Alibaba: Undervalued or Overexposed?

Alibaba: Undervalued or Overexposed?

The company has the potential for growth—but geopolitical risk is dimming its bright future

- Alibaba’s earnings report, which is on the schedule for tomorrow, is expected to shed light on how the company is managing China’s sluggish economic recovery.

- Following the elections, Alibaba and other Chinese companies face heightened U.S.-China trade tensions.

- But Alibaba’s long-term outlook remains strong, potentially offering opportunity for investors willing to ride out near-term uncertainties.

As Alibaba (BABA), a giant retailer and e-commerce company, prepares to report earnings on Friday, its outlook remains firmly tied to the health of Chinese consumers. Like other China-based companies, its performance often mirrors domestic economic conditions.

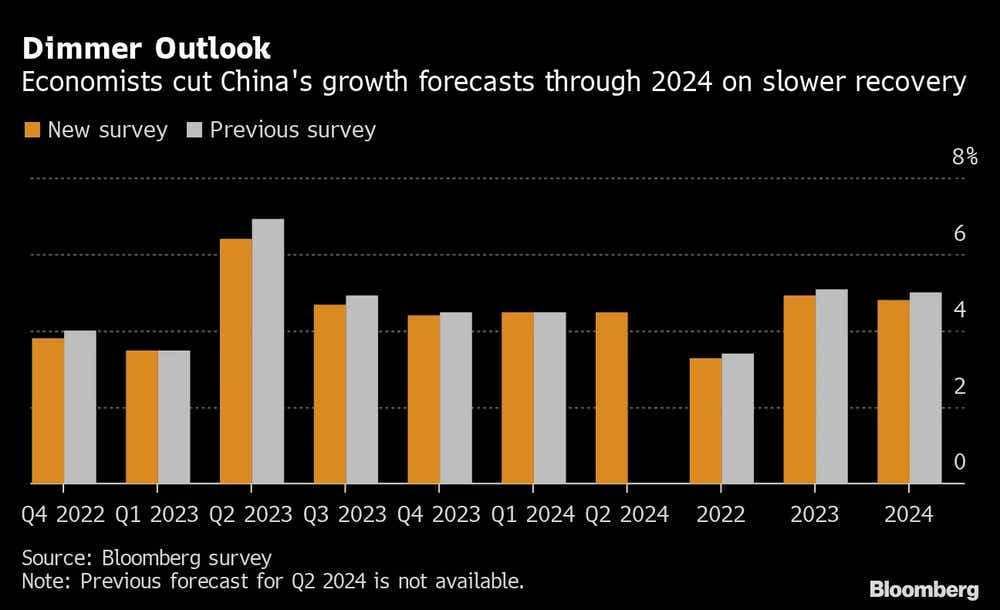

Since the COVID-19 pandemic, the Chinese economy has struggled to regain its footing, with cautious consumer spending weighing heavily on recovery. This sluggish rebound has left China’s consumers under financial pressure, creating headwinds for Alibaba’s core e-commerce business.

To help boost the economy, the Chinese government introduced a series of stimulus measures in autumn 2024. They include reductions in the reserve requirement ratio, cuts to short-term interest rates and support for the real estate sector. While these measures boosted short-term investor sentiment, some analysts have called them “too little, too late” to address the deeper structural challenges to China’s economy and consumer base.

Renewed geopolitical pressure is adding to the challenge. Donald Trump’s re-election and his well-known hardline stance on China have revived concern about fresh tariffs and other trade restrictions, muddling the outlook for Chinese companies operating on a global scale.

For Alibaba, which has strategically expanded into international e-commerce markets, the possibility of renewed trade tension adds another layer of uncertainty. As investors weigh Alibaba’s growth prospects, they must balance the company’s long-term fundamentals against a complex and shifting economic and geopolitical backdrop.

From marketplace pioneer to tech powerhouse

Alibaba Group occupies a central position in Chinese and global e-commerce, evolving from a simple online marketplace to a diversified tech powerhouse. The company, founded in 1999, revolutionized commerce in China by connecting small businesses with consumers.

Today, it operates in sectors that include retailing, cloud computing, digital media and logistics. Its e-commerce platforms, particularly Taobao and Tmall, have become household names in China, and the company’s reach extends internationally through investments in Lazada and AliExpress, providing an expansive marketplace for goods worldwide.

Alibaba’s e-commerce system centers on its robust platform infrastructure, which enables merchants to connect directly with consumers. Over time, Alibaba has introduced a range of digital tools and services that empower sellers and enhance customer experience, from advanced data analytics to AI-driven personalization.

