How Volatility Affects the Selection of Days to Expiration

.jpg?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

How Volatility Affects the Selection of Days to Expiration

By:Kai Zeng

Change the duration to boost profits!

To maintain a consistent daily P/L with the same strategy, adjust your options duration based on the IV level.

Use longer durations when IV is low and shorter durations when IV is high.

Exiting at 21 DTE helps to reduce position volatility, no matter the option duration.

Usually, tastytraders choose option expiration dates close to 45 days to maximize performance. But what should you do if a 45-day option isn’t available? Should you go a bit longer or shorter?

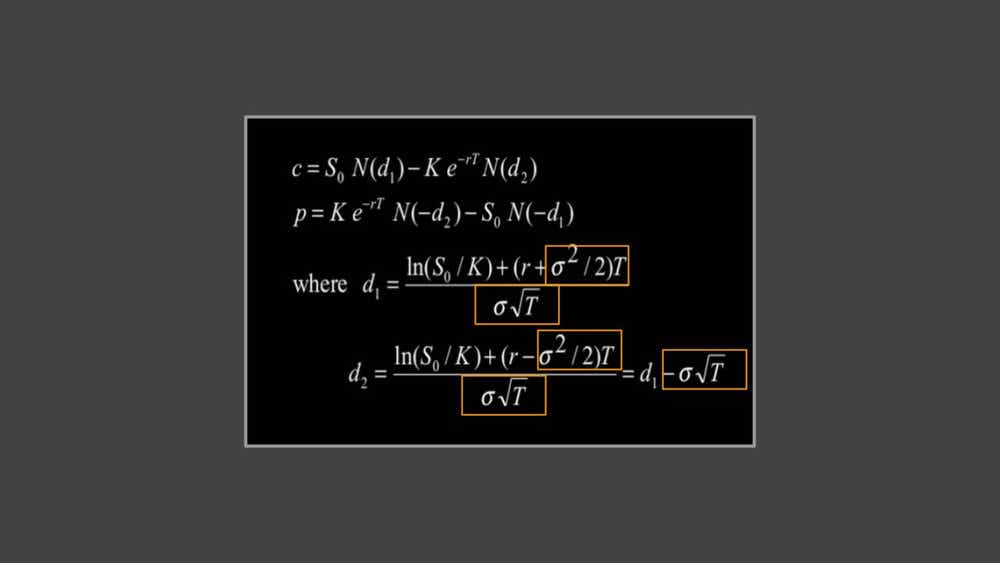

To price an option, you need five inputs: the current stock price, the option's strike price, interest rates, the stock's volatility and the time until expiration.

Once you have the stock price and the strike price, and considering interest rates are the least crucial factor, the two main factors that affect option pricing are time and volatility.

Here's a key insight: If you lower volatility, you can increase the duration of the option to balance things out. So, if volatility is low, a longer-term option can behave like a shorter-term option when volatility is high.

In simpler terms, you could use options with longer durations when volatility (often called "IV" for Implied Volatility) is low, and shorter durations when volatility is high. But how does this work in the real world?

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

To understand this better, we looked at options for SPDR S&P 500 ETF Trust (SPY) using three different durations:

60 Days to Expiration (DTE) when the Implied Volatility Rank (IVR) is below 30.

45 DTE in all market conditions.

30 DTE when IVR is above 30.

We tested these durations with two management styles:

Holding the option until expiration.

Exiting the option at 21 DTE.

Our analysis showed you can achieve a steady average daily profit/loss (P/L) by adjusting the option duration based on the IV level. Although the P/L volatility is a bit higher for shorter-duration options, the results are still similar.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

We also found that exiting the position at 21 DTE reduced P/L volatility across all durations, and the daily P/Ls are very similar, too.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.