Off the Charts: Oil Positioning; CEO Confidence; Inflation Expectations; Economic Surprises; Yen Carry Trade

Off the Charts: Oil Positioning; CEO Confidence; Inflation Expectations; Economic Surprises; Yen Carry Trade

These are the five charts that had an impact on my views on markets this week

Market Update: S&P 500 down 0.61% month-to-date

Each week, buy-side and sell-side analysts produce reams of charts and data visualizations to help contextualize price action across asset classes. These data can help shape one’s thinking, offering evidence for increased conviction or criticism about currently held beliefs. Likewise, they may offer insight into relative risk/reward opportunities in various markets. These are the five charts that had an impact on my views on markets this week.

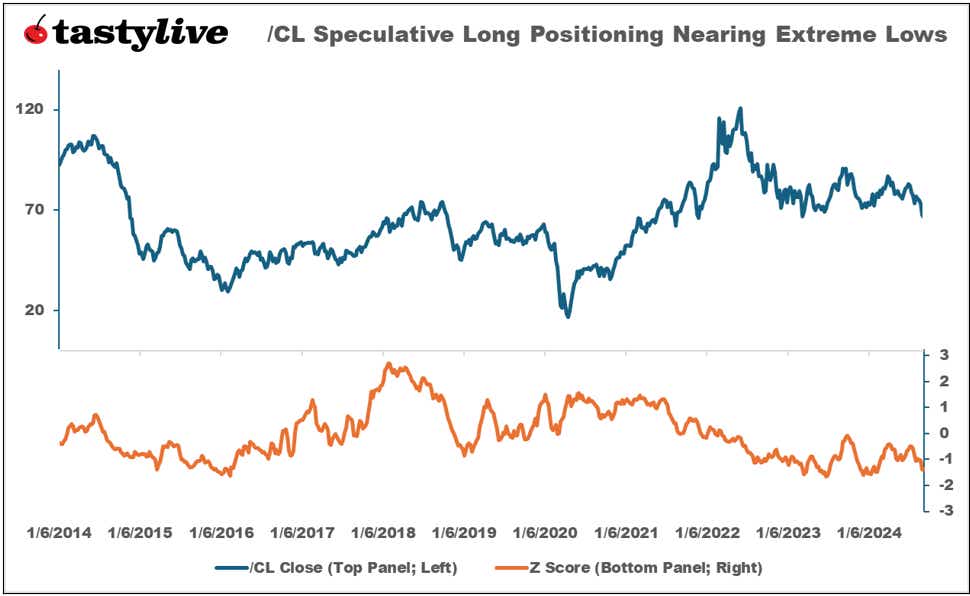

1) Crude Oil Positioning Nearing Relative Low Point Since 2014

TAKEAWAYS: Crude oil prices have declined sharply in recent weeks, falling nearly 19% from the August high to the September low. During this time, positioning in the futures market (which remains structurally long in oil) has dropped dramatically. The Z-score of positioning (2014 to present) coming into this week was -1.37.

TRADE IMPLICATIONS: Since 2014, when oil positioning has been in excess of 1.3 standard deviations below its mean, the one-month average return is 4.9% and the median return is 3.6%. Sustained elevated volatility (IVRs >50) in crude oil futures have made selling put spreads against recent lows an appealing prospect, so long as enough duration is afforded; timing the low is less important than time in the market.

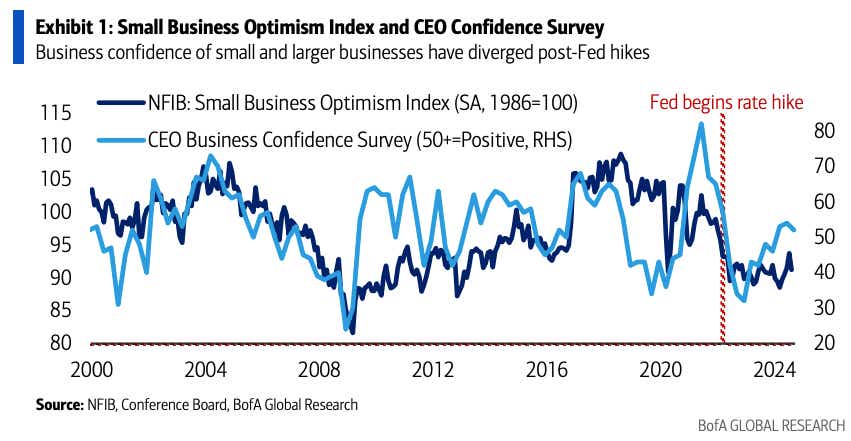

2) Rate Hikes Have Hurt Small Business Disproportionately; Will Cuts Help More?

TAKEAWAYS: The Federal Reserve’s rate hike cycle weighed more heavily on small- and medium-sized enterprises more than their larger counterparts. Simplistically, small businesses have relatively less robust balance sheets and are more reliant on floating rate debt than their larger firms. Since the Fed’s rate hike cycle began in March 2023, the mega cap, tech-heavy Nasdaq 100 has outperformed the small cap Russell 2000 to the tune of +33%.

TRADE IMPLICATIONS: If hikes were one reason that small caps may have underperformed large caps, then cuts may prove to have the opposite effect. Reversion trades in /RTY (or IWM) and /NQ (or QQQ) have been difficult to time in 2024: the Nasdaq was outperforming the Russell by over +21% year-to-date in early-July; now in September, that outperformance has shrunk to +7.6%. But the reversion started in July once it became clear that the Fed’s next move would be to cut rates. If the U.S. economy avoids recession, the Fed’s rate cut cycle should help the Russell close the gap with its mega cap counterparts.

