Monthly Futures Seasonality – April 2023: Stocks Rally, Bonds Slip

Monthly Futures Seasonality – April 2023: Stocks Rally, Bonds Slip

The start of the new month and quarter means it’s time to review seasonal tendencies in financial markets in recent years. For April, our focus is how different assets have performed over the past 5-years and 10-years; while a 15-year study may also prove valid, beyond there (e.g. a 20-year study) would encompass a pre-central bank intervention world – an entirely different monetary regime that may not yield any insight into today.

Nevertheless, even the more narrowly defined data series have their own issues. The COVID-19 pandemic, ensuing supply chain issues, and Russia’s invasion of Ukraine constitute unique events that don’t have many, if any, historical parallels.

Accordingly, traders may find themselves in the frustrating position where the reliability of seasonality has been diminished (if not rendered meaningless). Statistically, this frustration is validated by the fact that, for each of the instruments below, their 5-year average performances are all eclipsed by their respective standard deviation of returns.

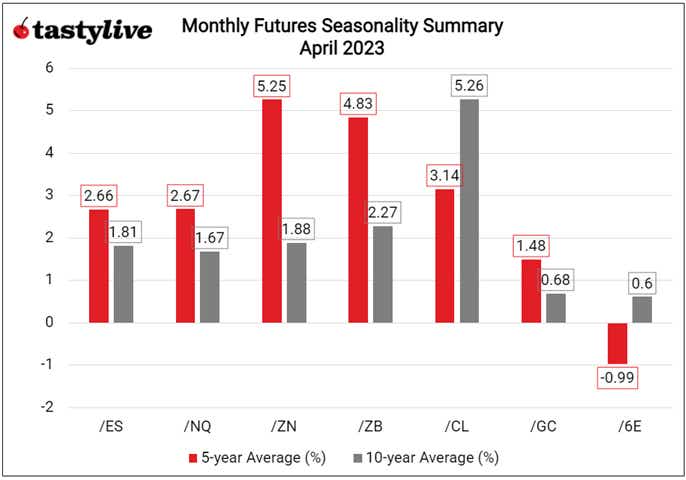

Monthly Futures Seasonality Summary – April 2023

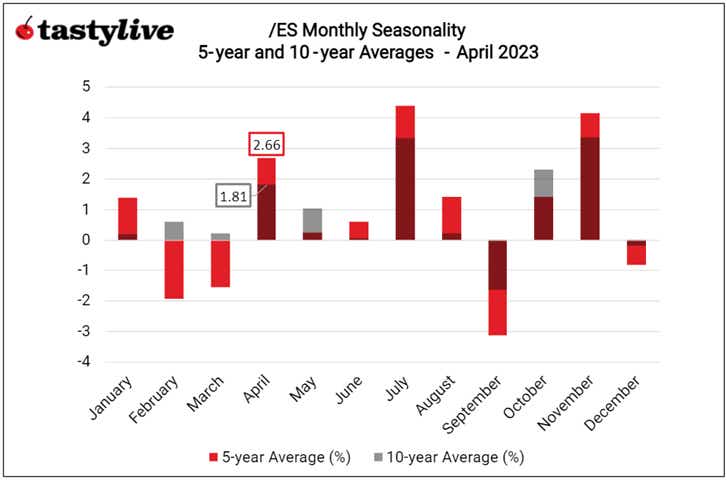

Monthly Seasonality in S&P 500 (/ES)

April is a bullish month for /ES, on a seasonal basis. Over the past 5-years, it has been the third best month of the year for the index, averaging a gain of +2.66% (σ = 7.97%). Over the past 10-years, it has been the fourth best month of the year, averaging a gain of +1.81%.

