What's Next for Meta in 2024? Over $100 Stock Price Move Expected

What's Next for Meta in 2024? Over $100 Stock Price Move Expected

By:Mike Butler

Now a dividend-paying stock Meta explodes to an all-time-high stock price

- Meta reported Q4'23 earnings and the stock surged past expectations to new all-time highs.

- Meta beat both earnings-per-share and revenue expectations after reporting $5.33 EPS on $40.11 billion in revenue.

- Meta surprised the market with a quarterly dividend declaration - the first being $0.50 per share payable on March 26, 2024.

Mark Zuckerberg has cracked the top-five richest people in the world, surging past Bill Gates after such an impressive earnings rally in Meta Platforms (META).

In our initial earnings preview for Meta, we outlined that the expected stock price movement after the earnings call—based on current implied volatility—was +-$26.66. The stock closed at $394.78 on Feb. 1, and rose to a new all-time high of $485.96 the next day following the stellar earnings call. From the closing price to the peak, that's a $91.18 rally—almost 3.5 times the earnings expectation to the upside.

EPS and revenue top expectations

Meta beat both earnings-per-share (EPS) and revenue expectations after reporting $5.33 EPS on $40.11 billion in revenue.

In Meta's press release, it surprised the market with a quarterly dividend declaration starting in March:

"Today, Meta's board of directors declared a cash dividend of $0.50 per share of our outstanding common stock (including both Class A common stock and Class B common stock), payable on March 26, 2024, to stockholders of record as of the close of business on Feb. 22, 2024," Meta announced. "We intend to pay a cash dividend on a quarterly basis going forward, subject to market conditions and approval by our board of directors."

This is big news for the tech-giant, and a sign of maturation for Meta as a whole. Most investors are aware of Meta, but now that it's a dividend-paying stock, it could bring more dividend investors to the table.

Meta reported another strong quarter for advertising demand and a revenue increase of 16% year over year (YoY), and that trend may continue in 2024 with big events like the United States election, and the Paris Olympics ahead.

"In the fourth quarter of 2023, ad impressions delivered across our family of apps increased by 21% year over year and the average price per ad increased by 2% year over year," Meta reported. "For the full year 2023, ad impressions increased by 28% year-over-year and the average price per ad decreased by 9% year over year".

Looking at a long-term chart of Meta, we can see just how meteoric this rise has been from the recent low of $88.09 in November 2022.

What's next for Meta in 2024?

The recent success for Meta brings some questions to light—how high can this stock go? Can the recent move be erased this year if the overall market is weak? As options traders, we can look at the landscape of expiration cycles for Meta to put some probabilities around certain numbers.

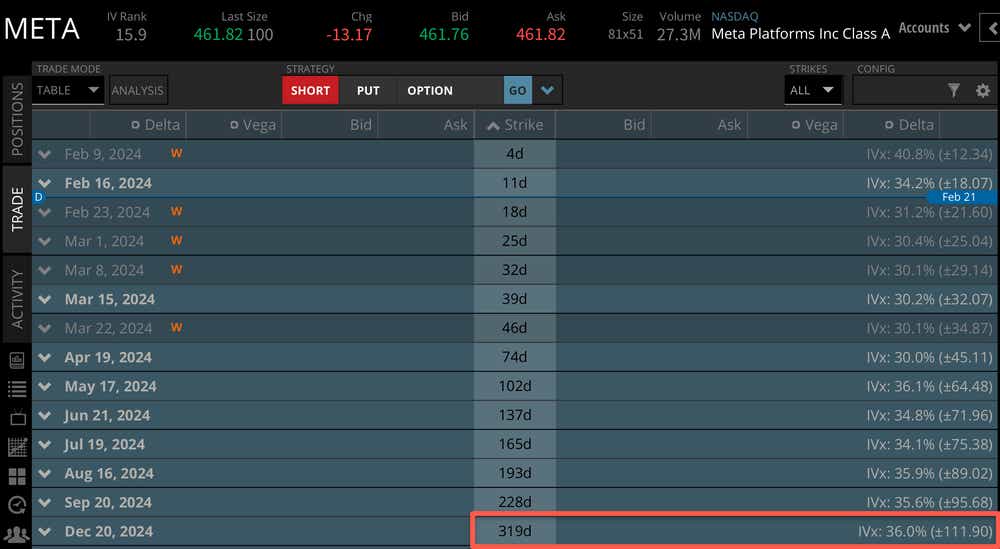

When looking at the table of expiration cycles for Meta stock, we can see that each expiration has a +- stock price expected move based on current options prices. To determine what the market expects from the stock price in 2024, we can use the closest expiration to the end of the year. In the image above, that's the December 2024 options cycle.

This cycle shows us an expected stock price move of +-$111.90 from the current price of $461.92. Using that figure, we have an expected stock price range between $350.02-$573.82 for just about the rest of the year.

Of course, this figure is just an estimate, but it helps us put context around what we can expect next from the tech giant. We can look back at this range at the end of the year to determine if current implied volatility covered the realized range, or if the stock price exceeds the expected range.

Traders and investors that were not paying attention to Meta before the most recent earnings call certainly are now.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.