Is Lemonade's (LMND) Disruptive Potential Enough to Keep Its Stock Soaring?

Is Lemonade's (LMND) Disruptive Potential Enough to Keep Its Stock Soaring?

Lemonade is setting new standards in insurtech, but does that justify its premium valuation?

- Lemonade is leveraging AI to challenge the traditional insurance model, but its ability to scale profitably remains uncertain.

- The company’s high valuation reflects investor confidence in its growth potential, but analysts remain cautious, questioning whether the stock is priced too aggressively.

- Lemonade's future hinges on whether it can accelerate growth and reach profitability, which means forthcoming earnings reports will be critical in determining whether the stock can sustain its lofty valuation.

Lemonade (LMND) is charting a bold course in the insurance business. With a digital-first approach and a reliance on AI-driven underwriting and claims processing, Lemonade aims to revolutionize an industry long dominated by legacy players. By striving for focus efficiency and using machine learning and bots, the company operates with a leaner headcount and reduced overhead. While it isn't yet profitable, it has demonstrated solid growth metrics, such as impressive increases in enforced premiums and improved customer acquisition and retention.

With Lemonade shares up more than 140% in 2024, investors are clearly betting on the company's long-term success, buoyed by its innovative approach and strong growth numbers. However, concerns about profitability persist, and the company's elevated price-to-sales (P/S) and price-to-book (P/B) ratios—both well above the sector median—may signal that much of this optimism is already priced in. Today, we unpack Lemonade's financials and examine the company's growth trajectory to determine whether they’ll be enough to keep its stock price elevated—or if the current market enthusiasm may be getting ahead of itself.

A tech-powered revolution in insurance

Lemonade is positioning itself as a disruptive force at the intersection of the financial and tech sectors, with a business model that blends traditional insurance with cutting-edge AI technology. The company's approach is digital-first, leveraging machine learning, bots and an automated system to provide low-cost, fast and highly efficient insurance services. Lemonade's core offerings include renters, homeowners, pet and car insurance, with an emphasis on streamlining the insurance process through AI. This allows the company to operate without agents, reducing administrative overhead while improving the customer experience.

The insurance industry, known for its legacy players and high barriers to entry, is highly competitive and often slow-moving. However, Lemonade has sought to challenge the status quo with its tech-centric model, which incorporates AI in underwriting, claims processing and customer interactions. This gives Lemonade a potential competitive edge because it aims to eliminate much of the inefficiency that plagues traditional insurers. The company's use of data and AI is its secret weapon, enabling rapid scaling without a proportional increase in costs—an advantage that has helped the company improve its gross loss ratio and attract a growing customer base.

Lemonade's expansion into new products and markets is a key part of its growth strategy. The company has not only diversified beyond its original renters' insurance to include car and pet insurance but has also ventured into international markets like Europe, where it is seeing growing demand. The company’s recent acquisition of Metromile, a car insurance company, has been central to its expansion into auto insurance and is expected to drive substantial growth. The company's ability to cross-sell products has increased lifetime value per customer, which is crucial for long-term profitability in this industry.

Despite operating at a loss, Lemonade’s path to profitability is becoming more apparent. The company has improved its loss ratio and cash flow—key steps toward financial sustainability. Its investment in artificial intelligence has improved operations, helping to streamline processes and reduce costs. It continues to expand its product portfolio while refining underwriting practices and enhancing its AI models. While achieving profitability may take time, these efforts put Lemonade on a promising trajectory with its tech-driven approach offering a competitive edge.

Lemonade’s recent earnings reports

In the most recent quarter, Lemonade delivered encouraging results that demonstrate the company’s potential for growth despite its ongoing quest for profitability. Revenue reached $137 million, a 19% increase year-over-year, driven by solid performance across key metrics. Enforced premiums—a crucial figure for insurtech companies—jumped 24% to $889 million.

Enforced premiums represent the total value of active policies the company holds at the end of the period, a critical indicator of long-term growth. This metric captures not just revenue but also the company's ability to attract and retain customers because it reflects the commitment of policyholders to continue paying for their insurance. The 24% growth in enforced premiums speaks to Lemonade’s ability to expand its customer base as it prepares to enter the auto insurance market in 2025. Alongside this, the customer base grew 17% year-over-year to 2.3 million, and premium per customer rose 6%, reflecting an ability to drive more value from each customer.

