How Often Do Options Overstate?

How Often Do Options Overstate?

To find out we looked at implied volatility to calculate the range the market was expected to move

Traders love options partly because they tend to overstate actual market movements. In other words, options are often priced higher than the market would indicate. That means they’re typically more expensive than the reality they reflect.

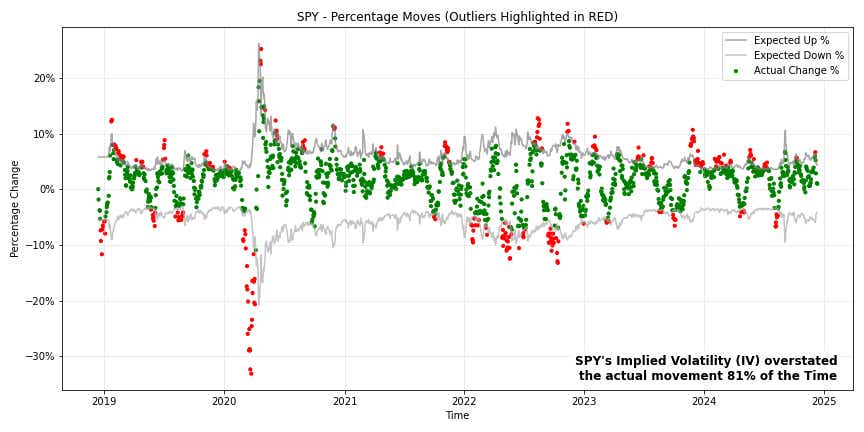

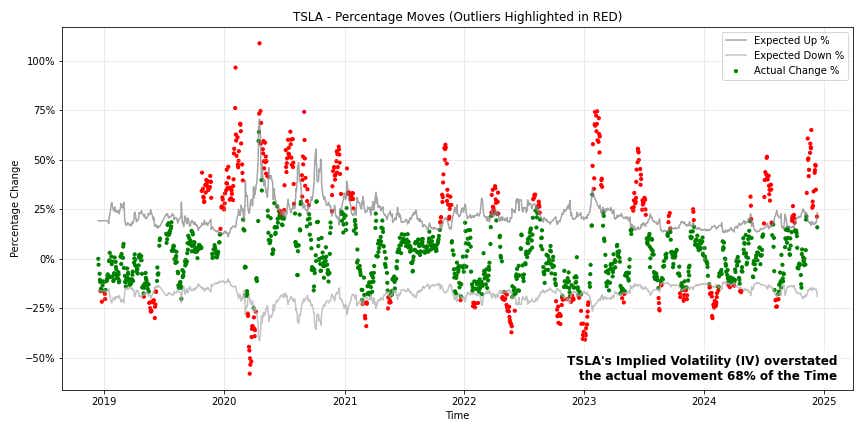

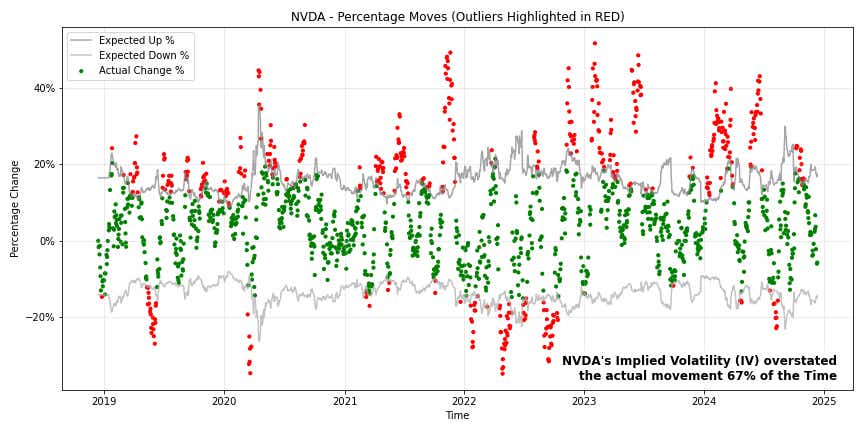

In the visuals below, we took a close look at implied volatility (IV) to calculate the range the market was expected to move—both up and down. Then, 30 days later, we checked to see how often the market stayed within that expected range.

Here’s what we found:

For SPY, implied volatility overstated market movements 81% of the time.

For Tesla (TSLA), implied volatility overstated market movements 68% of the time.

For Nvidia (NVDA), implied volatility overstated market movements 67% of the time.

