Is the Oil Volatility Index Sending a Message to Traders?

Is the Oil Volatility Index Sending a Message to Traders?

Traders should heed an important indicator as crude oil volatility falls to multi-year lows

- Crude oil volatility falls to its lowest point since November 2021.

- WTI crude oil prices (/CL) surge over 4%, extending rally.

- U.S. oil production to rise, challenging OPEC’s stance.

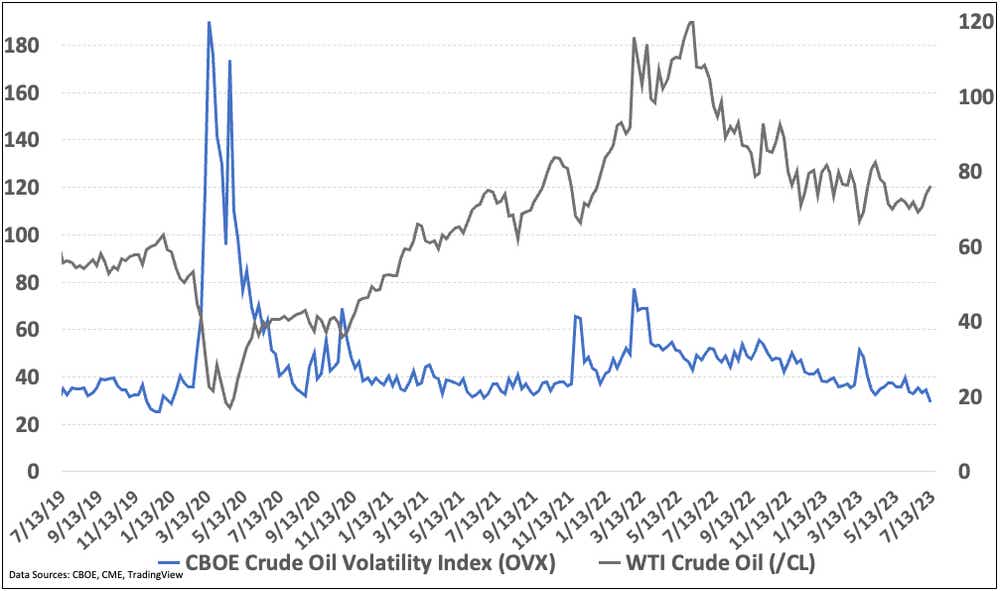

The Chicago Board Options Exchange’s Crude Oil Volatility Index (OVX) fell to its lowest level since November 2021 on Thursday, as crude oil prices (/CL) rose about 2%. The OVX is like the VIX but for oil traders. It tracks the expected 30-day volatility of the United States Oil Fund (USO).

That doesn’t necessarily tell us if a rally will or won’t occur, but it does reveal a perhaps complacent group of oil traders. However, prolonged periods where the OVX traded at relatively low levels near 30 and under have led to rallies in the past (see late 2020 to late 2021).

OPEC's influence

One take on what is causing this behavior is that OPEC, the Organization of the Petroleum Exporting Countries, is ready and willing to step into the market to arrest an unexpected price drop. This is likely dissuading oil traders from protecting their long positions with protective puts.

