How the Fed Rate Cut Affects Homeowners and the Mortgage Lending Sector

How the Fed Rate Cut Affects Homeowners and the Mortgage Lending Sector

As interest rates fall, the mortgage lending sector could offer fresh opportunities for investors and homeowners

The Fed’s recent cut in interest rates will benefit mortgage lenders and homeowners.

Lower rates may trigger a rise in mortgage originations and refinancing, but rising prices and supply shortages could temper those gains.

Homeowners should assess refinancing opportunities in light of declining rates, while investors may want to keep an eye on mortgage-focused lenders.

With more than $12 trillion in mortgage debt spread across 84 million loans, the U.S. mortgage lending market isn’t just important—it’s a cornerstone of consumer finance.

Mortgages account for a staggering 70% of all consumer debt, demonstrating just how vital they are to the financial system and economy. Given this immense footprint, the Federal Reserve’s decision to cut interest rates is poised to influence everything from borrowing costs to refinancing activity.

As rates edge downward, lenders and homeowners stand to reap benefits. For mortgage lenders, lower rates can drive a surge in demand as prospective buyers aim to secure favorable terms. Meanwhile, homeowners with higher-rate loans are exploring refinancing opportunities to lower their monthly payments and reduce long-term interest costs.

Let’s explore the ripple effects of the Fed cut on mortgage originators, and consider whether now is the right moment for homeowners to consider refinancing.

Shifting rates

In recent years, mortgage rates have climbed sharply as the Federal Reserve raised interest rates to combat inflation. Though these rates feel high compared to the ultra-low of the past decade, they remain moderate from a long-term perspective.

From 1972 to 2008, average mortgage rates in the United States never dipped below 5%, often hovering closer to 7%-8%. Following the Great Recession in 2008, however, the Fed slashed rates to stimulate the economy, pushing mortgage rates to record lows. From 2008 to 2022, rates remained below 5%. It wasn't until last year rates climbed back above 5%, with the average mortgage rate for 2023 at 6.09%.

This context shows why 6%+ mortgage rates may feel high in 2024. But mortgage rates were as high as 18% in the 1980s, making today’s rates seem more reasonable. That said, things are often relative, and the recent increase in rates has placed a heavier burden on American homeowners and prospective buyers.

But the Federal Reserve’s latest rate cut should offer relief. Mortgage rates, which tend to follow broader economic trends and Treasury bond yields, have already started to ease (illustrated below). For consumers, this presents an opportunity, making it a relatively more attractive time to secure a new loan or explore refinancing.

Benefit to mortgage lenders

As mortgage rates rise and fall, so too do mortgage originations. During the pandemic, when the Fed slashed rates to near-zero to stimulate the economy, the mortgage lending market boomed, with borrowers eager to take advantage of historically low rates. But as the Fed reversed course and began hiking rates in 2022 and 2023, the mortgage lending market experienced a sharp contraction.

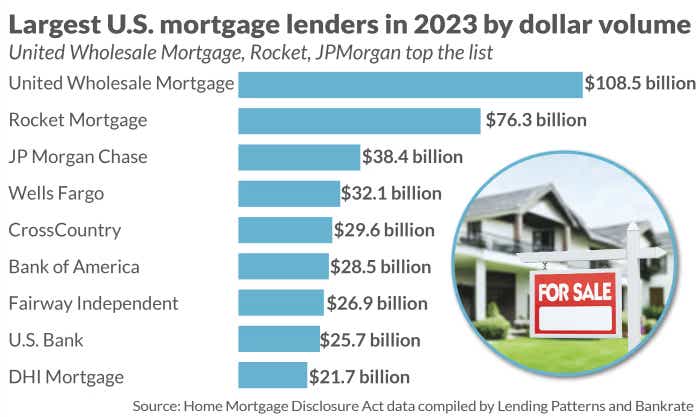

A mortgage origination is the process a lender and a borrower follow to complete a mortgage. The steps includes application, underwriting and funding the loan. Historically, banks like Wells Fargo (WFC) and Bank of America (BAC) dominated this space, but in recent years non-bank lenders such as UWM Holdings (UWMC) and Rocket (RKT) have become players in the industry, as illustrated below.

