Stocks at Risk, Dollar and Yen May Rise on Telltale Inflation Data

Stocks at Risk, Dollar and Yen May Rise on Telltale Inflation Data

By:Ilya Spivak

Inflation data from the U.S., the Eurozone and Japan headline a busy week of macro data battering financial markets.

- All eyes on the yen as Japanese inflation continues to slow.

- Stocks at risk if U.S. PCE inflation data surprises on the upside.

- The euro may fall as softening CPI sets the stage for ECB rate cuts.

Stocks were a notable standout in otherwise choppy markets last week, buoyed by another banner earnings report from artificial intelligence (AI) revolution darling Nvidia (NVDA).

Treasury yields ticked a touch lower at the long end of the curve while the front end firmed. Crude oil fell within its recent range. Gold rose, but also remained broadly anchored.

Here are the macro waypoints that are likely to shape price action in the week ahead.

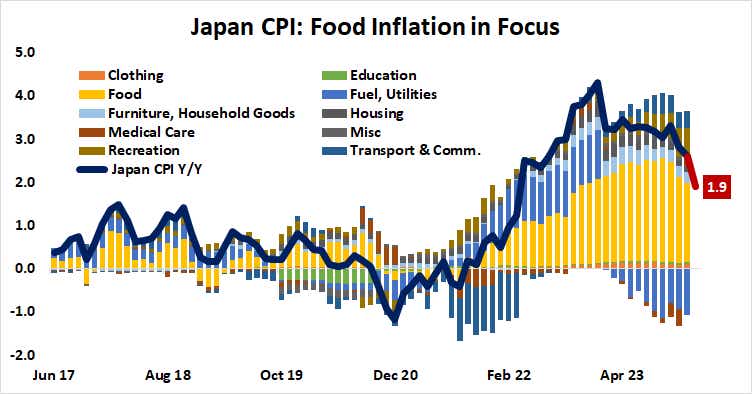

Japan consumer price index (CPI)

Inflation in Japan is expected to fall below the central bank’s 2% objective for the first time since March 2022. Food prices remain the largest contributor to price growth, reflecting imported pressures rather than the kind of domestically founded forces that might have inspired the Bank of Japan (BOJ) to rethink its long-standing dovish bias in earnest.

If the Japanese yen manages to hold up despite still more evidence that the BOJ is unlikely to embark on a hawkish policy “sea change”–the object of feverish speculation recently–that would suggest that the currency’s historic inverse relationship with global yields has truly returned. It would also warn that risk aversion may be on the horizon.

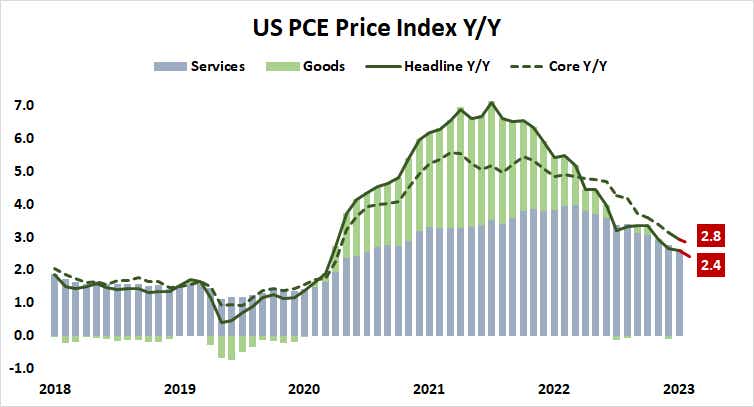

U.S. personal consumption expenditure (PCE) data

The Federal Reserve’s favored measure of inflation is expected to show that price growth continued to slow in January, echoing analog consumer price index (CPI) data released earlier in the month. That set of figures was pointedly hotter than expected however, eating into rate cut expectations and spooking financial markets.

Analytics from Citigroup suggest that U.S. economic news-flow has increasingly outperformed relative to baseline forecasts since mid-January. That has helped trim 2024 rate cut bets priced into interest rate futures from 158 basis points (bps) at the start of the year to 70 bps now. More of the same may be ahead of PCE figures overshot as well.

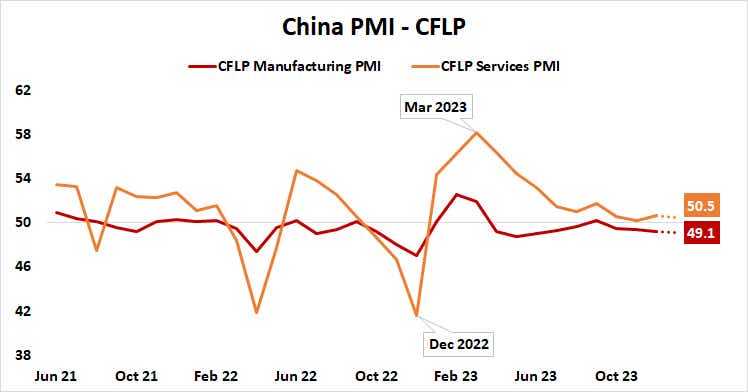

China manufacturing PMI data

The latest set of official purchasing manager index (PMI) readings from China is expected to show that the world’s second-largest economy remains at near-standstill. Economic activity growth is seen slowing in the service sector while the pace of contraction accelerates on the manufacturing side of the equation.

Anemic performance despite Beijing’s attempts at increasing stimulus efforts may stoke global growth concerns, warning that cyclical assets may be vulnerable. That is especially concerning for equities, where optimism linked to buoyancy in the rapidly growing AI space has seen decoupling from bellwethers like copper and crude oil.

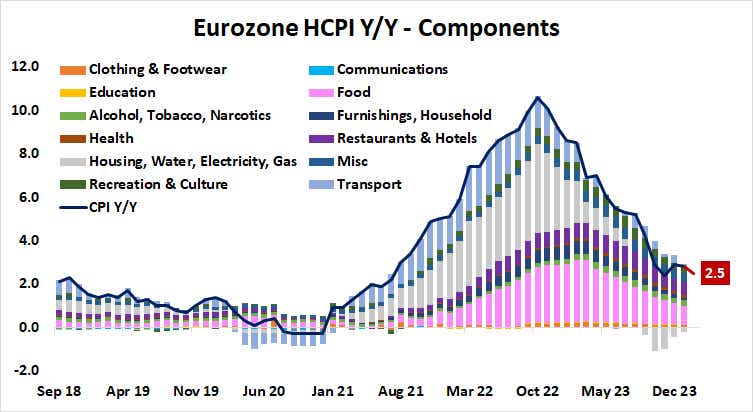

Eurozone consumer price index (CPI) data

Inflation is expected to continue to slow in the Euro Area, clocking in at a three-month low of 2.5% year-on-year in February. Food prices have been the biggest contributor to lingering price pressure, followed by discretionary components like hospitality and recreation.

The European Central Bank (ECB) has little agency over imported food costs, while ongoing recessionary conditions are aiming to pressure discretionary spending. If CPI data shows continued progress setting the stage for the ECB to move forward with rate cuts, the euro appears vulnerable.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.