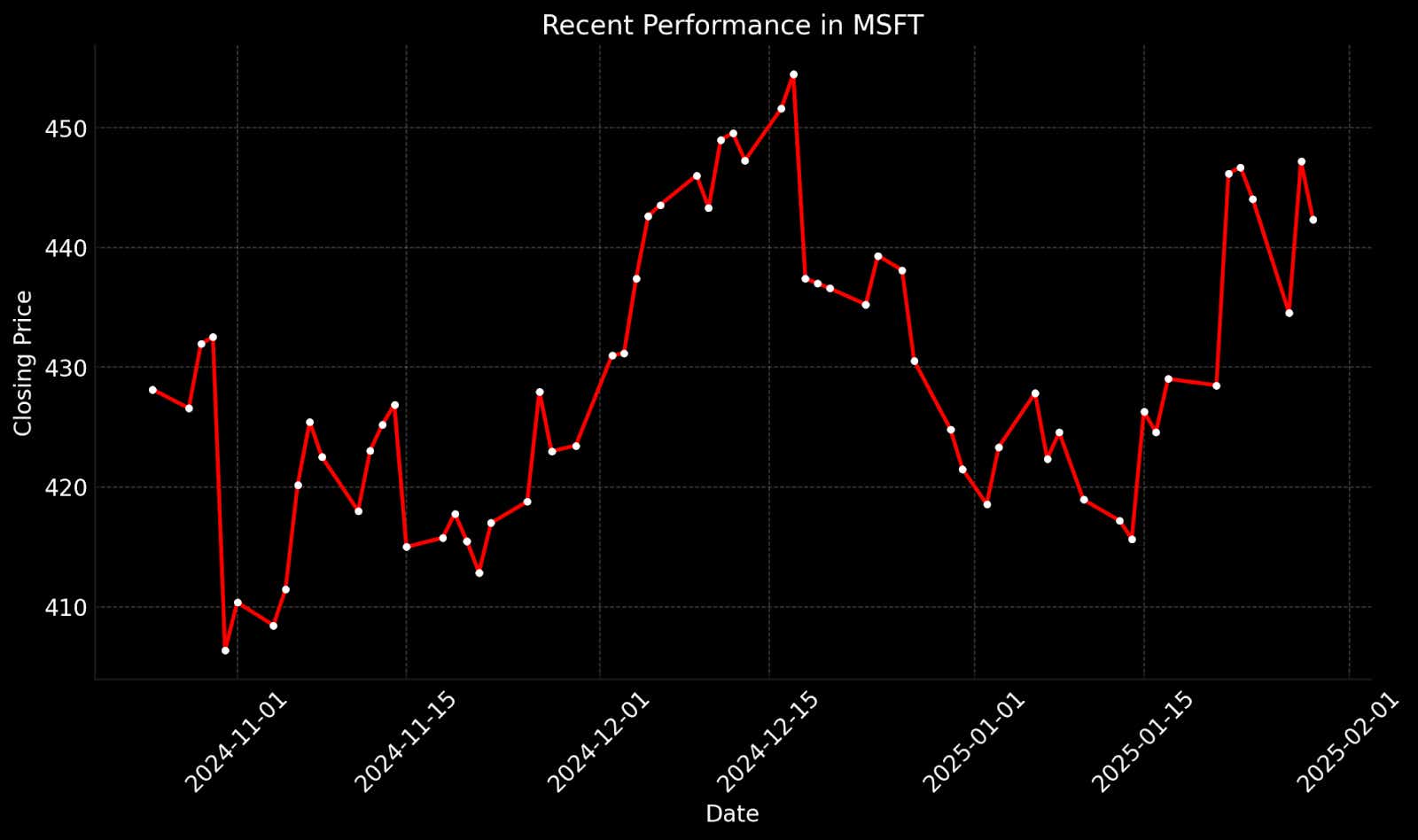

Microsoft shares lose their luster after earnings

Microsoft's earnings report, while solid, didn't quite hit the mark in the eyes of the market, particularly in the crucial cloud segment. Azure’s slowdown was more severe than analysts expected. This underperformance in Azure, which is central to Microsoft’s transformation into a cloud and AI powerhouse, left investors questioning the company's ability to maintain its growth trajectory in the cloud sector. Although the company reported a 12.3% increase in total revenue and beat EPS expectations, the less-than-stellar performance in Azure, dampened investor sentiment. In after-hours trading, the company’s stock fell as much as 5%.

Microsoft’s valuation—the stock trades at a GAAP P/E ratio of around 37—is still above the sector median of 31. While the company undoubtedly commands a premium because of its leadership in cloud computing and AI, this elevated multiple suggests much of the upside may already be priced into the stock. Its price-to-sales (P/S) ratio of 13 and price-to-book (P/B) ratio of 11.5 are considerably higher than the sector averages of 3.0 and 3.5, respectively. That indicate that market is not underestimating Microsoft’s potential. On the contrary, the stock’s premium valuation could make it less attractive for investors seeking value at current levels.

The market's response to Microsoft's earnings amid the DeepSeek-triggered selloff, also points to the broader sentiment surrounding AI investment. Despite Microsoft’s strong positioning with OpenAI and its $80 billion AI infrastructure plan for 2025, the market appears to be recalibrating its expectations for the cost of AI. With cheaper alternatives like DeepSeek emerging, concern is mounting about the sustainability of heavy investment in AI. Microsoft's valuation could reflect uncertainty about whether its planned capex investment will bring the promised returns.

Still, Microsoft remains a key player in AI and the cloud, and likely belongs in any diversified portfolio. Of the 60 analysts who cover Microsoft, 57 rate the shares “buy” or “overweight.” However, investors considering new positions have arguably more attractive options. Nvidia (NVDA), in particular, stands out. With its focus on AI hardware, Nvidia is more directly exposed to the AI boom, and its stock has pulled back significantly in the wake of the DeepSeek news, making it potentially more appealing from a valuation standpoint. Broadcom (AVGO), another major player in AI chips, looks more attractive after the DeepSeek-induced selloff. Its shares are down about 15% since Monday.

Takeaways

Meta’s strong earnings and commitment to a huge investment in AI tell a compelling growth story despite a cautious outlook for 2025. With a projected spend of up to $65 billion on AI infrastructure, the company is betting big on its future. But the uncertainty surrounding TikTok and a slight slowdown in growth mean it’s a stock to watch closely. For now, we rate shares a “hold,” but if the TikTok ban materializes, Meta’s fortunes could change dramatically, making it a "buy" in a heartbeat.

Microsoft, meanwhile, presents a more complicated picture. Despite strong earnings, the slowdown in Azure’s growth and the competitive pressure from rivals are hard to ignore. Microsoft’s lofty valuation at a P/E of 37 makes it less attractive, especially if its cloud strategy hits a bump. For now, investors may want to look elsewhere for a more compelling investment case.

For those seeking more direct exposure to the AI boom, Nvidia and Broadcom may offer better value. With their direct exposure to AI hardware, these companies are integral to the AI revolution. The recent pullback in their stock prices, especially in the wake of the DeepSeek disruption, presents a potentially attractive entry point in either stock—or both.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.