Markets Shrug Off China Stimulus Plans as Economic Data Disappoints

Markets Shrug Off China Stimulus Plans as Economic Data Disappoints

By:Ilya Spivak

Stocks and copper retreat while deflation and weak trade data signal deeper troubles

- The markets aren’t impressed as China signals more stimulus is ahead.

- Investors are hoping for fiscal support as monetary measures disappoint.

- Chinese stocks, the Australian dollar and copper paint a dismal picture.

Financial markets offered a circumspect response as China signaled readiness to do more to revive its flagging economy this week. Most critically, the country’s top officials promised a “more proactive” fiscal policy in the year ahead after a meeting of the 24-member Politburo, a steering committee that includes President Xi Jinping.

On the monetary side of the ledger, a “moderately loose” stance will be pursued. That is more potent than it sounds. The same label was attached to policies undertaken from late 2008 to 2010 amid the global financial crisis and the Great Recession. Nevertheless, the fiscal bit matters most for markets.

A flood of Chinese monetary measures has failed to revive growth

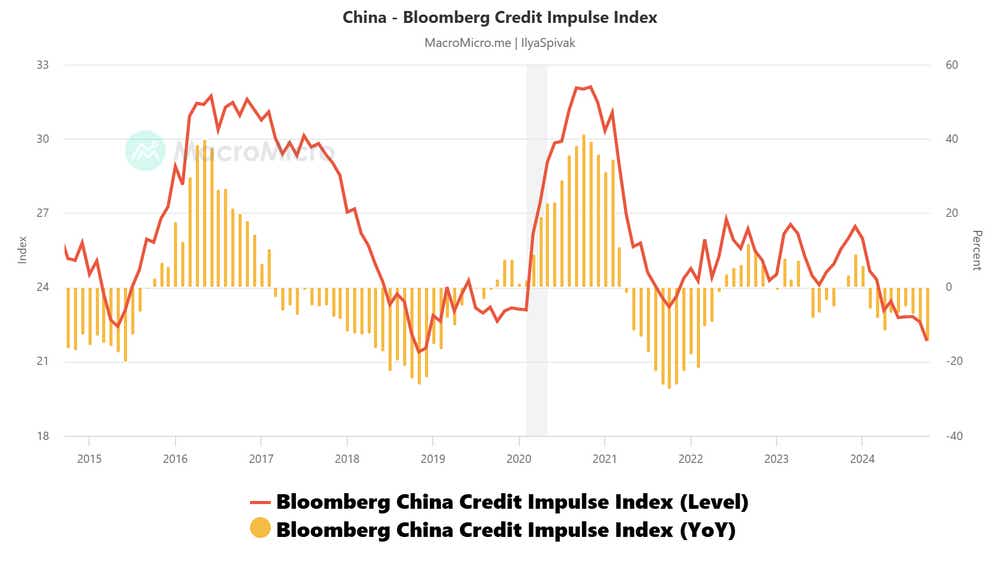

That is because monetary stimulus has plainly failed to deliver. The People’s Bank of China (PBOC) has delivered escalating policy support since early 2022. Benchmark interest rates and bank reserve requirement ratios have been cut, and a raft of measures were introduced to shore up the ailing housing market.

Nevertheless, the Bloomberg Credit Impulse gauge measuring the share of new loans in gross domestic product (GDP) dropped in October to the lowest point since December 2018. The contribution from credit growth fell for a ninth consecutive month, shrinking at a blistering rate of 14.5% year-on-year. That’s the fastest since February 2022.

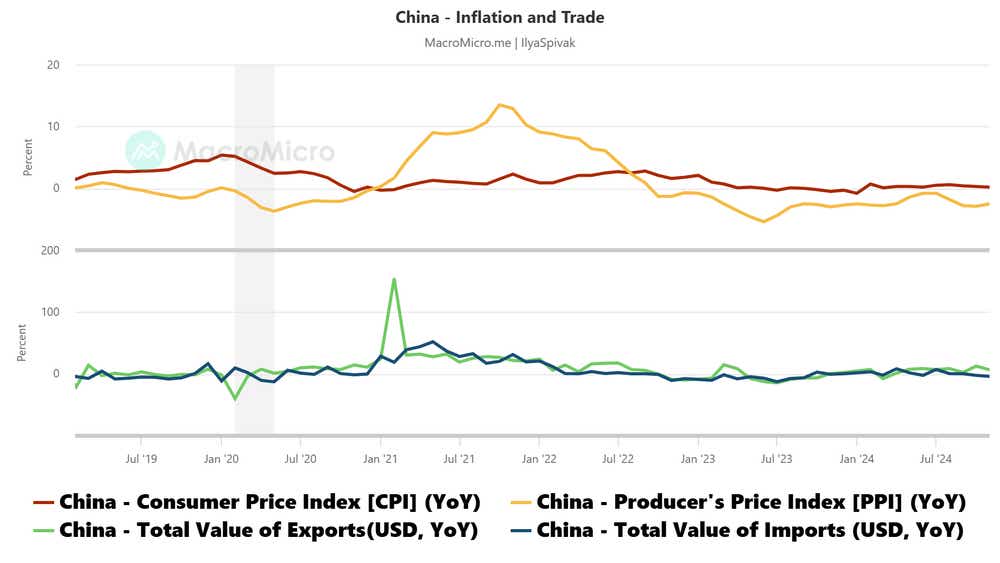

This has left China mired in a deflationary slump. For six consecutive quarters, nominal expansion of gross domestic product has been slower than real growth, which has been adjusted to factor out inflation. This points to a negative coefficient on prices, implying anemic demand has forced the whole of the economy into the discount bin.

Markets shrug off another Chinese hint at fiscal stimulus

Against this backdrop, markets have long hoped for a big dose of government spending to restart momentum. They roared with approval in September when the Politburo signaled that it was finally overcoming its reluctance to open Beijing’s purse strings in earnest. Local stock markets jumped nearly 40% in a mere six days.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

What followed proved underwhelming. Pledges to shore up municipal finances as well as buy up idle land and commercial properties stopped short of direct demand generation. Once again, officials seemed to offer inducements to tempt everyone but the central government to spend.

China’s benchmark CSI 300 stock index tracking the top issues in Shanghai and Shenzhen promptly erased half its breakneck rally, then settled into a choppy sideways range for the next two months. The latest promise to get serious about fiscal stimulus failed to dislodge shares from this perch.

China’s trade and inflation data disappoint yet again

Meanwhile, data flow from the world’s second-largest economy continues to disappoint. Consumer price index (CPI) figures published this week showed inflation unexpectedly slowed to 0.2% year-on-year in November, the weakest in five months.

Trade figures missed the mark as well. Exports grew 6.7% year-on-year last month, undershooting forecasts anticipating a rise of 8.5%. Imports looked still more troubling. They fell 3.9% year-on-year, a yawning misfire relative to expectations of a 0.3% increase and the biggest drop since February. This marked escalation after a 2.3% decline in October.

All this has made for soggy trade in China-dependent markets. Copper prices popped higher as the Politburo teased fiscal stimulus but have since retreated, erasing more than half of the advance. The about-face for the Australian dollar was even more dramatic. It also cheered the news but has since flipped over to track down on the week.

Perhaps the market will be ready to give President Xi and company the benefit of the doubt at some point, but this week’s price action suggests that time is not now.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.