Markets May See Trump vs. Harris Outcome as Bet on Global Recession Risk

Markets May See Trump vs. Harris Outcome as Bet on Global Recession Risk

By:Ilya Spivak

China and Europe are leading the global economy in the wrong direction

- Polls show the U.S. presidential election deadlocked as voting begins.

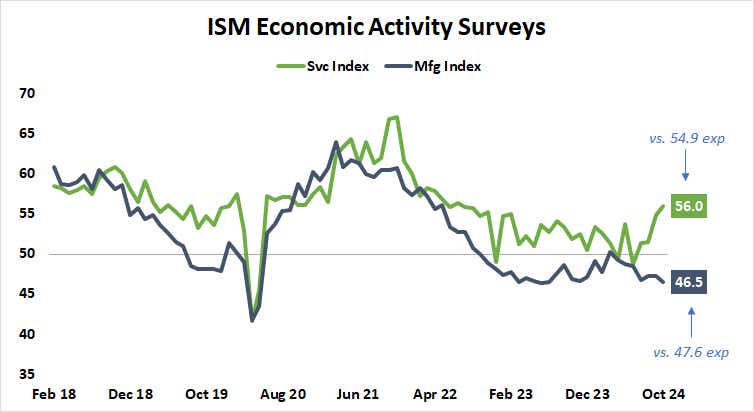

- ISM service-sector purchasing managers’ index (PMI) data shows the strongest growth in 28 months.

- U.S. strength coupled with global weakness points to risk of recession.

The margins look razor thin as Americans head to the polls to (hopefully) settle the arduous contest between Republican former President Donald Trump and current Vice President Kamala Harris for who will be next to occupy the White House. A polling average from Real Clear Politics gives Harris a lead of just 0.1 percentage points. That is a tie.

Political betting markets give an edge to Mr. Trump. Positioning on the U.S.-based Kalshi marketplace favors him with a margin of 58% to Harris’ 42%. His odds on PredictIt—another U.S. venue—are narrower at 54% to 51% for his Democratic Party rival. The offshore Polymarket has Trump ahead with 62.1% in a two-way race with Harris.

The U.S. economy shows potent strength in ISM service-sector data

When the dust settles, the election’s winner will stand in line to inherit an economy that a cover story in The Economist magazine dubbed “the envy of the world” last month. Data from the Institute of Supply Management (ISM) tracking conditions in the service sector emphasized as much even as America’s polling places took in votes.

The report showed that in October, the pace of economic activity growth in services unexpectedly rose to the highest since August 2022. That follows a 19-month high recorded in September. Rebounding employment stood out as an especially striking catalyst. Hiring grew at the fastest in 13 months following a contraction in the prior month.

The contrast between such strength and analog numbers tracking the other two engines of global economic growth—the Eurozone and China—is painfully stark. A final revision of October’s purchasing managers’ index (PMI) data from S&P Global due this week is expected to confirm that Eurozone economic activity contracted for a second month straight.

China and Europe heading in the wrong direction

The situation might be improving a bit in China, but only tentatively so. The PMI report compiled by S&P Global alongside Caixin—a Chinese media group–showed overall manufacturing and service sector growth rebounded in October to the fastest pace since June. Still, the chasm between this and chipper U.S. performance remains vast.

![World - Purchasing Managers' Index [PMI].png](https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blte161b5d2431d9cb9/672afc0475742fa31812e5ef/World_-_Purchasing_Managers_Index_[PMI].png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Strong U.S. demand has been pointed inward at domestic services firms, explaining why the world economy is not seeing signs of positive spillover. In fact, global PMI data from S&P Global and JPMorgan shows worldwide growth has been slowing since May, hitting a nine-month low in September.

That is a problem as U.S. economic strength dilutes expectations for a Federal Reserve interest rate cut, especially for next year. That has sent Treasury yields higher. Worldwide rates have followed because of the U.S. dollar’s dominant position in global trade, whereby a rise in the cost of borrowing the greenback is a rise in the cost of credit overall.

The next occupant of 1600 Pennsylvania Avenue in Washington D.C. may have to contend with the looming threat of global recession if anemic growth outside the U.S. buckles under the weight of higher-than-expected lending rates. How markets expect Mr. Trump or Ms. Harris to handle such a challenge may have much to say about their trajectory from here.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.