Iron Condors are in Season

Iron Condors are in Season

By:Kai Zeng

Supercharge your returns in slightly bullish, low volatility markets

- Selling a short call and a put spread is called an iron condor.

- Investors favor the iron condor trading strategy in high implied volatility markets.

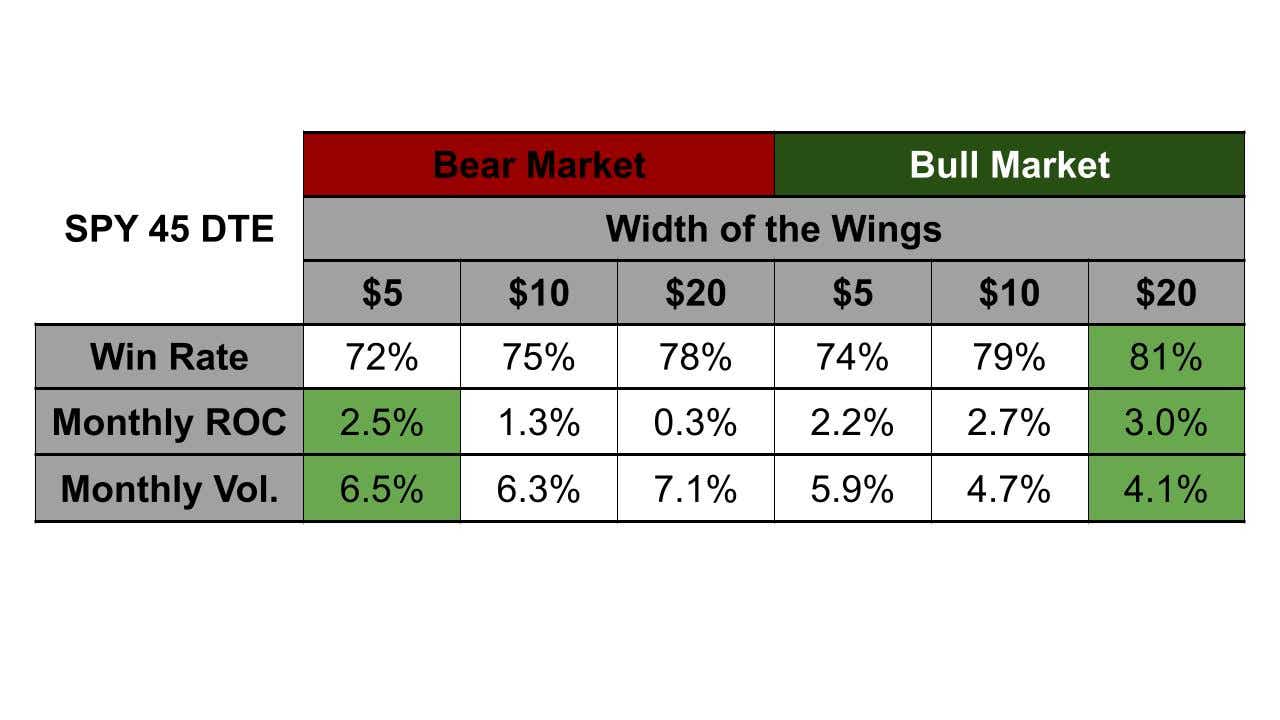

- Wider iron condors generally perform better in bull markets, while tighter iron condors offer more stable returns and volatility in bear markets.

