Recession May Now Be Inescapable for the Markets: Macro Week Ahead

Recession May Now Be Inescapable for the Markets: Macro Week Ahead

By:Ilya Spivak

Stocks and the dollar may fall again but bonds are aiming higher as recession fears take center stage

- Markets stepped back from the brink last week as the White House cooled its tariff rhetoric.

- But incoming economic data will likely point to anemic growth in China and Europe.

- Global recession might be inescapable as the U.S. converges on weakness elsewhere.

Stock markets managed a rebound last week. The bellwether S&P 500 added 4.5% while the tech-oriented Nasdaq 100 rose 6.3%. Borrowing costs eased across the yield curve. The 10-year Treasury rate slipped 1.8% while the two-year fell 1.2%. Gold prices declined 0.9% and the U.S. dollar stabilized against the euro and the Japanese yen.

In all, this pointed to an embrace of the flash of moderation coming from the White House. Treasury Secretary Scott Bessent said a trade deal with China is inevitable because an embargo at both ends of the world’s most critical supply chain is untenable. Meanwhile, President Trump clarified that he will not try to fire Federal Reserve Chair Jerome Powell.

Speculation about the onset of global recession may now retake center stage, reverting to the way markets traded from mid-February as uncertainty about U.S. fiscal policy began to dampen economic growth. Stocks and the dollar may be back on defense while bonds rebound amid a steady stream of downbeat macro data points.

China’s economy continues to struggle

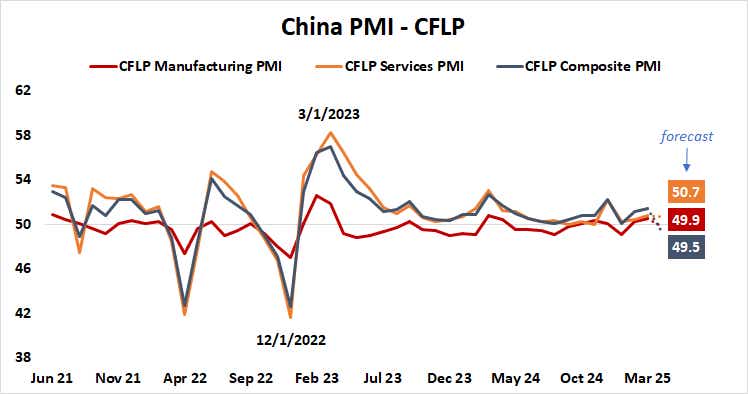

Official purchasing managers’ index (PMI) data is expected to put China’s economy at near-standstill in April. A sliver of growth in services is penciled in to narrowly offset an idle manufacturing sector. Meanwhile, slowing Australian inflation may point to the downstream effects of weak Chinese demand.

Australia’s consumer price index (CPI) figures are projected to show headline price growth slowed to 2.3% year-on-year in the first quarter. The so-called “lucky country” has enjoyed perky domestic demand recently but the weakest price pressure in four years might imply Australia is feeling the soggy uptake from its top trading partner.

Europe is still searching for lasting growth

Eurozone gross domestic product (GDP) data is expected to show growth remains difficult to come by in the currency bloc. A quarterly rise of just 0.2% is expected for the first three months of 2025, matching the previous period. Leading S&P Global PMI data has pointed to standstill since the middle of last year.

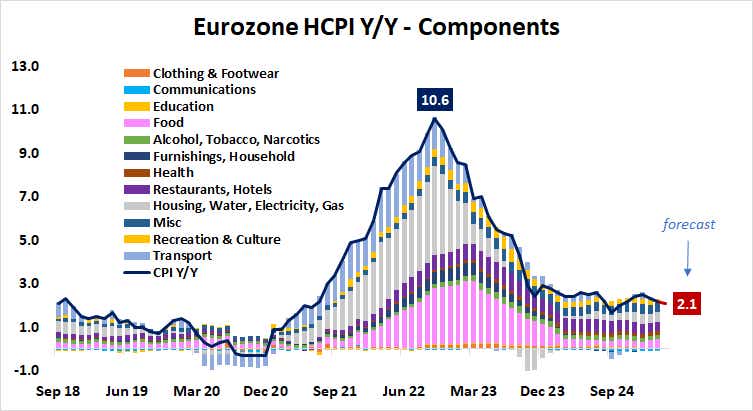

Meanwhile, CPI data is projected to show inflation cooled to 2.1% year-on-year in April, the slowest in six months. This seems to line up with a priced-in policy outlook calling for 60 basis points (bps) in further rate cuts this year from the European Central Bank (ECB).

However, a brighter view for next year might help underpin the euro.

Is the U.S. already slipping toward recession?

First-quarter GDP data is expected to show the economy grew a meagre 0.4% in the first quarter, marking the worst result since the three months ending June 2022. The Federal Reserve’s favored personal consumption expenditure (PCE) inflation gauge is seen coming down to 2.2% year-on-year, the lowest since September.

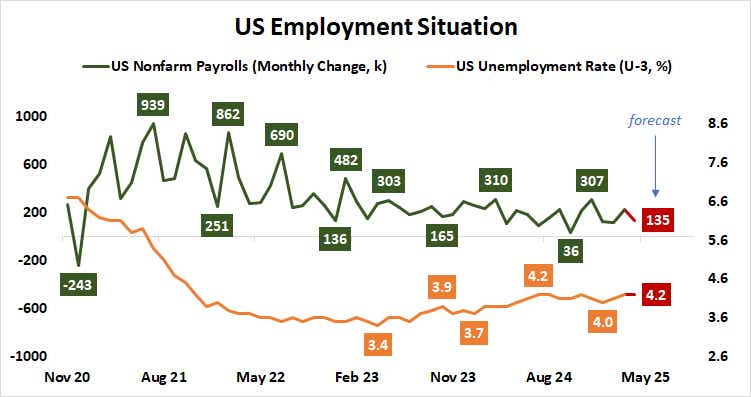

A survey tracking the manufacturing sector from the Institute of Supply Management (ISM) is projected to deliver the second consecutive month of contraction. The pace of decline is seen accelerating to the fastest in seven months. Official employment data are expected to bring a slowdown in jobs growth, with just 135,000 added to nonfarm payrolls.

April’s U.S. PMI data from S&P Global showed growth of U.S. economic activity slowed to its weakest in 16 months. Most worryingly, the weakness came from the service sector, which has been the top engine of global growth since May 2024. Recession may be inescapable if this falters while China and Europe remain anemic.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.