Is the US Economy in a Recession? It’s Complicated

Is the US Economy in a Recession? It’s Complicated

What is a recession?

The layman definition is typically “two consecutive quarters of contracting GDP.” But the official body that designates recessions in the US, the National Bureau of Economic Research (NBER), has a different definition, calling it “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

Concerns regarding a US recession have been percolating in recent months. The slowdown at the start of 2022, a surprising rebound in the second half of last year, and a 2023 banking episode (see: Silicon Valley Bank, Signature Bank, and First Republic) – not to mention the Federal Reserve’s interest rate hikes – have led to an avalanche of calls from financial analysts, pundits, and market participants that a 2023 recession is a fait accompli.

Here are three perspectives to consider on either side of the argument.

Recession: Not Now, Not Immediately

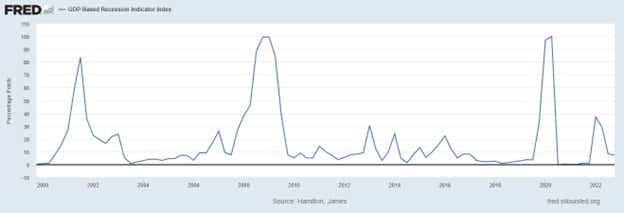

1) GDP-based Recession Indicator Index

The index corresponds to the probability (measured in percent) that the underlying true economic regime is one of recession based on the available data.

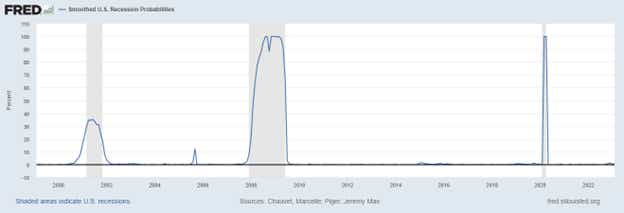

2) Smoothed US Recession Probabilities

Smoothed recession prob for the US are derived using 4 monthly coincident variables: NFP employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.

3) Real-time Sahm Rule Recession Indicator

The Sahm Recession Indicator signals the start of a recession when the 3-month moving average of the national unemployment rate (U3) rises by 0.50% or more relative to its low during the previous 12 months.

Recession: When, Not If

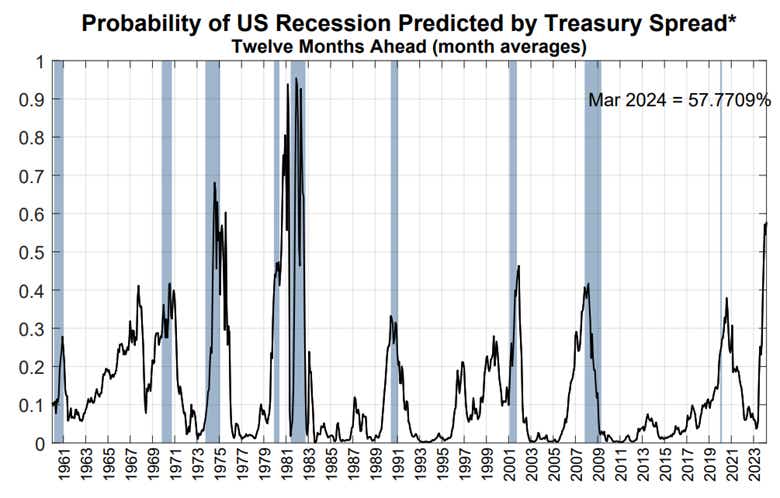

1) NY Fed 3m10s spread

Parameters estimated using data from January 1959 to December 2009, recession probabilities predicted using data through Mar 2023. The parameter estimates are α=-0.5333, β=-0.6330.

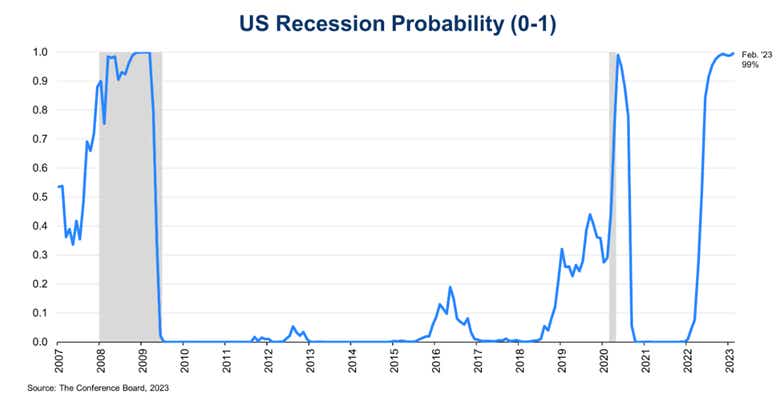

2) Conference Board Recession Probability

The probability is estimated using several leading indicators including: the yield spread; financial conditions; and the Federal Reserve’s balance sheet.

3) IACPM Credit Outlook Survey

The respondents are members of the International Association of Credit Portfolio Managers, seeing challenges posed by inflation, interest rates and geopolitics concerns are now met by a threat by credit risk concerns.

Signal or Noise?

The state of the US economy is clearly complicated. There is a clear schism between actual economic data and market pricing. In turn, an asymmetric situation has arisen: either the market is correctly positioned for a recession, and the data will sour in the coming months; or the data is resilient for a good reason, and the market is incorrectly positioned economic growth.

In the former scenario, downside for risk assets may prove limited. After all, /ES futures positioning is the most net-short since October 2011, per the CFTC’s COT report; the bear side is extremely crowded already.

In the latter scenario, if the US economy does prove resilient, then traders expecting a recession – and there appears to be quite a few – may find themselves on the wrong side of tedious, slow moving short covering rally in stocks over the coming months, marked by low volatility and low trading volumes.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.