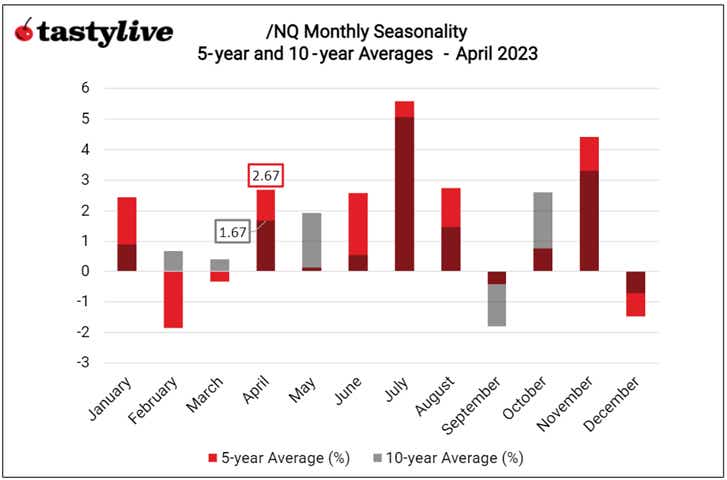

Monthly Seasonality in NASDAQ 100 (/NQ)

April is a bullish month for /NQ, on a seasonal basis. Over the past 5-years, it has been the fourth best month of the year for the index, averaging a gain of +2.67% (σ = 10.60%). Over the past 10-years, it has been the fifth best month of the year, averaging a gain of +1.67%.

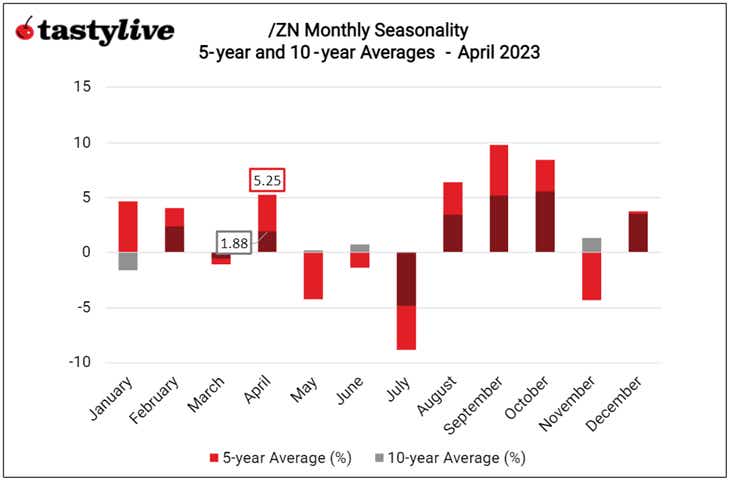

Monthly Seasonality in Treasury Notes (/ZN)

April is a bullish month for /ZN, on a seasonal basis. Over the past 5-years, it has been the fourth best month of the year for the notes, averaging a gain of +5.25% (σ = 10.96%). Over the past 10-years, it has been the sixth best month of the year, averaging a gain of +1.88%.

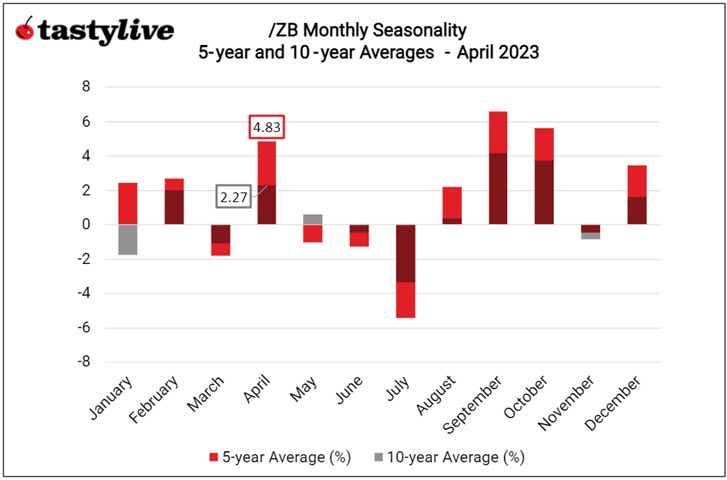

Monthly Seasonality in Treasury Bonds (/ZB)

April is a bullish month for /ZB, on a seasonal basis. Over the past 5-years, it has been the third best month of the year for the bonds, averaging a gain of +4.83% (σ = 10.73%). Over the past 10-years, it has been the third best month of the year, averaging a gain of +2.27%.

