Lean Hog Happy Days

Lean Hog Happy Days

Fundamental and technical conditions suggest firm pig prices this summer

- Agricultural commodities, including lean hogs and live cattle, have seen a bullish start to summer trading.

- The cattle-hog spread (/LEN-/HEN) has receded from early June's nearly unsustainable +90 levels.

- The daily pig chart provides several reasons to believe a bullish follow-through is afoot.

Lean hog futures (/HE) surrendered early gains on Thursday and turned negative by about 1% in afternoon trading to 100.05 per pound. On a weekly basis, prices remain up almost 5% and over 30% from the April swing low.

The agricultural commodities market, including lean hogs and live cattle, has seen a bullish start to summer trading, with several fundamental and technical factors supporting higher prices, although some grains have given back gains. Let's discuss a few of those factors specific to the lean hogs market.

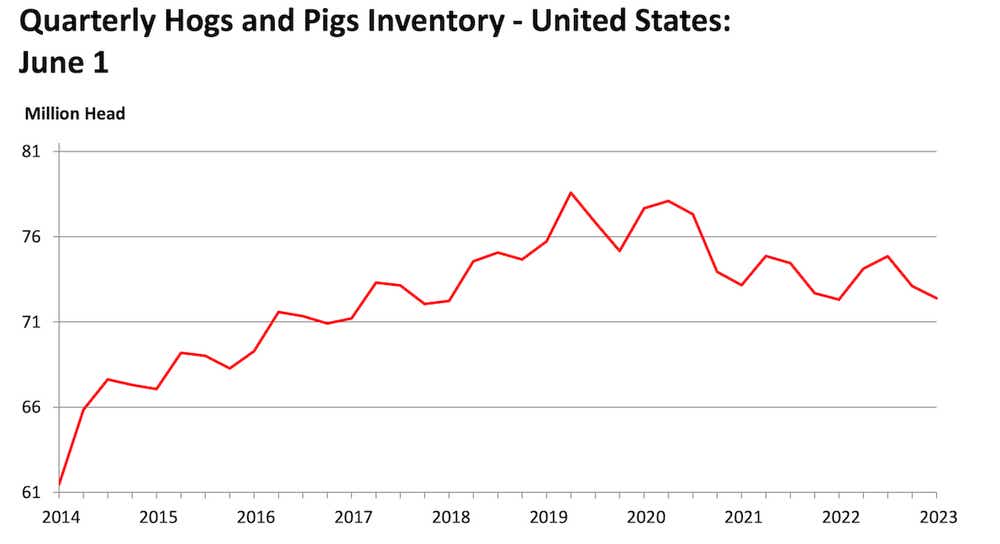

Quarterly hogs and pigs report

The United States Department of Agriculture (USDA) released its Quarterly Hogs and Pigs report on June 29 for the quarter ending June 1. This report was neutral for a short-term outlook but potentially bullish when looking beyond.

While market inventory increased slightly from the year prior at 72.4 million, intended farrowings—birthing pigs—fell 4% to 2.95 million sows for September to November. That could potentially reduce inventories later this year, particularly if demand outstrips producers’ forecasts.

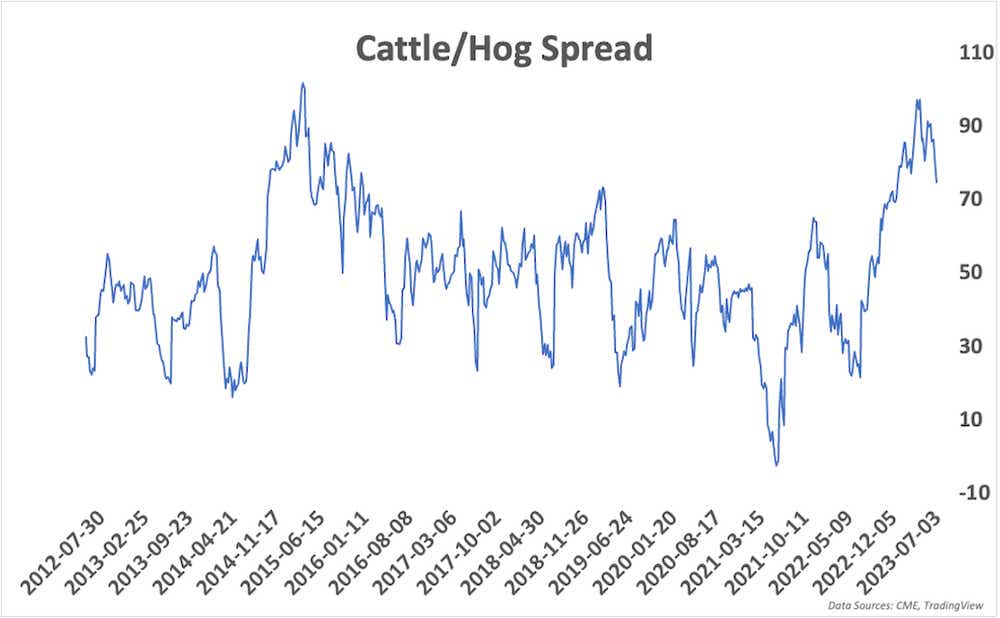

The cattle-hog spread as a predictive tool

The cattle-hog spread (/LEN-/HEN) has receded from +90 levels—often unsustainable—seen in early June. Cattle prices (/LE) topped out around the earlier June high before falling, which supports a further tightening in the spread.

While the spread isn’t a crystal ball, analyzing it can inform an outlook. And because the spread is tightening from multi-year highs, we can trade with the expectation that it will continue when considering the broader analytical framing.

The consumer and market have been resilient as credit tightens, but that could still cause shifts in discretionary spending. Americans usually cut their spending on top beef cuts after the Fourth of July holiday. This trend may be more ingrained in consumer behavior following high inflation.

That said, the spread tightening should be monitored over the next several months. Betting on that spread direction would put a trader long lean hogs while being short cattle.

Technical chart underpins bullish outlook

The daily pig chart indicates several reasons to believe a bullish follow-through is afoot. Earlier this week, prices pierced above the 200-day simple moving average (SMA), which hasn’t been traded above since early March.

That move coincided with the relative strength index (RSI) breaching above the 70 overbought mark, which typically indicates strong momentum in the current move. Potential resistance may come around the 105-107 levels, where prices were capped in February and March.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Image generated with Midjourney.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.