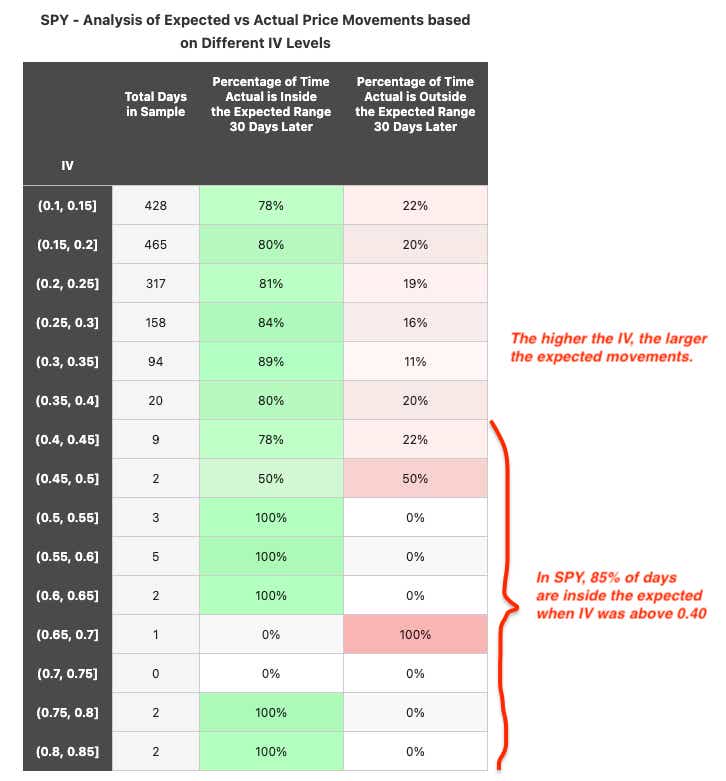

Below, we grouped implied volatility (IV) in SPY to see how often prices fell within the expected range. Interestingly, we found the larger the IV, the more prices were likely to stay within those expectations.

This insight explains why selling expensive options is such a popular strategy. When options are overpriced relative to actual movements, selling them can create opportunities.

Two Trade Ideas

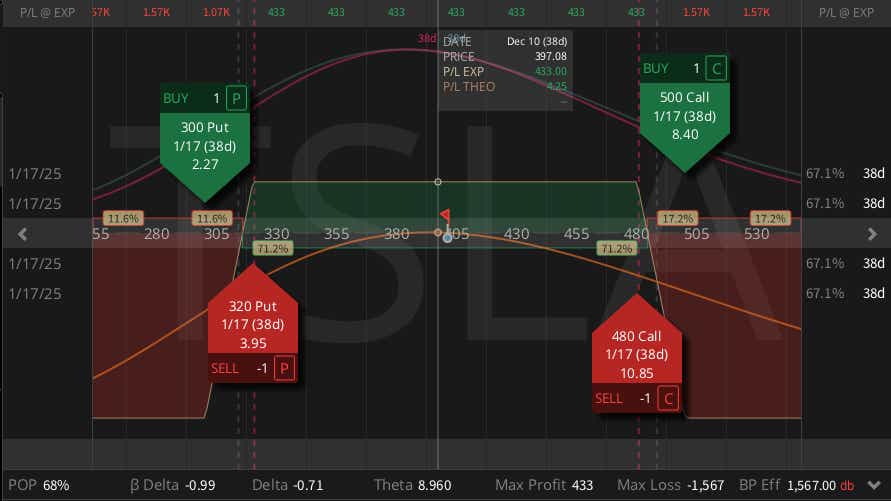

TSLA ($400) iron condor (JAN) $4.33 credit

TSLA has seen volatility explode into this up move, and call skew has increased to nearly 4x the equal distance puts. If you think volatility might contract a bit, or will maybe make just some sideways movement over the next couple of weeks, a wide iron condor is a defined risk way to play it. Short the 320/300 put spread and the 480/500 call spread trades at roughly $4.33 credit, and profits from an inside +/- $80 move or a contraction in volatility.

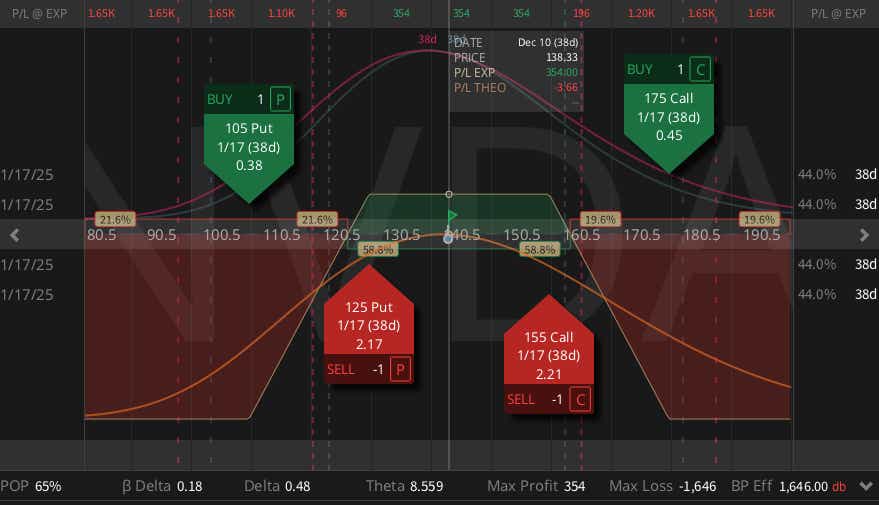

NVDA ($138) iron condor (JAN) $3.54 credit

NVDA got back up to highs in October and since then has chopped around between 135-150. It's still one of the higher volatility stocks in the Mag 7, but hasn't seen much realized volatility. Selling a wide iron condor plays into more of the same, selling the 125/105 put spread and the 155/175 call spread covers the two-to-three-month range the stock has chopped around in.

Subscribe to Cherry Picks

Subscribe to Cherry Picks and get our newsletter in your inbox every week.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.