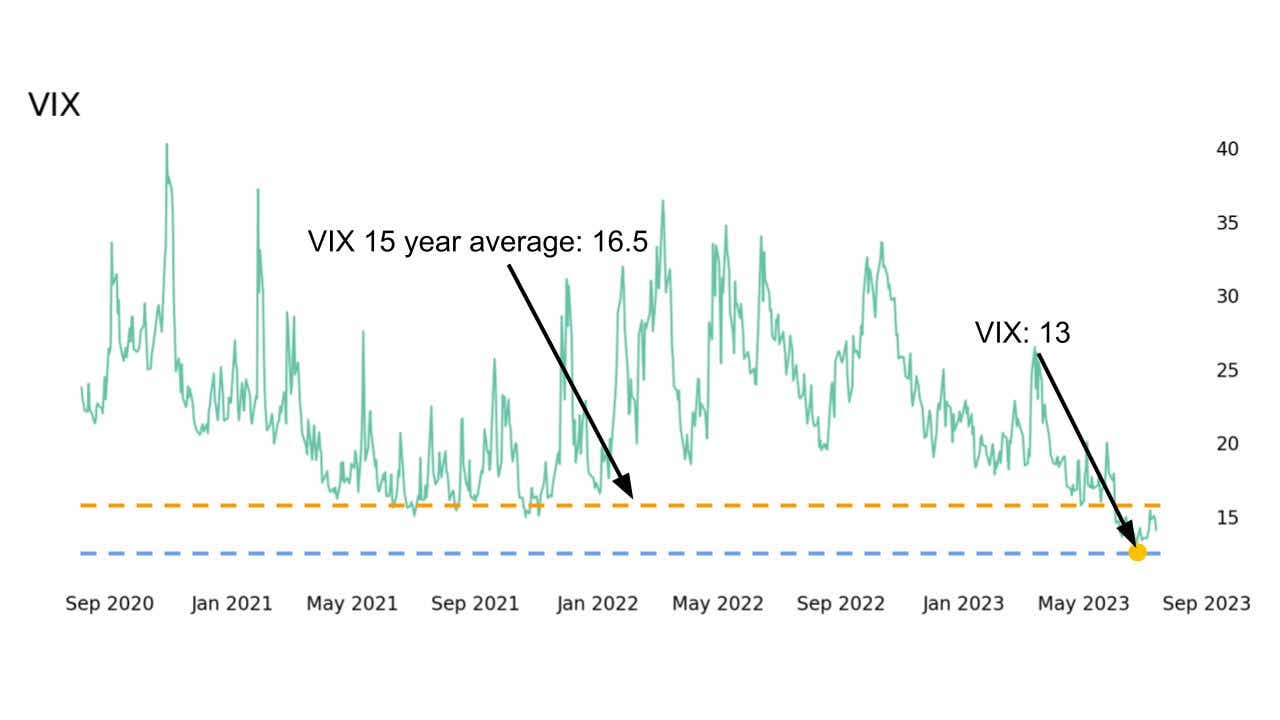

The world of options is complex and constantly changing, offering traders a variety of strategies and techniques. One of the most popular strategies, the iron condor, is favored in high implied volatility environments. However, with the current market exhibiting its lowest level of implied volatility since the onset of the COVID pandemic, options traders who rely on volatility-selling strategies, such as the iron condor, are facing challenges.

The iron condor involves simultaneously selling a short call and a put spread, making it most advantageous when volatility is high. In low implied volatility markets like the current one, premiums decrease and the profit zone narrows. This raises the question of whether it is wise to avoid iron condor trading altogether until implied volatility increases, or if alternative approaches can enhance the success rate and return on capital for such trades.

The condor's wings

One important factor that affects the risk and reward of iron condors in low volatility markets is the width of the wings. The wings refer to the difference between the long and short strike. Opting for wider wings creates a position similar to a synthetic strangle, allowing for greater price movement before becoming unprofitable. In contrast, narrower wings limit the maximum potential loss in a single position, effectively reducing tail risk. The choice between wider or narrower wings for an iron condor in a low implied volatility market is a consideration worthy of exploration.

