Implied Volatility and Strike Distance: Why High IV Markets Favor Options Sellers

Implied Volatility and Strike Distance: Why High IV Markets Favor Options Sellers

By:Kai Zeng

Adjusting your strategy based on IV can improve your trading outcomes

- Option premiums are significantly higher in markets with elevated IV, allowing for greater distances between strike prices and the current market price.

- That benefits option sellers because the realized success rate and return on capital are greatly enhanced, even though the theoretical probability of profit (POP) remains unchanged at the time of order entry.

- Understanding how to adjust your strategy based on IV can be a valuable tool for improving your trading outcomes.

Selling options when implied volatility (IV) is high can lead to better trading outcomes.

The main advantage of trading in high IV markets is that option sellers can collect larger premiums. These richer premiums allow you to set your put and call options farther away from the current market price, increasing your chances of making a profit.

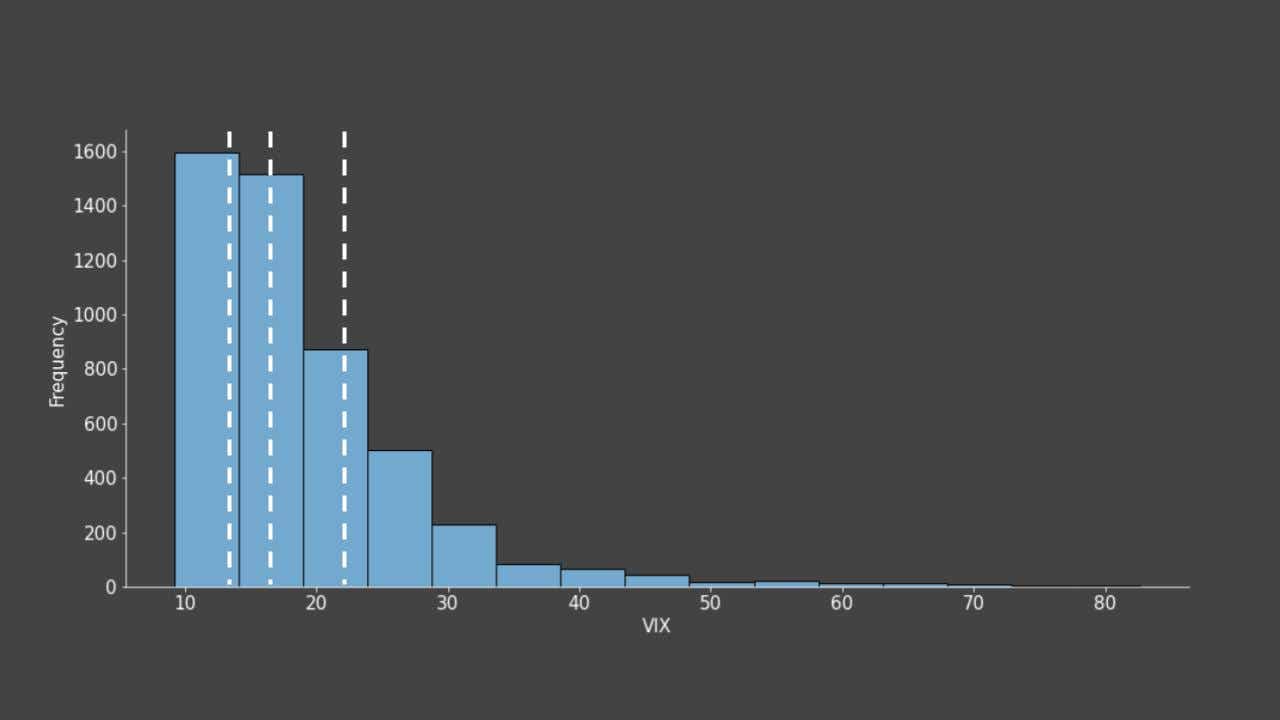

To understand how often different levels of IV occur, let's examine the VIX, which measures market volatility, over the past 20 years.

If we divide the VIX into four groups based on frequency, they would be:

- Less than 13

- 13 to 16

- 16 to 22

- Greater than 22

Next, we need to explore how changes in volatility, whether it expands or contracts, impact where you set your strike prices and how this affects your trading performance.

We conducted tests using SPY 16-delta strangles with a 45-day duration, managing all positions 21 days before they expire.

As the VIX increases, the distance between the strike prices and the current market price expands significantly for the same delta options. When the VIX is above 22, these distances more than double compared to when the VIX is below 13. Additionally, the credit received as a percentage of the stock price rises considerably, pushing the strikes even farther away.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

In terms of performance, higher uncertainty and volatility in high IV markets—especially when the VIX is between 16 and 22—can result in slightly lower win rates. However, these win rates remain favorable for option sellers. The wider strike distances when IV is high lead to better performance in terms of return on capital (ROC).

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.