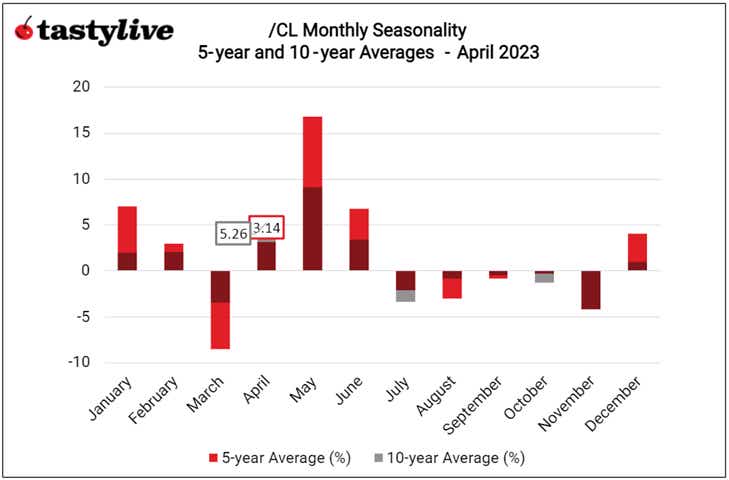

Monthly Seasonality in Crude Oil (/CL)

April is a bullish month for /CL, on a seasonal basis. Over the past 5-years, it has been the fifth best month of the year for the energy product, averaging a gain of +3.14% (σ = 6.33%). Over the past 10-years, it has been the second best month of the year, averaging a gain of +5.26%.

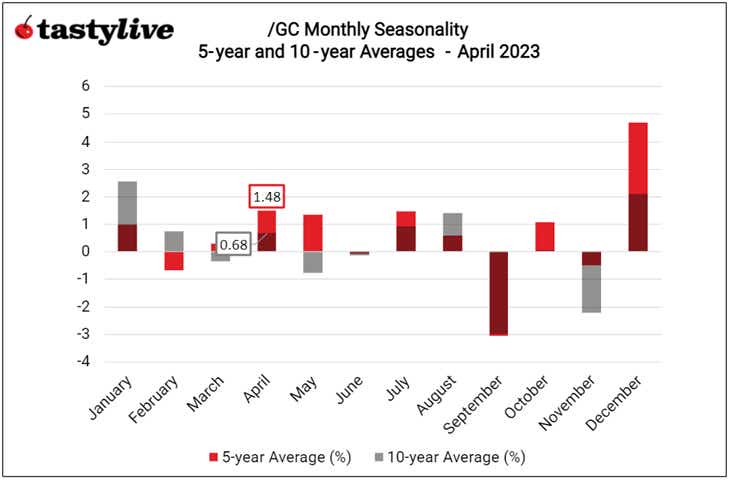

Monthly Seasonality in Gold (/GC)

April is a bullish month for /GC, on a seasonal basis. Over the past 5-years, it has been the second best month of the year for the precious metal, averaging a gain of +1.48% (σ = 3.61%). Over the past 10-years, it has been the sixth best month of the year, averaging a gain of +0.68%.

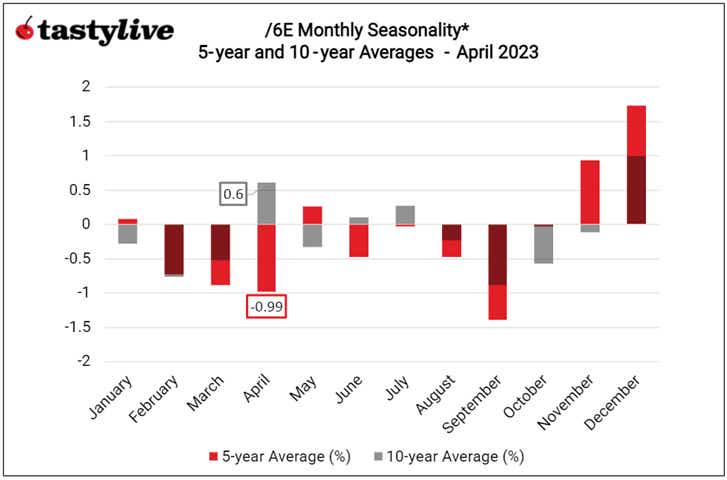

Monthly Seasonality in Euro (/6E)

April is a mixed month for /6E, on a seasonal basis. Over the past 5-years, it has been the second worst month of the year for the pair, averaging a loss of -0.99% (σ = 2.64%). Over the past 10-years, it has been the second best month of the year, averaging a gain of +0.60%. Note: the time series for Euro futures does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.