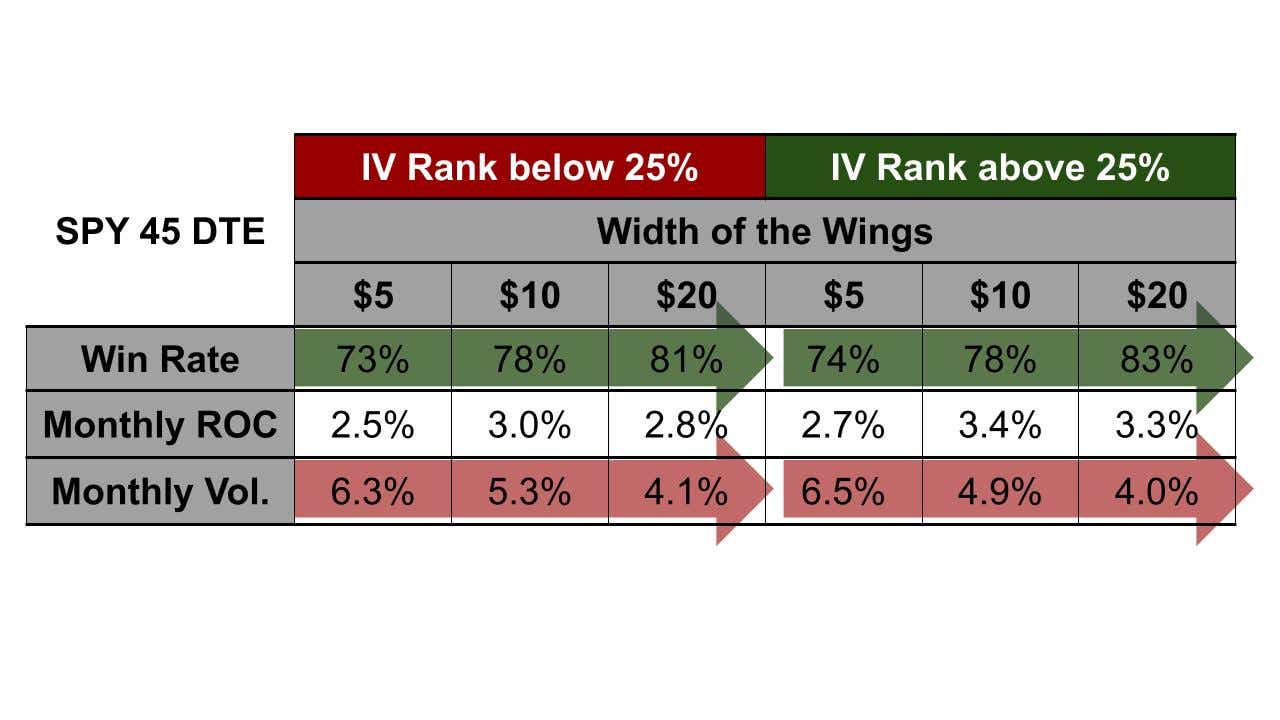

To shed light on this matter, we conducted two quantitative studies using an extensive historical dataset. Our research focused on options with 45 days-to-expiration (DTE) in SPY, where we sold the 25 delta strangles and purchased wings with widths of $5, $10 and $20 in these three strategies.

Testing the condor

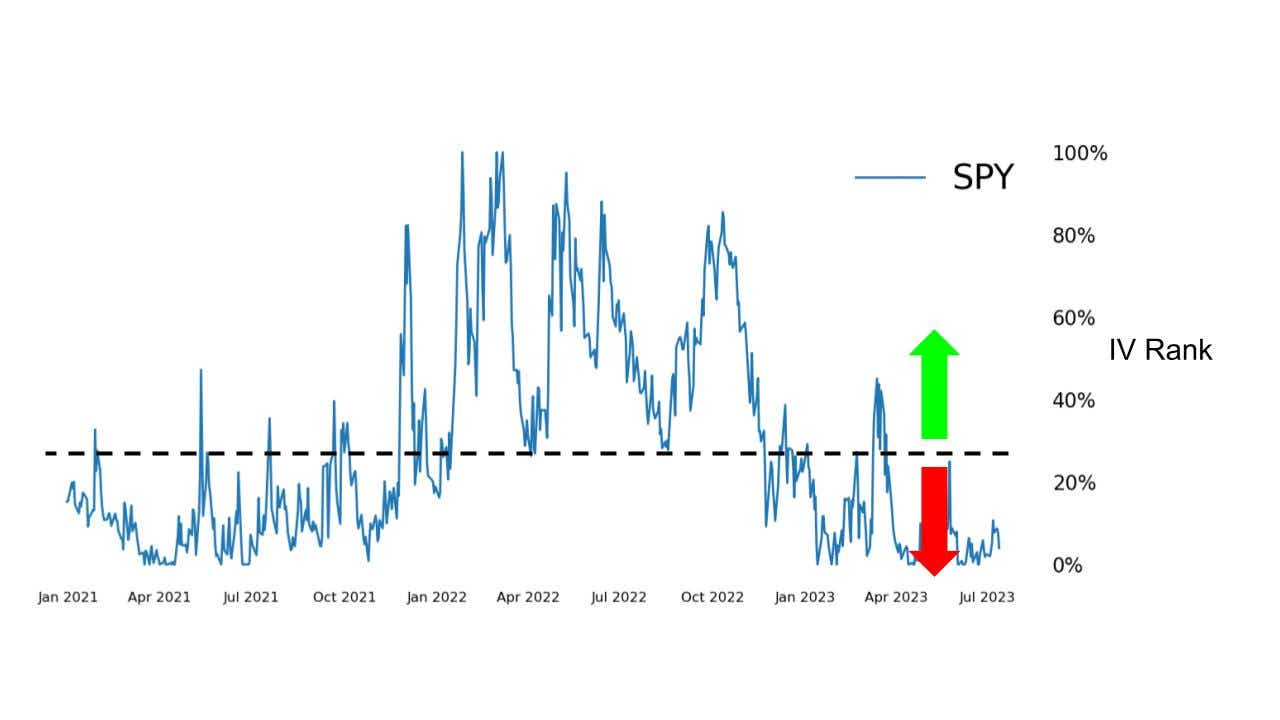

The first test compared the results in high and low implied volatility markets. We used a 25% implied volatility rank (IVR) as the threshold to define the level of implied volatility. Generally, an IVR above 25% indicates a higher implied volatility level with rich premium in options.

