Insider Secrets: How to Profit from Earnings

Insider Secrets: How to Profit from Earnings

Dr. Data on how to master the art of trading earnings season volatility

- During the earnings report season, options pricing typically peaks because of expected market movements.

- But the projected changes are often less dramatic than the actual market swings— so there are profits to be had.

- Trading during this season carries risk, so keep positions small.

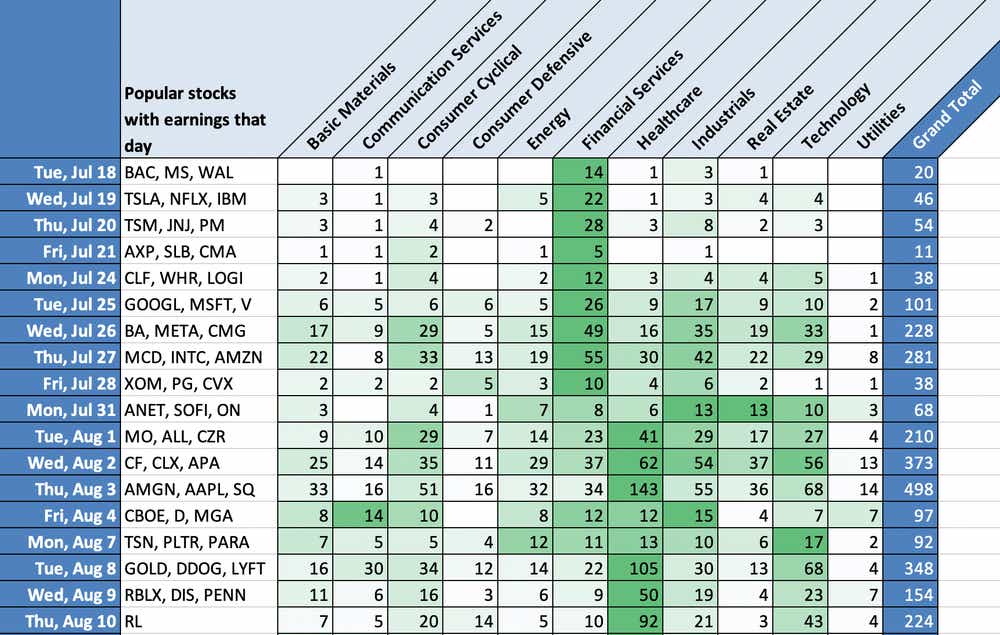

As seen on the calendar below, some big names are scheduled to release earnings reports in the coming days. Companies in the financial services sector are among the first and will have a big impact on exchange-traded funds like XLF, a banking ETF. Healthcare stocks begin at the beginning of August and should have a big impact to XLV.

Why engage in earnings season trading?

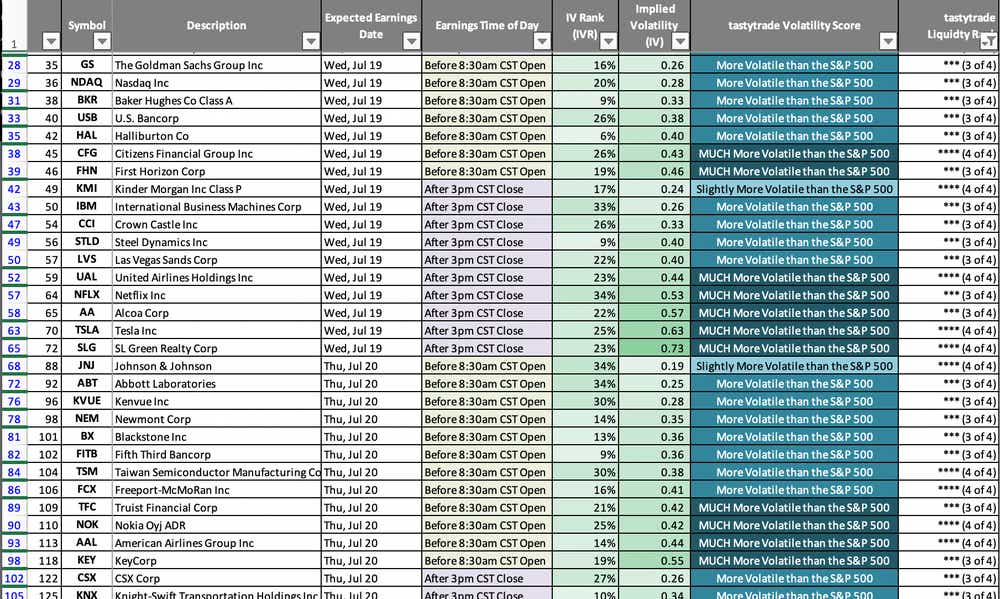

Have a look at the downloadable calendar provided here, showcasing stocks with liquidity levels of 3 and 4 stars. Given the notable volatility in stock prices these days, you may question the rationale behind trading during earnings season. The answer resides in the market mechanics related to options pricing. During earnings reports, options pricing typically peaks because of expected market movements. Interestingly, the projected changes are often less dramatic than the actual market swings.

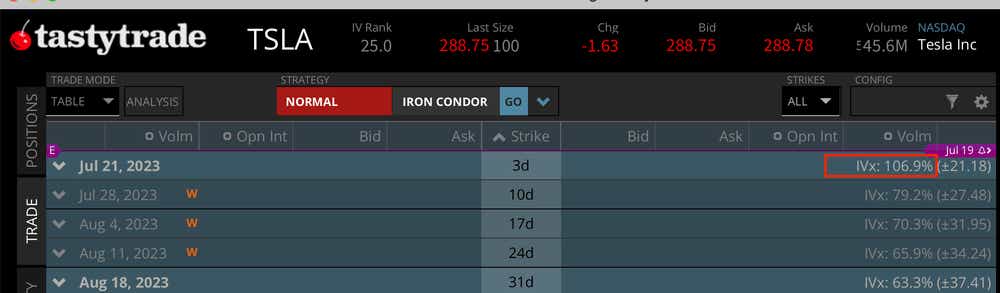

Let's use Tesla (TSLA) as a case in point—its earnings report is slated for July 19, after the market closes. The predicted price fluctuation up until the closing bell this Friday is approximately $21.18, either upward or downward.

The implied volatility is notably high at 106% for this upcoming week, far exceeding the 79% implied volatility just one week later. This means the market is pricing in the largest movement, right before this Friday's expiration.

How should you navigate earnings?

First and foremost, you should strive to maintain reasonable position sizes. Keep in mind that price fluctuations are generally not as sizable as predicted; this is the very reason why insurance firms provide risk alleviation mechanisms at a cost, or premium. This concept holds true for stock options as well. Investors are often willing to pay to transfer their risk to others. As you assume this risk, your role can be likened to that of the insurer. However, given that you don't have endless financial resources, keeping your positions modest is key. Another suggestion is to purchase “wings,” or outer options, to avoid massive losses on either side of the trade.

Take TSLA as an example. Consider a strategy that includes writing (or selling) a short 265 put and a short 315 call (also known as a strangle). Simultaneously, consider buying a 260 put and a 320 call. This effectively turns the trade into an iron condor strategy, which should ideally be applied using this Friday's expiration.

Michael Rechenthin (aka “Dr. Data”), managing director of Research and Development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.