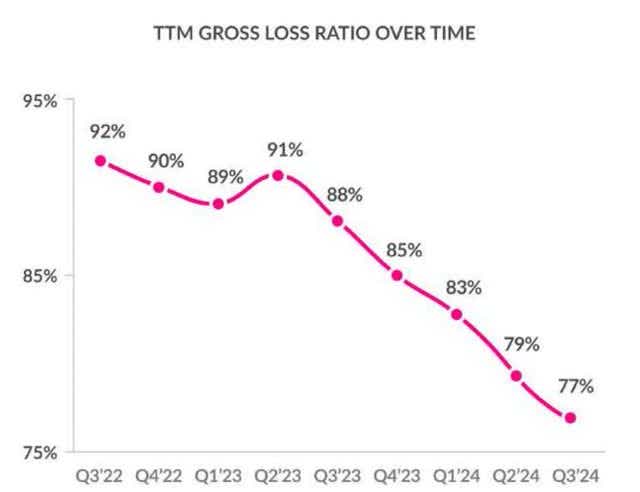

The company reported a dramatic improvement in its gross loss ratio, which fell to 73%—the lowest it’s been in four years (illustrated below). The gross loss ratio measures how much of every dollar of premium income goes toward paying out claims, so lower numbers are better. This drop suggests Lemonade is becoming better at managing risk and underwriting policies, a key focus for any insurer. The improvement is attributed to Lemonade’s investment in AI for underwriting and claims processing, enabling the company to do a better job of assessing and pricing risk.

With an AI-driven approach, Lemonade can predict and manage claims more effectively, which helps to reduce overall payouts. This technology-driven model has been a hallmark of Lemonade’s strategy and one of the reasons it stands apart from traditional insurers. A lower gross loss ratio is vital for long-term sustainability, because it tends to correspond with improved profitability.

While these trends are promising, Lemonade still faces hurdles. Operating expenses surged by 27% in Q3, driven largely by rising customer acquisition costs, reflecting the company's efforts to expand its user base aggressively. This spending contributed to a net loss of $68 million for the quarter. However, the company posted a positive net cash flow of $48 million, signaling it has the liquidity to support its growth initiatives without jeopardizing financial stability.

Another aspect of Lemonade's strategy is its focus on operational efficiency, demonstrated by a 7% reduction in headcount even as it continues to scale. This reflects Lemonade’s commitment to streamlining costs while enhancing productivity, a crucial step as its transition from aggressive growth to long-term sustainability. Overall, the company’s improvements in loss ratios, rising premiums and growing customer base demonstrate its ability to scale profitably. If Lemonade can maintain its growth trajectory while tightly managing expenditures, it is well-positioned to achieve sustained profitability in the increasingly competitive insurtech sector.

Lemonade’s premium valuation

Lemonade has emerged as a standout in insurance, positioning itself at the intersection of traditional financial services and cutting-edge technology. As a result, the company now enjoys a premium valuation relative to its competitors—trading at a price-to-sales (P/S) ratio of 5.60, nearly double the sector median of 3.29. For context, the P/S ratio for Progressive (PGR), an established competitor, is closer to 1.95. This elevated P/S ratio reflects investor optimism that Lemonade’s growth will remain strong, fueled by its potential to revolutionize the industry through AI-driven underwriting and claims processing.

A high price-to-book (P/B) ratio of 5.27, also significantly above the sector median of 1.32, reinforces the implications of Lemonade's elevated price-to-sales (P/S) ratio. Both metrics signal investors are valuing the company not just for its current tangible assets but also for its growth potential driven by technology and customer base. This market sentiment reflects confidence in Lemonade’s future, but it also introduces risk. If growth slows or profitability remains elusive, the gap between market value and tangible book value could widen, undermining investor confidence and challenging the sustainability of the company’s premium valuation.

Underscoring the above concerns, analysts remain cautious about the company’s outlook, with six of 10 maintaining a "hold" rating and four issuing "sell" recommendations. The average price target of $30 per share—substantially lower than its current price of $40—highlights a growing disconnect between the market’s optimism and the company’s financial realities. While the market is betting on Lemonade’s ability to scale and revolutionize the industry, analysts remain concerned that the company’s continued quarterly losses could ultimately derail these high expectations.

