Markets Eye Powell Speech & Jobs Data as Fed Rate Cut Odds Churn

Markets Eye Powell Speech & Jobs Data as Fed Rate Cut Odds Churn

By:Ilya Spivak

Will stocks change course as bonds and the dollar turn a corner?

- Bond markets and the U.S. dollar hint Fed-driven speculation may be cooling.

- Will Fed Chair Jerome Powell tell markets anything they don’t already know?

- ISM services PMI and official U.S. jobs statistics are in focus on the data front.

Wall Street marked modest gains in last week’s holiday-shortened trade, but the action outside of stock markets seemed more convincing. The S&P 500 added 1.1% and the tech-tilted Nasdaq 100 inched up 0.7%. By contrast, bonds fell across maturities, with two- and 10-year Treasury yields down by close to 5%.

The currency markets echoed the moves in rates, with the U.S. dollar trading broadly lower against its major counterparts. Tellingly, the Japanese yen delivered outstanding performance with a rise of 3.4%. The perennially low-yielding currency tends to benefit when globally trend-setting U.S. rates come down.

These moves may reflect the sense that — after three months of repositioning for reflation — the near-term speculative narrative has run its course. This may set the stage for a larger recovery in bond markets and a steeper pullback in the dollar, if only as tactical traders lighten up on exposure to the latest wave of macro repositioning.

A steady stream of relevant event risk will test these moves for follow-through as liquidity rebuilds. It might also help reveal what they imply for stocks, another market where the case for a correction remains open after a blistering year of trend development.

These are the key macro waypoints to consider in the days ahead.

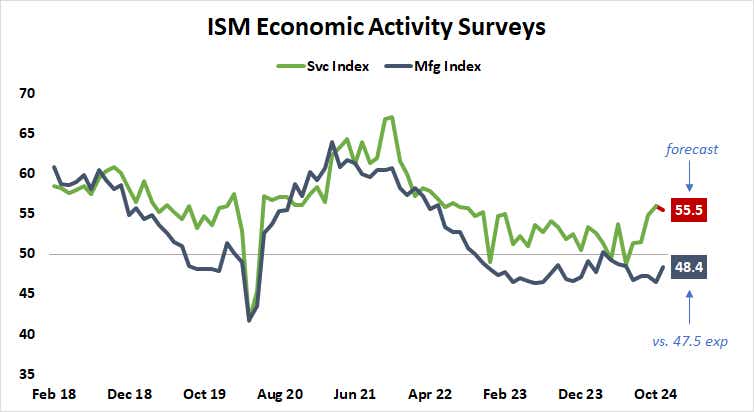

ISM services PMI survey

The Institute of Supply Management (ISM) is expected to report that service-sector economic activity growth slowed only modestly in November after jumping to a two-year high in the previous month. As expected, the companion report tracking manufacturing showed ongoing contraction. On the bright side, the pace of decline was slower than analysts feared.

U.S. economic data outcomes have tended toward outperforming consensus forecasts for the past two months, according to Citigroup. However, upside surprise momentum waned somewhat in the second half of November. This may mean that forecast models are readjusting to narrow the gap between expected and realized results.

If this translates into ISM data that hews close enough to the baseline view that established Federal Reserve policy expectations remain broadly in place, the speculative unwind on display last week may continue.

Fed Chair Jerome Powell speaks

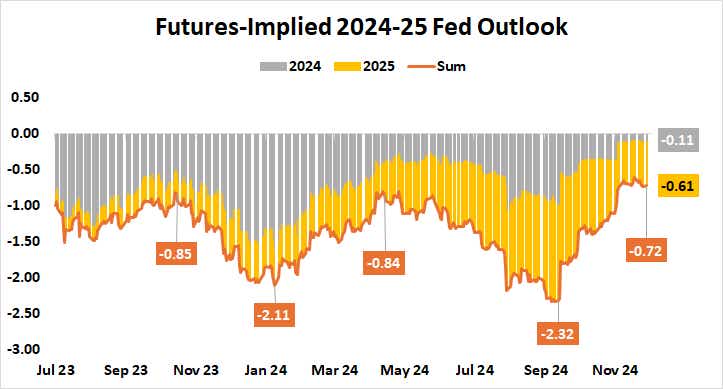

The New York Times DealBook Summit will bring a moderated discussion with the leader of the U.S. central bank mid-week. Powell has channeled the sense of hawkish repositioning in Fed officials’ baseline worldview at the press conference after November’s policy meeting as well as a high-profile speech thereafter (as expected).

For the markets, the critical question now seems to be whether more of the same at this week’s outing will change anything for priced-in policy bets. As it stands, the likelihood of 25-basis-point (bps) cut this month stands at 62.4%. Another 60bps in easing is on the menu for 2025. If that is left intact, last week’s lead may endure.

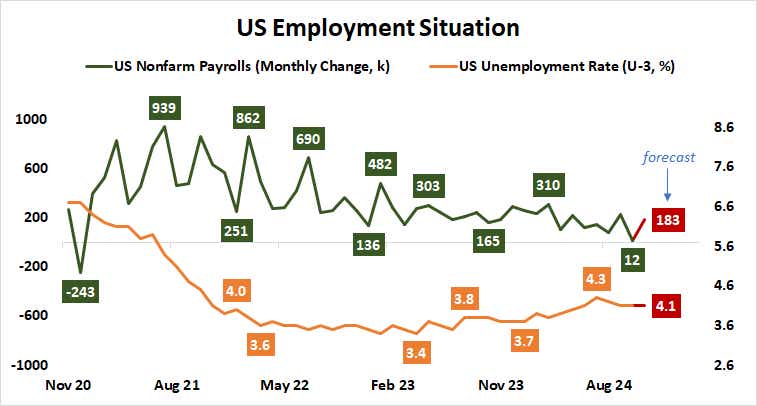

U.S. labor market data

November’s official U.S. employment figures are expected to show a rise of 183,000 in nonfarm payrolls after the prior month’s shock 12,000 move. Traders will be looking to see if that disappointment was a one-off misstep, as widely believed. The unemployment rate is seen holding at 4.1%.

As with the ISM data, the key question here will be whether the results dislodge the prevailing Fed policy consensus. The risk of such an outcome seems to be asymmetrically low. The bias toward easing seems firmly in place even as scope for adjustment has shriveled, and hikes are almost certainly off the table. That leaves a narrow path.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.