As expected, iron condors performed better in high implied volatility markets, with a slightly higher success rate, improved return on capital and better volatility control. Additionally, iron Condors with wider wings ($10, $20 wide) outperformed their narrower counterparts in all metrics, giving us more confidence in using these wider and larger strategies in a slow-moving market.

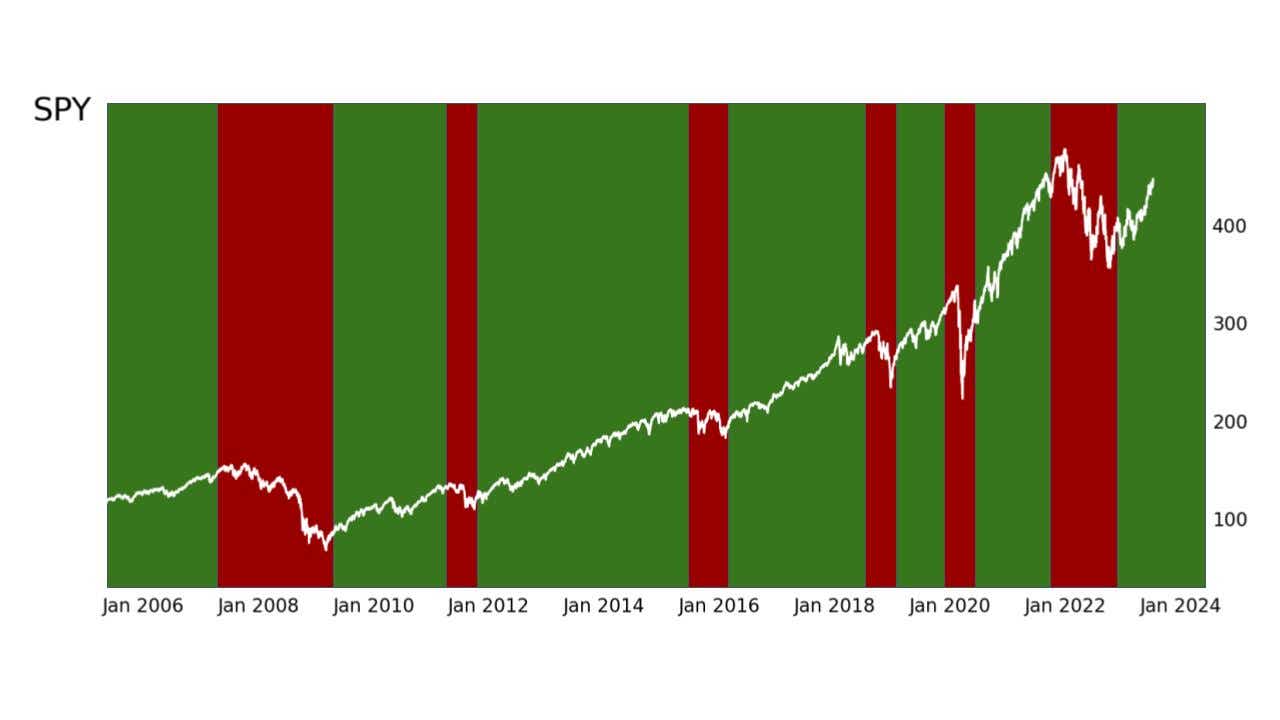

Because a slow grinding bull market often leads to decreasing implied volatility, as we observed between 2013 and 2018, we also tested the performance of iron condors in both bull and bear markets from 2005 to the present. The chart below defines the bullish and bearish years, and there have been a total of six major market drawdowns.

Iron condors showed less consistency between bull and bear markets. Wider iron condors generally performed better in bull markets, while tighter iron condors offered more stable returns and volatility in bear markets. In a slightly bullish market with decreasing implied volatility, using wider iron condors can consistently yield higher success rates, better returns and reduced volatility. Narrow iron condors are generally not preferred in most markets because of their limited profitability, especially in this case.

Understanding the dynamics of iron condors, particularly in low volatility markets, is crucial for traders. The market can continue to inch higher with low implied volatility for extended periods, sometimes years. The width of the wings, the implied volatility rank and the market conditions all play key roles in the performance of this strategy. Wider iron condors offer the most reliable and consistent returns regardless of IV Rank. However, in a low volatility market, choosing a wider iron condor is the smarter choice.

For more on iron condors in low IV markets, watch the video below.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has a 20-year background in derivatives trading and market experience. He cohosts multiple live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.