Under new CEO Eddie Wu, Alibaba has signaled a strategic shift towar focusing more closely on third-party merchants, thus positioning Taobao and Tmall as open marketplaces instead of having them rely on Alibaba’s own direct sales. This pivot aligns with the company’s long-term goal of creating a sustainable and agile e-commerce ecosystem in response to China’s shifting consumer landscape.

In recent years, Alibaba has invested heavily in areas beyond e-commerce. Its cloud computing division, Alibaba Cloud, has grown into one of the largest cloud providers in Asia, offering advanced computing power and AI tools to enterprises in differing sectors.

While this segment contributes a smaller portion of revenue compared to its e-commerce platforms, it is viewed as a key growth driver because of the rising demand for AI solutions and digital transformation services. Alibaba Cloud’s focus on high-margin contracts and AI-enhanced offerings positions it well in a competitive but expanding market, making it an integral part of Alibaba’s growth strategy.

The composition of Alibaba’s revenue reflects this strategic diversification. Its core e-commerce operations remain its financial backbone, but recent shifts toward cloud computing and international commerce signal a broader vision. This approach aims to buffer the company against fluctuations in consumer spending in China, while capturing growth from overseas markets and enterprise clients.

Alibaba’s cloud investments, along with its international reach through Lazada and AliExpress, embody its ambition to evolve from a domestic e-commerce giant into a globally diversified tech leader. As Alibaba adapts to market dynamics and competitive pressures, its multifaceted business model provides resilience, offering potential for sustainable growth in both established and emerging segments.

Navigating domestic challenges while pursuing global growth

Alibaba’s recent earnings reveal a company in transition as it navigates a challenging domestic market while bolstering its growth ambitions abroad. In fiscal Q4 (January through March 2024), Alibaba posted a modest 1% year-over-year revenue increase to $30.7 billion, a trend that continued in Q1 with a 5% year-over-year rise to $34.01 billion.

However, profitability has been less resilient; net income fell 85% in Q4 and declined another 29% year-over-year in Q1, largely because of investment losses and operational income declines. This dip underscores the pressures on Alibaba’s core e-commerce business, which has faced intense competition and cautious consumer spending in China.

Quarter-over-quarter (from the January-March quarter to the April-June quarter of 2024) revenue rose 11%, signaling some improvement, especially compared to the year-over-year figures cited above. However, the company’s core Taobao and Tmall segments remain under strain, with revenue from China e-commerce slipping 1% in Q1, compared to to Q4.

Despite that, Alibaba noted double-digit growth in gross merchandise value (GMV) across its platforms, suggesting a steady base of consumer engagement even as spending in China remains constrained. CEO Eddie Wu’s shift toward third-party merchants and enhanced monetization on Taobao and Tmall aims to catalyze fresh momentum during the next six months, but a recovery in this sector will probably be contingent upon improvement in the underlying Chinese economy.

While domestic e-commerce has seen limited growth, Alibaba’s international commerce operations have provided a much-needed boost. International sales rose 32% year-over-year in Q1, driven by platforms like Lazada and AliExpress, which continue to expand in key overseas markets. The company’s overseas expansion supports diversification of its revenue stream, and positions Alibaba to capture growth in emerging markets—a move that offers some degree of insulation from the Chinese market.

Alibaba’s cloud computing division also offers attractive long-term potential, with revenue up 6% year-over-year in Q1 to $3.69 billion. With a strategic pivot toward higher-margin contracts and burgeoning demand for AI, Alibaba’s cloud division is positioned to expand. The segment’s adjusted EBITA soared 155% in Q1, benefiting from gains in efficiency and rising demand for AI-related services.

However, Alibaba’s cloud growth rate remains modest compared to the explosive growth seen in U.S. tech peers, and its future will hinge on the success of its AI offerings, as well its the effectiveness of its strategic investments in cloud infrastructure.

The upcoming Q2 earnings report, slated for tomorrow, will be pivotal because investors seek clarity on whether Alibaba can stimulate growth in its Chinese e-commerce segment, while sustaining momentum in its cloud and international divisions. Overall, the recent earnings reports at Alibaba are indicative of a company trying to balance domestic challenges while attempting to grow its global footprint—a value proposition that may appeal to investors looking for long-term growth and are willing to weather short-term uncertainties.