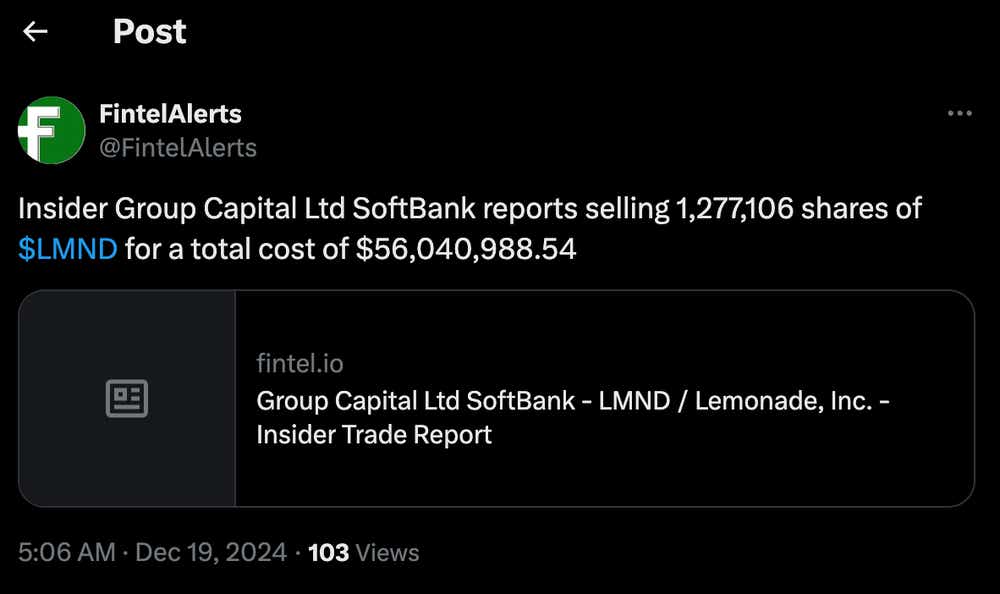

If growth slows, or the path to profitability proves more difficult than anticipated, the gap between Lemonade’s market price and its underlying financial performance could widen, potentially triggering a pullback. In short, the premium valuation may be reflecting a vision of what Lemonade could become, not what it is today—an imbalance that carries considerable risk for investors. Adding to this uncertainty, SoftBank's (SFTBY) recent decision to liquidate approximately 12% of its Lemonade stake (at prices between $43 and $47 per share) is a noteworthy signal, suggesting the stock may be closer to a "sell" than a "buy" at its current levels, especially near the top end of its 52-week range ($45 and above).

On the other hand, the bullish investment case can’t be overlooked, either. Lemonade’s strong growth trajectory provides a convincing argument for its future potential. Despite ongoing concerns about profitability, the company continues to post impressive numbers. In Q3 2024, Lemonade saw a 19% year-over-year revenue increase, driven by a 24% rise in enforced premiums and a 17% jump in its customer base.

These figures reflect robust customer acquisition and retention, suggesting Lemonade’s model is resonating in a competitive market. As the company leverages its AI-driven technology to scale and refine its offerings, the market’s optimism about its disruptive potential becomes more understandable. If Lemonade can continue to build on this momentum, its premium valuation may ultimately be justified.

Faster growth could validate recent gains, push shares higher

Lemonade's current market valuation is driven by a mix of optimism and risk. With shares up more than 140% in 2024, investors are clearly banking on the company's long-term growth potential. This optimism is underpinned by Lemonade's strong customer acquisition and retention metrics, alongside its innovative use of AI-driven underwriting. Together, these factors indicate the company is gaining traction in a competitive market, even though it continues to face challenges with profitability. But with much of Lemonade’s potential already priced into the company’s valuation, there’s limited room for error.

Lemonade’s ability to grow will help determine whether its stock can not only maintain its current valuation but potentially surpass it. If the company can drive revenue growth at an accelerated pace and scale operations more efficiently, the stock could see further upside. This would likely attract investors eager to capitalize on the company’s disruptive potential in an industry ripe for innovation, reinforcing Lemonade’s compelling narrative.

On the other hand, if growth fails to accelerate, or stagnates, the stock's lofty valuation may become increasingly difficult to defend. In this scenario, stock price could fall toward the average analyst price target of around $30 per share, bringing the company's market cap down from its current $2.9 billion to approximately $2.1 billion. For some investors, this scenario could actually present an opportunity to buy additional shares at more attractive levels, assuming they are strong believers in Lemonade’s long-term prospects.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.