3) Consumer Inflation Expectations Nearing Four Year Lows

TAKEAWAYS: U.S. one-year consumer inflation expectations, according to the University of Michigan, have hit 2.7%, the lowest level since December 2020.

TRADE IMPLICATIONS: The fight against inflation is over, at least for now. The Federal Reserve has indicated as such in recent policy announcements, highlighting the increased risks to the labor market to curate a more balanced view. Traders anticipating volatility around inflation reports may prove disappointed moving forward; weekly and monthly labor reports like JOLTs, jobless claims, and ADP employment are likely to carry more importance through the end of the year.

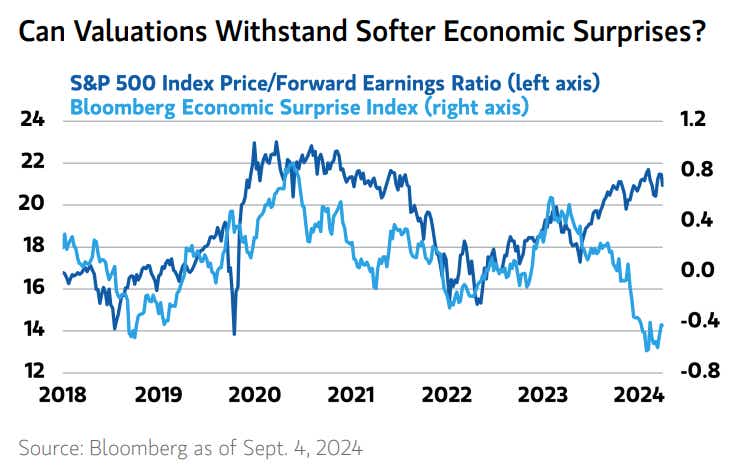

4) Equities Ignoring Deteriorating Economic Data

TAKEAWAYS: In recent years, there was a straightforward, positive contemporaneous relationship between the S&P 500’s price-to-forward earnings ratio and the Bloomberg Economic Surprise Index: as economic data beat expectations, equity markets enjoyed a boost to forward earnings expectations. Since mid-2023, U.S. economic data has been disappointing to a greater degree, yet stocks have not seen a meaningful correction in the P/FE ratio.

TRADE IMPLICATIONS: As bad has the data have been, it’s worth noting that that the Bloomberg Economic Surprise Index has started to turn higher. One might make the argument that the resiliency seen by the S&P 500 during a period of disappointing economic data which, in recent years, might have otherwise catalyzed a more significant decline in share prices, bodes well for the future, insofar as valuation compression may not transpire as feared.

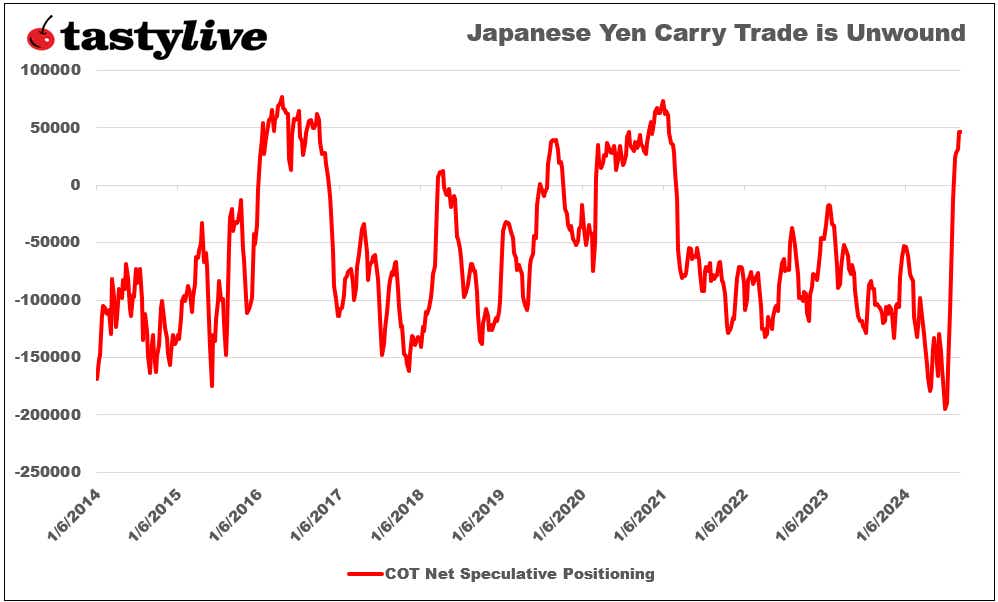

5) The Yen is No Longer Markets’ Scape Goat for Equity Declines

TAKEAWAYS: In early-August, the VIX spiked above 60 amid a sharp sell-off in Japanese equities and an unwind in the yen-financed carry trade. In effect, traders were borrowing in yen to buy bonds and equities outside of Japan. Positioning was stretched: traders hadn’t been as short the Japanese yen in July as they were at anytime since the onset of the Global Financial Crisis. Now, traders are net-long the Yen to the largest tune since February 2021.

TRADE IMPLICATIONS: The Japanese yen is no longer trading like the Bank of Japan is the only central bank not hiking rates; instead, it’s behaving like it did throughout the 2010s, whereby interest rate differentials and liquidity needs were the primary drivers of price action. So goes the U.S. bond market, so goes the yen: if Treasuries are trading higher, the yen is likely to as well.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.