How to Short Regional Banks

How to Short Regional Banks

Rate Hikes and Banking Crisis: What happened?

Here comes another 25 basis points!

The FED has continued tightening with another 25 basis point rate hike, moving rates up to 5.25%. The rapid increase in interest rates has put massive pressure on regional banks which now have massively underwater bond portfolios. Couple that with a flight of liquidity to higher yielding assets – like current treasury bills or money market funds – and many banks become insolvent. $SIVB, $SNBY, and $FRC have all folded over the last couple months.

Top 2 ETFs to Short The Regional Banking Sector

You can use the following ETFs to short the regional banking sector:

1) KRE – SPDR S&P Regional Banking ETF

KRE is a regional banking sector ETF consisting of 144 smaller banks. Most of the ETF is weighted toward mid cap regional banks, around 50% of the banks currently have a sub 2.7 billion dollar market cap, with around 15% of the basket representing large cap banks. The top three holdings of KRE consist of NYCB - New York Community Bancorp (5.07%), MTB - M&T Bank Corporation (3.22%), RF – Regions Financial Corp (3.04%).

2) KBE – SPDR S&P Bank ETF

KBE is another banking ETF which heavily skews toward the mid cap banking stocks (51%), but with a little bit more exposure to large cap banks as well (27%). The top three holdings consist of FCNCA – First Citizens Bank (2.91%), NYCB - New York Community Bancorp (2.56%), and MTG – MGIC Investment Corporation (2.04%).

Discover more ETFs and opportunities for bullish, bearish, and neutral strategies on tastytrade's platform, open an account now.

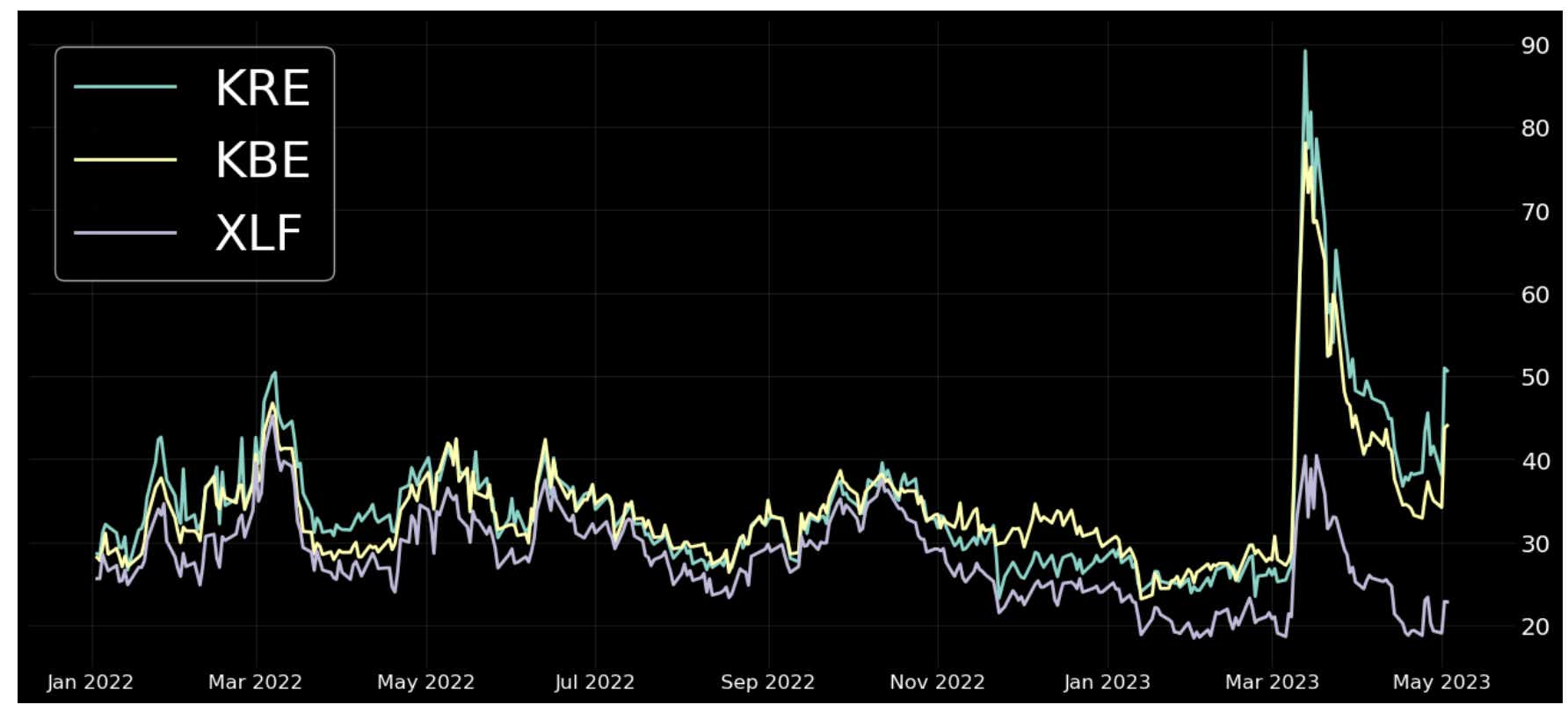

Regional Banking ETFs vs Financial Sector ETFs

Much of the focus, and volatility, has been centered around the regional banking sector vs financials as a whole. While the sector has been weak – larger cap financial sector banks/companies like JP Morgan, Visa, Mastercard, Berkshire Hathaway, and Bank of America, the top 5 holdings of the XLF Financial Sector ETF, have not seen the same level of volatility as regional banks. Volatility in regional bank ETFs has historically been slightly higher. Over the last two months, regional bank sector ETFs like KRE and KBE have seen volatility explode to nearly doubled compared to XLF.

Are there more regional banking collapses on the horizon? Volatility says there might be!

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.