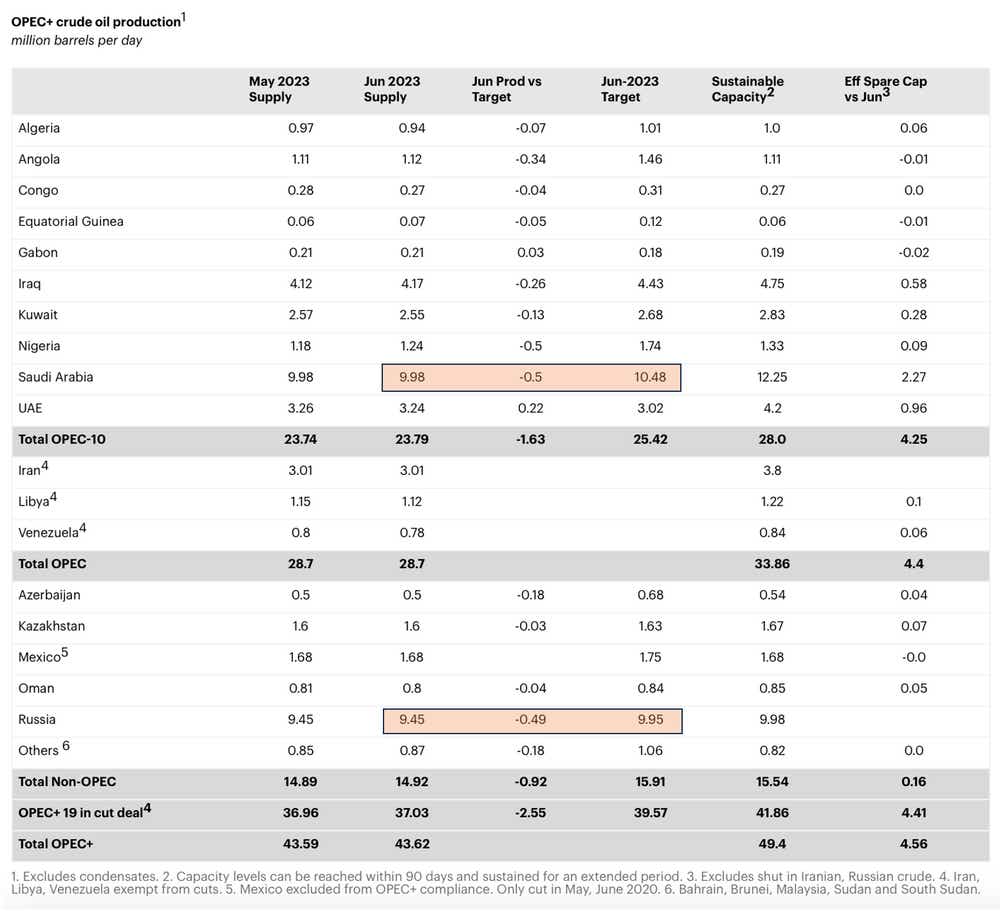

OPEC has made a series of production cuts, led by Saudi Arabia—the cartel’s bona fide leader—to underpin crude prices. Riyadh is sacrificing its output as other OPEC members’ output remains relatively consistent, although Russian output appears to be declining as well, according to the International Energy Agency (IEA). The IEA also shows a 500,000 barrel per day drop for Saudi Arabia (see chart below).

Oil prices haven’t risen much during these cuts because other oil producers, such as the United States, have increased production, which has limited the Saudi Arabia’s efforts to raise prices. However, those production increases may continue and force OPEC’s hand.

The STEO prediction

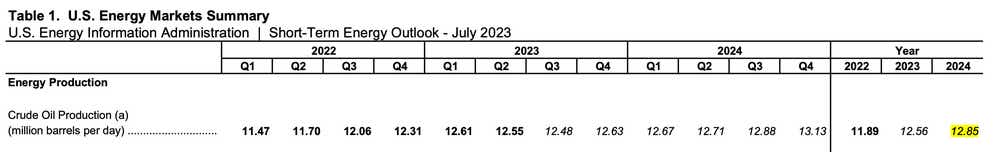

The U.S. Energy Information Administration’s Short-Term Energy Outlook (STEO) sees U.S. crude oil production rising to a record 12.85 million barrels per day in 2024. Saudi Arabia, and OPEC, will have to decide between artificially limiting their production or keeping the cuts in place to help support prices, even if it means helping the United States.

Meanwhile, U.S. oil executives seem well-positioned to take advantage of today’s market structure and geopolitical landscape, and they know it. The Permian region is attracting more rigs, including Exxon-Mobil and Chevron. Earlier this year, Exxon (XOM) CEO Darren Woods said he wants to double the company’s shale production. For now, it’s a wait-and-see game.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.