Stock in Meta Rallying Ahead of Earnings

Stock in Meta Rallying Ahead of Earnings

By:Mike Butler

The stock is ripping to all-time highs, but revenue estimates are 15% higher than last quarter

- Meta Platforms is scheduled to report quarterly earnings after the market closes tomorrow.

- Analysts expect the company to announce earnings per share of $6.74 on $46.99 billion in revenue.

- Revenue estimates are up over 15% from last quarter.

- Meta has a strong earnings history, beating estimates four quarters in a row.

Meta Platforms (META) will report quarterly earnings tomorrow after the market closes, and the tech giant bears a lot of weight ahead of the earnings call. Not only is the stock price ripping to all-time highs ahead of the announcement, but revenue estimates are over 15% higher than last quarter and earnings-per-share (EPS) estimates are significantly higher as well. Meta has exceeded earnings expectations four quarters in a row, and the market seems to expect another strong report.

Meta is expected to report an EPS of $6.74 on $46.99 billion in revenue.

Mark Zuckerberg, Meta CEO, is fully invested in the AI transformation sweeping through tech. Just last week, he stated that Meta plans to invest $60 billion to $65 billion in artificial intelligence projects, including but not limited to a massive new data center in Manhattan.

In the previous earnings call, Meta chief financial officrer Susan Li offered words of encouragement for the future: “We anticipate our full-year 2024 capital expenditures will be in the range of $38 billion to $40 billion, updated from our prior range of $37-40 billion,” Li said. “We continue to expect significant capital expenditures growth in 2025.”

After the announcement of China's DeepSeek AI, which sent companies like NVIDIA (NVDA) plummeting, two notable standouts moved in the opposite direction and surged to the upside—Meta Platforms (META) and Apple (AAPL). Whether or not this was a liquidity rotation into big tech that was less tightly tied to the actual AI chip space, the market clearly favored Meta into the initial sell-off and beyond. In just over 24 hours, we will get a better picture of Meta's quarterly figures and hopefully more commentary around 2025 plans as well.

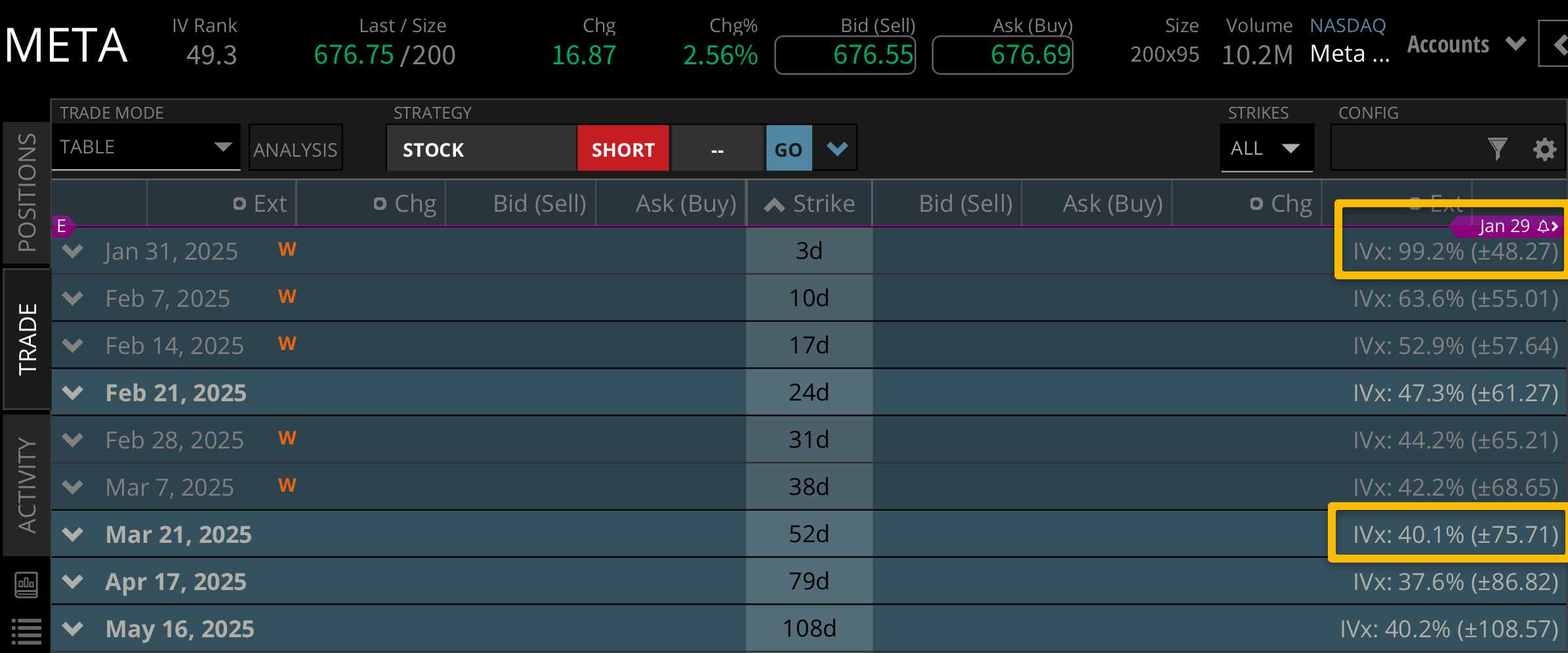

Looking at the implied volatility of the options cycle for this week, we can see a pretty large expected stock price move relative to the notional value of the stock.

This week, we're seeing a +/- $48.27 expected stock price move against the current price of $676. This is about 7% of the stock price, which puts Meta Platforms on the higher end of the typical 5%-10% stock price range we typically see for earnings announcements. Looking to the March expiration cycle, we can see a +/- $75.71 expected move. That means this week's announcement makes up for about two-thirds of the implied volatility priced into the next few months.

Bullish on META stock for earnings

If you're bullish on META stock for earnings, it feels almost certain that you'd need to see a big earnings beat from both an EPS and revenue perspective. Both figures are higher, but the stock price is surging to all-time highs as I type. It appears the stock market is very bullish on the tech giant ahead of earnings, but numbers don't lie—we'll need to see a big earnings beat to see this thing really take off to the upside.

Bearish on META stock for earnings

If you're bearish on META stock for earnings, any sort of EPS or revenue blunder, or a weak outlook for 2025, could stifle the rally we're seeing this week. If there is a big surprise miss, we could see a big stock price sell-off, considering the highs the stock has reached this week already. Market pressure can be a powerful accelerant—or an extinguisher of recent performance all the same.

Tune in to Options Trading Concepts Live at 11 a.m. CST tomorrow ahead of the META earnings call for an options trading strategy overview.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.