Lowe's Earnings Preview: Will It Mimic Home Depot's Rally?

Lowe's Earnings Preview: Will It Mimic Home Depot's Rally?

By:Mike Butler

Lowe's (LOW) is set to report earnings before the market opens on Tuesday, Nov. 21. Can it beat expectations?

- Lowe's is set to report earnings before the market opens on Tuesday, Nov. 21.

- Home Depot crushed its earnings announcement, and Lowe's rallied almost $10.

- Lowe's is expected to report earnings per share of $3.03 on $20.86 billion in revenue.

- Earnings per share and revenue figures for Lowe’s are significantly lower than last quarter's expectation.

- The home improvement company exceeded expectations four quarters in a row, while only beating revenue expectations twice in the same period.

Lowe's Earnings Preview

Lowe's (LOW) has had a back and forth 2023, opening the year at $201.49 and reaching a high of $237.21 in July. Just a few months later, the stock tumbled to the annual low of $181.85. It currently sits at $205.33 after receiving a nice $10 "sympathy" rally after Home Depot (HD) rallied $15 after its earnings announcement.

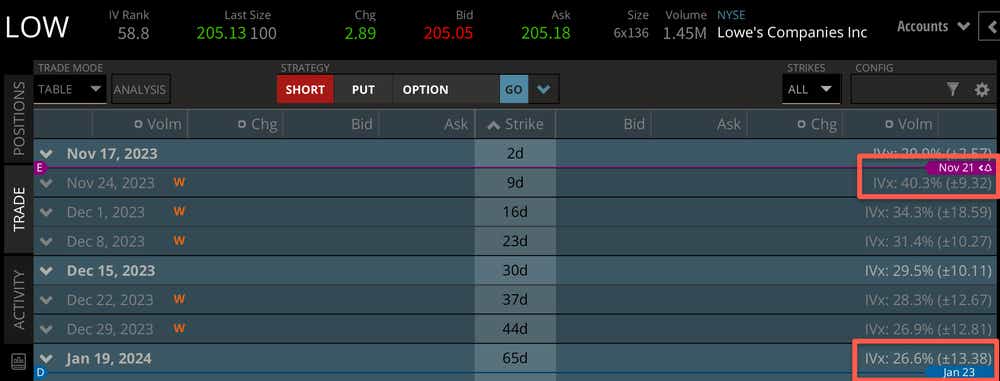

Lowe's is expected to announce earnings per share (EPS) of $3.03 on $20.86 billion in revenue before the market opens on Tuesday, Nov. 21. The stock price expected move based on current implied volatility is +-$9.32, which is just under 5% of the current stock price.

Looking farther to the January 2024 options cycle, you can see the expected stock price move is +-$13.38. This cycle makes up a large chunk of the expected move through the rest of the year, even though the stock has already moved higher in the past few days.

Bullish LOW stock for earnings

The previous earning’s estimate was an EPS of $4.48 on $24.98 billion in revenue. This quarter, we're looking at an EPS estimate of $3.03 on $20.86 billion in revenue. That is a big reduction in expectations, especially when you consider that Home Depot just beat revenue and EPS estimates pretty handily, after a similar reduction in estimates. If the popular home improvement company can beat EPS and revenue figures in this recent bull rally, I wouldn't be surprised to see the stock continue higher.

Bearish LOW stock for earnings

Lowe's beat EPS estimates four quarters in a row up to this upcoming earnings announcement, but it posted its weakest beat of 1.79% this most recent quarter. The stock saw a $10 rally after Home Depot earnings, but that could mean consumers are heading to Home Depot instead of Lowe's. It seems as though after the sympathy move, the home improvement company will have to post similar or better earnings numbers relative to Home Depot to maintain the recent rally. If there is a big miss or weak guidance, we could easily see the stock retreat after the announcement is made.

Tune in to Options Trading Concepts Live on Monday, Nov. 15 for a look at options trading strategies ahead of the Lowe's quarterly earnings announcement the next morning.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.