Bitcoin Exposure Made Easy: iShares Bitcoin Trust ETF Options Are Now Available

Bitcoin Exposure Made Easy: iShares Bitcoin Trust ETF Options Are Now Available

By:Mike Butler

Options began trading yesterday on IBIT and is already the most popular exchange traded bitcoin product

- IBIT—the iShares Bitcoin ETF—was launched yesterday and already has become one of the most popular exchange-traded bitcoin products.

- It’s designed to provide investors with a clean, dynamic exposure to the daily movement of bitcoin.

- With IBIT trading around $54 per share, this opens the door for strategic choices for small and medium sized accounts.

The iShares Bitcoin Trust ETF (IBIT) is BlackRock's Bitcoin ETF. It was launched on Jan 5, 2024, and has been gaining popularity and trading activity ever since. The fund has eclipsed 100 million shares traded twice this year already, which puts it in the same boat as the S&P 500 ETF (SPY). IBIT traded about 50 million shares on average over the last 30 days.

The fund holds over $44 billion in assets and is 100% weighted in bitcoin. This is important because a "clean" exposure to the movement of bitcoin ensures a few other factors move the price of the product. There hasn't been a clean ETP product that just holds Bitcoin 1:1 until now. The ProShares Trust Bitcoin ETF (BITO) offers a big dividend, and MicroStrategy (MSTR) has a leveraged Bitcoin exposure.

IBIT trades around $54 per share and seeks to track the percentage change performance of the spot-price of bitcoin. With a notional value of $5,400 for 100 shares of IBIT, this product is affordable in small to mid-sized accounts.

IBIT reflects a similar high implied volatility when compared to bitcoin, with an average implied volatility of around 70% for each of the available options cycles. That means options will be relatively expensive, which is efficient for cost basis reduction on short options strategies. This can also benefit long options strategies if traders are directionally correct in a short period of time.

IBIT options—what you need to know

Investors should be aware of several factors before trading IBIT options. Here are a few key points:

IBIT ITM options expire to shares. This is not a cash-secured product, which means in-the-money (ITM) options held through expiration convert to shares of IBIT. If you don’t want shares in your portfolio, make sure to close or roll options positions before expiration.

IBIT options have limited expirations for now. Because this is a new product, and expiration choices are tied to options activity, only six expirations are available to trade on IBIT. They are all regular monthly expirations, and more weekly or daily expiration cycles may open up as market makers get a feel for activity in the current active options chains.

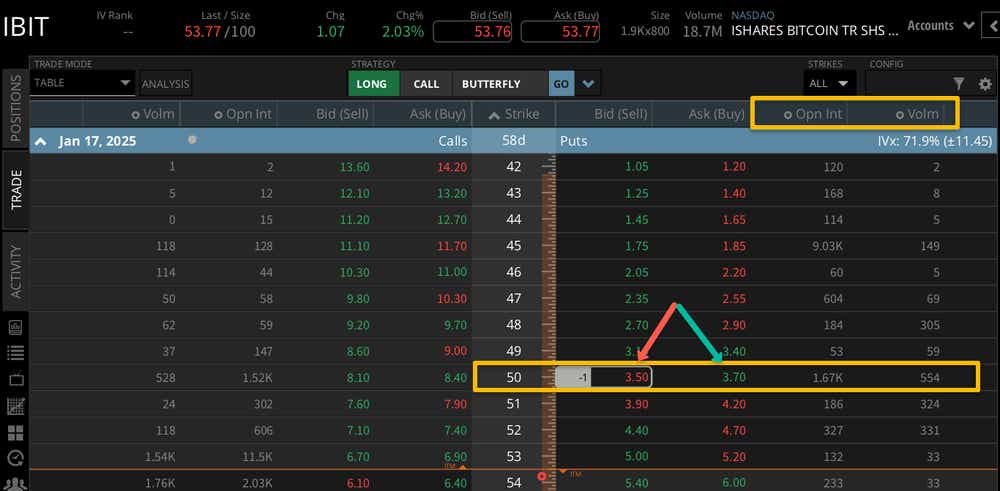

IBIT options can have wide bid-ask spreads. This is a new product with limited activity, so the bid-ask spreads for options can be quite wide. That means traders disagree, and there is a larger difference in price between the bid where options are sold, and the ask where options are bought. You may need to be more patient getting filled on options strategies because of this.

In these environments, I typically like to stick with "round numbers" because that’s where most traders go (50,55,45 strikes, etc.). Be sure to check the open interest and volume columns on the tastytrade platform to see where traders and investors are gravitating in each expiration cycle.

It's an exciting time for the world of cryptocurrencies, with a lot of flexibility around what we can do to gain exposure to the bitcoin world these days. Ideally, we see products like IBIT generate a large options pool with many different expirations and strike choices for pure flexibility for speculating and hedging options positions. It's a great step forward for crypto popularity any way you slice it!

Join us on Options Trading Concepts Live each day as we manage our IBIT options positions and seek out new trades in other products as well!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.