Lululemon Earnings Preview—Over 10% Stock Price Move Expected

Lululemon Earnings Preview—Over 10% Stock Price Move Expected

By:Mike Butler

The company posts strong growth and beats earnings estimates, and yet the stock is down almost 50% on the year

Lululemon will report earnings on Thursday after the stock market closes.

Although the premium athletic clothing retailer has had a strong earnings history, the stock is down over 46% on the year.

Lululemon is expected to post earnings-per-share of $2.94 on $2.41 billion in revenue.

Product demand and increased sales will be a focal point this quarter.

Lululemon Athletica (LULU) is set to report earnings after the stock market closes on Thursday. The premium athletic clothing retailer will seek to continue the streak of exceeding earnings-per-share (EPS) and revenue estimates for the fifth quarter in a row.

Lululemon is expected to report an EPS of $2.94 on $2.41 billion in revenue.

While earnings have been strong, the stock price has slipped dramatically from 2024 highs, with the high print being the first trading day of 2024 at $508.92. Since then, the stock price has dipped as low as $226.01 in early August. LULU stock currently sits around $271 per share. I have to admit it's strange to see a company continue to beat earnings estimates but have its stock price fall month after month.

Strong performance was highlighted in the company’s annual report: “In 2023, we celebrated our 25th anniversary and our teams continued to deliver strong and balanced results. As our product innovations, guest experiences and market expansions connected us with our guests and communities, we saw growth across each of our categories, channels and regions, and ended the year with $9.6 billion in net revenue, representing a year-over-year increase of 19%."

Calvin McDonald, CEO of Lululemon, offered remarks in the previous earnings call as well: “In the first quarter, we saw strong momentum in our international markets, demonstrating how our brand continues to resonate around the world. Guests responded well to our product innovations across categories, and we are pleased by the progress we are making to optimize our U.S. product assortment. Looking ahead, we continue to have a significant runway for growth and are confident in our team’s ability to powerfully deliver for our guests in 2024 and beyond."

With the stock price near the lows of the year, it's going to take some strong positive momentum for the popular athletic clothing company to rebound. Earnings are on deck and based on current implied volatility, the market is expecting a wide range of stock price movement.

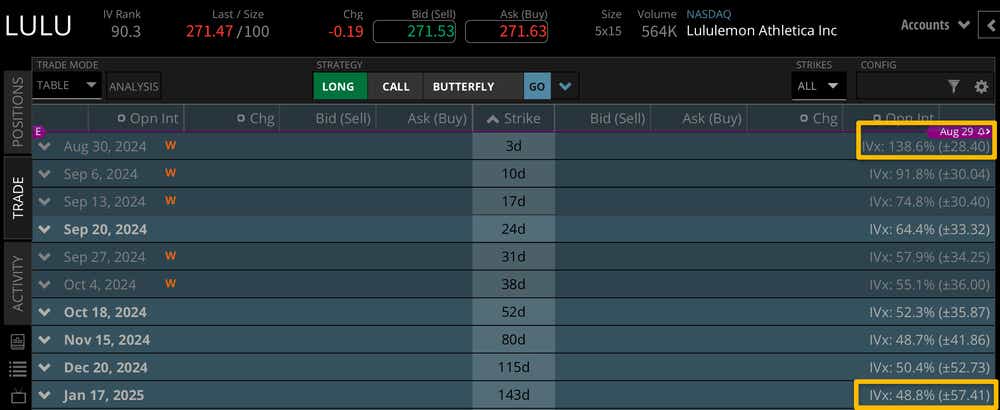

Looking at the weekly options cycle for this week, we can see a +/- $28.40 stock price move, which is over 10% of the notional value of the current stock price. Looking through the end of the year, we see a +/- $57.41 stock price move in the January 2025 options cycle. This week accounts for almost 50% of the expected move price in for the rest of the year. That's a big differential and suggests we could see a big move in either direction after the earnings announcement on Thursday.

Bullish on LULU Stock for Earnings

It's peculiar that Lululemon continues to post strong growth and beats earnings estimates, and yet the stock is down almost 50% on the year. Could it be a worry that spending may cease with inflation worries looming for most of the year? Is it the new competitive landscape? Time will tell, but LULU really needs to post a stellar earnings announcement and have a positive sentiment for the rest of the year if we expect to see the stock rally after the earnings call Thursday. With that said, we have seen Starbucks (SBUX) and Target (TGT) explode off annual lows after a strong earnings announcement, so we could see the same for LULU stock if bullish sentiment flips to the upside.

Bearish on LULU Stock for Earnings

Considering the fact that LULU has posted earnings beats four quarters in a row and the stock is down big in 2024, if EPS or revenue is missed I'd be surprised to see the stock move to the upside. Bearish traders in LULU stock are looking for a miss, or weak guidance for the rest of the year. If this happens, we could see the stock price retreat to annual lows.

Expect fireworks for Lululemon earnings this Thursday, and join us on Options Trading Concepts Live at 11 a.m. CDT for earnings options strategies in the stock!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.