Intel Earnings Preview: Can New CEO Reverse the 2025 Slide?

Intel Earnings Preview: Can New CEO Reverse the 2025 Slide?

By:Mike Butler

The company has struggled to regain momentum ever since its stock fell 27% after the August earnings report

- Intel will report quarterly earnings after the market closes on Thursday.

- The semiconductor company is expected to announce earnings per share of $0.24 on $12.3 billion in revenue.

- PC demand is at the heart of the storm with tariff implications looming.

- This will be the first earnings call for new CEO, Lip-Bu Tan.

Once the tech darling of the trading world, Intel (INTC) has seen its stock price fall below $20 per share—the lowest level since 2012. The initial drop in stock price was a result of the Aug. 1, 2024, earnings report, when it dropped over 27% in a day. Ever since, the company has struggled to gain any sort of positive momentum.

Unfortunately, Intel will not dodge the tariff implications that still loom. It has facilities in Ireland, China, Costa Rica, Ireland, Israel, Malaysia and Vietnam, and each country could be affected in a different way.

The new CEO, Lip-Bu Tan, offered these remarks in the 2024 year-end shareholder letter: “Intel’s future success requires an honest assessment of past performance. As I look back on the company’s 2024 results, there is no sugarcoating the fact that we fell short of your expectations. There are many reasons for this, but there are no excuses. I am focused on solutions that will enhance the long-term performance of the company and deliver for you, our shareholders.”

Tan went on to say the work the company has been doing to deliver on the $10 billion cost action plan announced last year plays an important role in the chipmaker’s plans. It includes last year’s 15% reduction in the workforce, cuts in operating expenses and capital expenditures, simplification of the company’s portfolio. and elimination of organizational complexity—all while maintaining critical investment in future growth.

The company reports its most recent quarterly results showed signs of progress. It delivered revenue, gross margin and earnings per share (EPS) above its guidance, the 2024 shareholder letter said.

“While our performance is nowhere near where I believe it ultimately can and must be,” Tan noted in the letter. “This gives us a lot to build on in 2025 as we continue to drive a disciplined focus on execution and value creation."

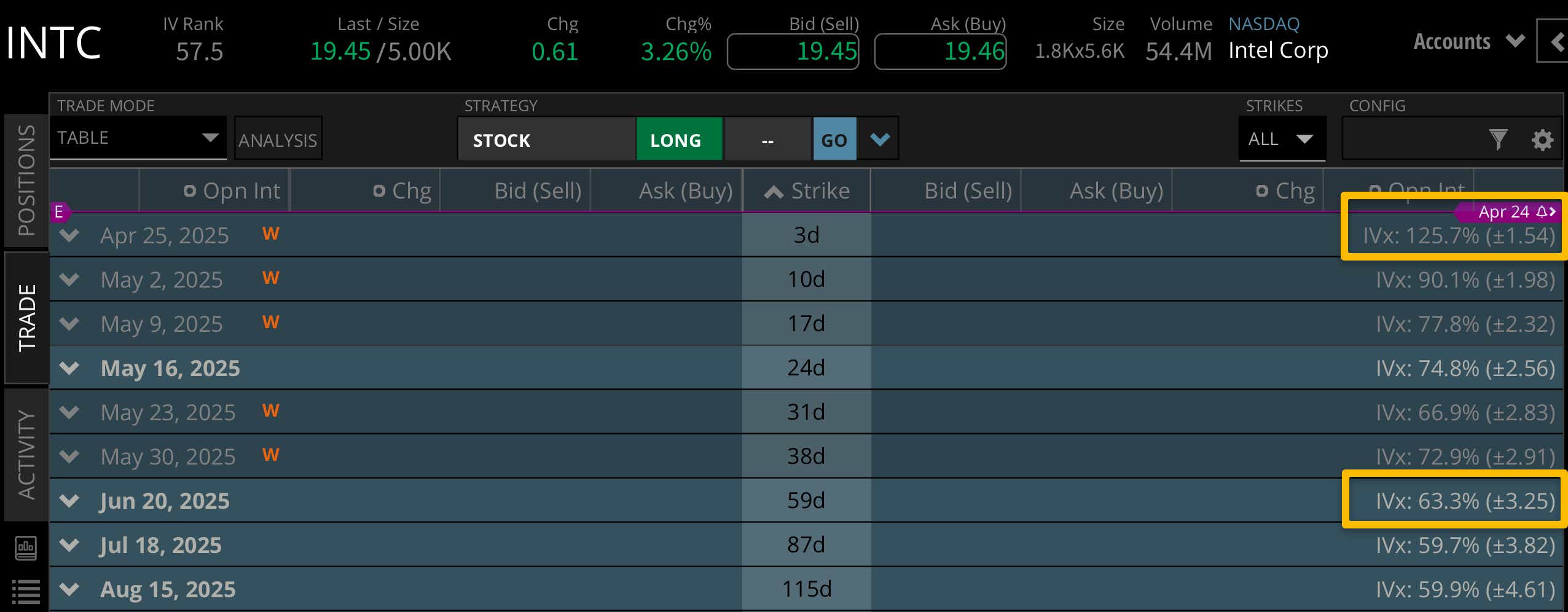

Looking at the options market, we can see an expected stock price range of +/- $1.54 based on this week's implied volatility. Implied volatility is derived from options prices and helps us understand how large or small certain binary events could affect the stock price. This week's expected move is about 7% of the notional value of the stock price, which is pretty high, all things considered.

Looking to the June expiration cycle, we see a +/- $3.25 implied stock price range. That tells us this week has a large impact on the expected stock price range over the next few months, given the fact this week accounts for almost 50% of the range projected through the June expiration cycle.

Bullish on Intel stock for earnings

If you're bullish on INTC stock for earnings, you want to see a strong earnings report and a positive outlook from the new CEO. Many investors are looking to the Intel Foundry event on April 29, which will shed light on the semiconductor manufacturing service Intel offers.

Bullish traders may consider including that date in their strategy if they believe it could result in a boost to the stock price as more information is released.

Bearish on Intel stock for earnings

If you're bearish on INTC stock for earnings, you may assume earnings results will be weak and tariffs could have a larger impact on the company than previously thought. Any sort of weak guidance could send investors scurrying for other tech stocks, especially with the sharp drop in the stock prices we've seen already in the past few months.

Tune in to Options Trading Concepts Live on Thursday for an in-depth look at options trading strategies for Intel and Alphabet (GOOG) earnings.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.