Lean Hogs May Find Support as China Grapples with Swine Flu

Lean Hogs May Find Support as China Grapples with Swine Flu

Lean Hogs Put in Big Weekly Drop But Futures Prices Bounce on Friday

Lean hog futures for April bounced on Friday following sharp declines from earlier in the week that saw prices for April delivery sink to the lowest point of the year at $78.3 before recovering to hold small gains into the afternoon. Prices remain down about 8.5% on the week, the biggest drop on record for the April contract (/HEJ3).

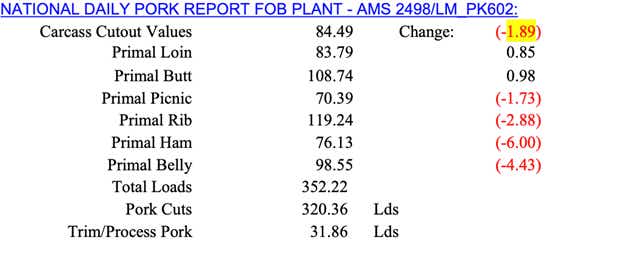

The cash market for pork prices has put a lot of pressure on futures prices this week. And despite a $1.89 drop in cutout prices—per the USDA’s National Daily Hog and Pork Summary—futures moderated, suggesting that selling may be overdone for now. The broader market volatility as banking concerns weighs on sentiment may have also played a hand in the lower prices this week.

Chinese Swine Flu Could Underpin Prices Soon

U.S. exports in January were up 13% from a year ago, according to data from the U.S. Census Bureau. Meanwhile, China—a major pork-consuming country—is facing a wave of African Swine fever, which will likely reduce hog output this year, according to a Reuters report citing Chinese farmers. That said, the need for U.S. pork will likely increase over the coming months. While China has made substantial progress in its pork infrastructure to prevent the spread of disease following outbreaks in recent years, the illness is hard to contain once enough droves are infected. Farmer reports and monthly export data will be key to watch going forward.

Lean Hogs Chart Shows Incoming Bounce?

Monday’s price action revealed a pause in selling following sharp early-week declines. A rise in the CEM lean hog index that tracks 2-day average cash prices has risen over the past week. The futures prices on an 8-hour timeframe showed a bullish crossover in the Relative Strength Index (RSI), falling and then rising above the 30 oversold level. The 50-day Simple Moving Average (SMA) offers a target for a technical bounce.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.