Meta Q3 Earnings Preview: Can the Company Beat Expectations?

Meta Q3 Earnings Preview: Can the Company Beat Expectations?

By:Mike Butler

The stock is up 65% in 2024, and investors are wondering about the Reuters deal

- Meta Platforms is set to report quarterly earnings Wednesday after the market closes

- META stock is up almost 65% in 2024

- Earnings for Meta have been stellar, exceeding earnings-per-share (EPS) and revenue expectations three quarters in a row

- Meta is expected to report $5.27 EPS on $40.30 billion in revenue this quarter.

- More information on the deal between Meta and Reuters will be a focal point

Stock in Meta Platforms (META) has had a great 2024 thus far, opening at $351.32 and currently sitting at $578, just off the recent high of $602.95. So far, the company has issued a quarterly dividend of $0.50 each quarter, beginning in Feb 2024. The Mag 7 tech company has seen great returns with AI and just inked a new deal with Reuters to feature news in Meta's AI chatbot. It's been a bullish year for Meta, but earnings are just around the corner and as we've seen many times—anything can happen after an earnings announcement.

Meta's earnings have exceeded expectations three quarters in a row, and expectations are even higher this quarter. Meta is expected to report an EPS of $5.27 on a whopping $40.30 billion in revenue.

In the last earnings call, Meta founder and CEO Mark Zuckerberg had positive words on the AI front: “We had a strong quarter, and Meta AI is on track to be the most used AI assistant in the world by the end of the year. We've released the first frontier-level open source AI model, we continue to see good traction with our Ray-Ban Meta AI glasses and we're driving good growth across our apps."

While the sentiment has been strong, and META stock is just off all-time highs, earnings can be a beast of a hurdle if sentiment turns south, especially after such a strong year for the tech giant.

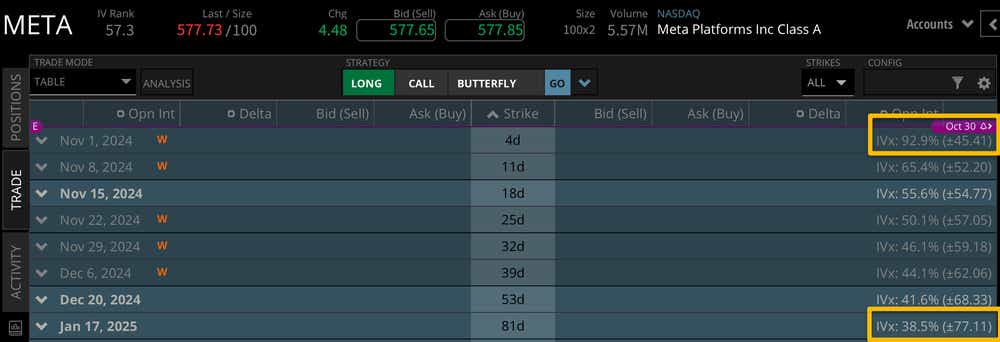

Looking at the current implied volatility landscape of the options market can tell us a lot about the expected earnings move for Meta Platforms. META stock has a +/- $45.41 expected stock price move through the end of the week, which contains the earnings announcement. With the stock price hovering around $578, this means the weekly expected move is around 7.7% of the current stock price, putting it on the higher end of the range for earnings that normally fall between the 5%-10% range for most stocks.

Looking through the end of the year, we can see a +/- $77.11 expected stock price move through Jan. 25. In other words, more than half of the move through the January options cycle is being priced into this week's earnings announcement. We can expected to see some big moves after the market closes on Wednesday when Meta releases quarterly earnings.

Bullish on META stock for earnings

Investors who are bullish on META stock are looking for a strong earnings report with an EPS and revenue beat, and positive sentiment around the new Reuters deal that will allow Meta to feature Reuters news in their AI chatbot. After such a strong year, Meta will need to outperform elevated earnings expectations if we're going to see the stock reach new all-time highs after the close on Wednesday.

Bearish on META tock for earnings

Bearish META traders are looking for a leak in the strength the company has shown thus far through 2024. Any sort of EPS or revenue miss could send the stock lower after three straight quarters of outperformance. The earnings expectations this quarter are significantly higher than last quarter's estimates, so a really strong quarter be needed to beat estimates again.

Whether you're bullish or bearish, expect some stock price movement in META after the close on Wednesday given the 7.7% notional value move that's expected for the rest of the week. Tune in to Options Trading Concepts Live on Wednesday at 11 a.m. Central for a deep dive into options strategies ahead of the announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.