In 2023, UWM and Rocket together originated more than 580,000 mortgages, leaving banks well behind. For example, Bank of America, the third-largest originator, handled about 92,000 mortgages last year. However, 2023 was a down year for the sector as a whole. Mortgage originations plummeted to fewer than $2 trillion, compared to more than $4 trillion in 2021 when rates were near historic lows.

Though the 2023 levels were consistent with pre-pandemic figures, the rapid rise and fall in mortgage originations have taken a toll. Many originators were forced to cut headcount as demand shrank in response to higher borrowing costs. And with mortgage rates once again moving lower, originators are undoubtedly hoping for a recovery, though the pace of that rebound will depend upon the health of the underlying economy.

Not surprisingly, the stocks of many companies exposed to the mortgage sector have started to rise in anticipation of better times ahead. Year-to-date, shares of Rocket Mortgage have risen 34%, while UWM Holdings has rallied 23%. If mortgage rates continue to decline, these stocks could see additional gains as demand for new originations and refinancing increases.

According to The Wall Street Journal, 15 analysts cover Rocket, with 10 rating the stock a hold, two rating it underweight and three rating it a sell. Based on those 15 ratings, the average price target for Rocket is about $15.50 per share. The stock is up 34% year-to-date and trades for about $19 a share.

Twelve analysts cover UWM Holdings, with two rating the stock a buy, seven rating it a hold and three rating it a sell. The average price target is $8.00 per share. The stock has rallied by about 23% this year and is trading for about $8.50 a share.

Assessing a refinancing

In the wake of the Fed’s super-sized rate cut, many homeowners are thinking of refinancing. If you’ve secured loans in the last couple of years, refinancing could lower your monthly payments. However, the decision depends on factors like the cost of refinancing and how long you plan to stay in your home.

If you expect to remain in your home long enough to recoup the associated costs—typically 2%-5% of the amount of the loan—refinancing may be prudent. A refinancing opportunity looks most attractive if the new rate is at least 1% lower than your existing rate. It's also important to factor in the type of refinance (e.g., cash-out, shorter loan term) when evaluating your choices.

For those locked into higher rates, now could be an ideal time to explore refinancing—especially if rates continue to decline. By consulting with a mortgage professional and thoroughly analyzing refinancing options, homeowners can position themselves to capitalize on favorable market conditions.

Takeaways

The Fed’s recent rate cuts have created opportunities and challenges. For mortgage originators, lower rates offer the potential for increased demand as homebuyers look to secure favorable terms, whether it be a new or existing loan. As a result, mortgage lenders like Rocket and UWM appear well-positioned to capitalize on this shift, as shown by the recent performance of their shares.

However, the mortgage landscape remains sensitive to broader economic trends. While falling rates can stimulate borrowing, factors like housing supply shortages and general economic uncertainty could temper a full-fledged recovery in the mortgage market.

In the end, whether you’re a homeowner eyeing refinancing or an investor watching the mortgage market, the key takeaway is this: Timing matters. Monitoring rate trends, evaluating costs and acting when conditions align with your financial objectives are critical steps to making the most of changing rates.

Besides Rocket Mortgage and UWM Holdings, investors may want to consider adding Mr. Cooper Group (COOP) and PennyMac Financial Services (PFSI) to their watchlists. Both small-cap, non-bank mortgage lenders have gained significant traction in 2024. Year-to-date, shares of Coooper Group have surged 44%, while PennyMac has climbed 28%, demonstrating investors’ confidence in a potential recovery in mortgage lending.

Anyone interested in traditional banks with substantial exposure to the mortgage market, might consider monitoring Bank of America (BAC), JPMorgan (JPM), PNC Financial (PNC), US Bancorp (USB) and Wells Fargo (WFC). Like non-bank originators, these financial institutions typically benefit from declining interest rates, often seeing a rise in new mortgages and refinancing as borrowers seek more-favorable terms.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.