An attractive but uncertain earnings multiple

Alibaba’s valuation reflects both its long-standing market presence and the challenges it faces in a shifting regulatory and competitive environment. The company’s trailing 12-month GAAP price-to-earnings (P/E) ratio stands at approximately 24. That’s above the sector median of 19, indicating investors assign a premium to its scale, global reach and diversified business model. With a market capitalization of about $220 billion and a share price hovering around $92, Alibaba trades at a multiple that suggests confidence in its capacity to sustain long-term growth, even amid pressures in its core e-commerce segment and a challenging domestic market.

For comparison, Amazon (AMZN), a global competitor that’s often benchmarked against Alibaba, trades at a much higher price-earnings (P/E) ratio of 45. This difference demonstrates Alibaba’s relative undervaluation against its American counterparts, especially given Alibaba’s similar scale and diversified revenue streams in e-commerce, cloud computing and logistics. Yet, Alibaba’s comparatively lower multiple reflects the risks associated with its primary market in China, including regulatory challenges and a slower economic recovery compared to the rebound in the U.S.

Adding to the complexity of Alibaba’s valuation outlook is the impact of recent economic policies. In September 2024, the People’s Bank of China introduced a sweeping stimulus package aimed at supporting the economy. The package included reductions in the reserve requirement ratio to the lowest levels in years, as well as lower mortgage rates and incentives for the property sector, sparking a brief rally in Chinese stocks.

For Alibaba, this stimulus provided a short-term lift in outlook as investors anticipated a potential recovery in consumer spending and corporate performance. However, the stimulus is widely seen as limited in scope, and analysts suggest China’s government is unlikely to depart significantly from its restrained stimulus approach, which prioritizes manufacturing over consumer sectors.

The outlook has become even more uncertain with the election of Trump, who has pledged to increase tariffs on China. This has introduced renewed concern about the U.S.-China trade relationship, with potential impacts on Alibaba’s international operations and overall market sentiment.

While the Chinese stimulus may buoy Alibaba in the near term, the risk of escalating trade tensions poses a potential headwind for the company and its valuation. As Alibaba navigates these complex economic and geopolitical challenges, its relatively modest P/E multiple could reflect both a cautionary signal and an opportunity, depending upon how effectively it manages these external pressures and leverages growth in its diversified business units.

Investment takeaways

Alibaba’s current valuation reflects both the caution and the promise that define this tech giant’s future. Trading at a P/E ratio of 25—well below Amazon’s 44—the stock appears reasonably priced, particularly given its diversified revenue streams and strategic shift to empower its independent business units.

Wall Street analysts generally agree Alibaba’s potential for long-term growth makes it an appealing investment opportunity. Among 61 analysts covering the stock, 43 rate the stock a “buy,” eight rate it “overweight” and 10 rate it a “hold.” Notably, none of the analysts rate the stock a “sell” or “underweight.” Based on these ratings, the average price target for Alibaba stands at approximately $120 per share—implying significant upside potential from its current price of $92.

On the other hand, Alibaba’s trajectory is not without obstacles. With Donald Trump poised to re-enter the White House in January, the stock may face new headwinds as the administration’s China policy evolves. Potential tariff increases or other trade constraints could affect Alibaba’s growth outlook, adding an element of geopolitical risk to its promising fundamentals.

Until U.S.-China relations are clarified, investors may need to balance Alibaba’s growth potential with the possibility of increased near-term volatility. Yet for those willing to ride out these uncertainties, Alibaba could offer a compelling combination of value and potential.

Beyond Alibaba’s individual valuation, one could argue Chinese stocks as a group are undervalued compared to their global peers, particularly American equities. Over the past five years, shares of Alibaba have lost more than 50% of their value, and the KraneShares CSI China Internet ETF (KWEB), which serves as a barometer for Chinese tech, has declined by roughly 34% over the same period. This broad underperformance highlights the degree to which Chinese equities have lagged behind, weighed down by regulatory uncertainty and economic pressure.

From this vantage point, any upside surprise—whether a stronger-than-anticipated recovery in China’s economy or a softened approach to U.S.-China trade relations under the new U.S. administration—could act as a powerful catalyst, sparking a “snapback” rally across Chinese equities.

Should such a rally materialize, investors may find themselves with an opportunity to capture substantial gains, riding the momentum as Chinese stocks regain some of their lost ground. For those willing to navigate the near-term volatility, this potential for a rebound adds an appealing layer to Alibaba’s current valuation.

In the near term, however, performance in shares of Alibaba will be closely tied to the tomorrow's earnings release. But once the immediate effects of the earnings report settle, the stock’s future direction is likely to be shaped more by broader economic and geopolitical factors.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.