Q2 Earnings Recap

Q2 Earnings Recap

By:Kai Zeng

A look at how companies performed this past earnings season

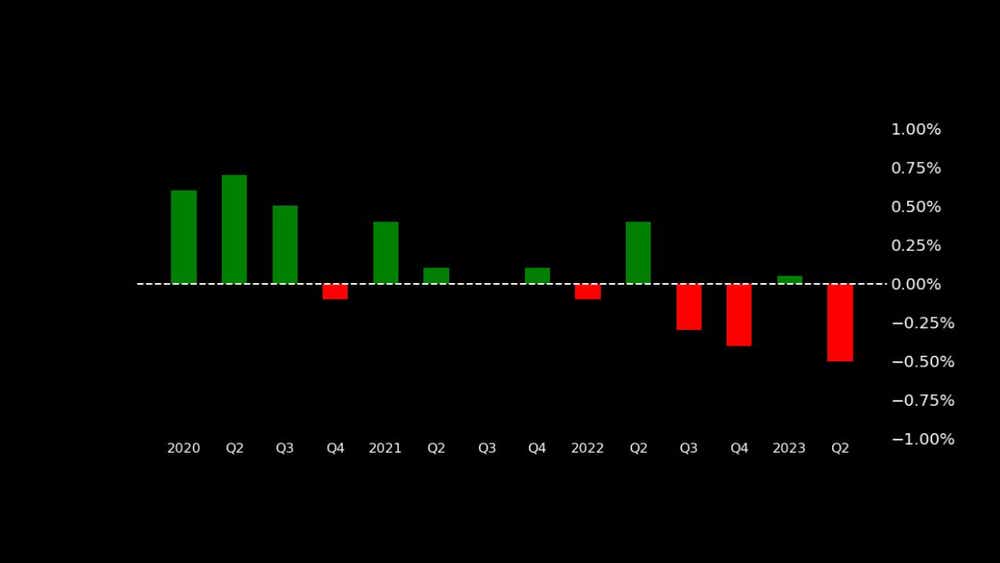

While the recent quarter has seen some of the lowest post-earnings returns in the last three years, the historical data provides a silver lining, showing a 50/50 split between positive and negative returns.

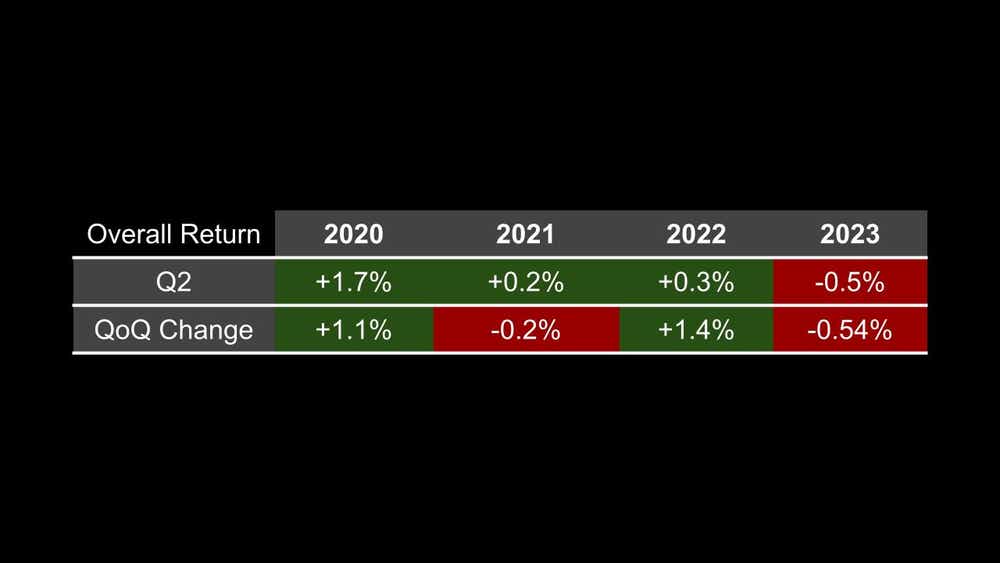

This past quarter was the first time a second quarter experienced a negative return since the onset of the COVID-19 pandemic and demonstrated the worst quarter-over-quarter performance.

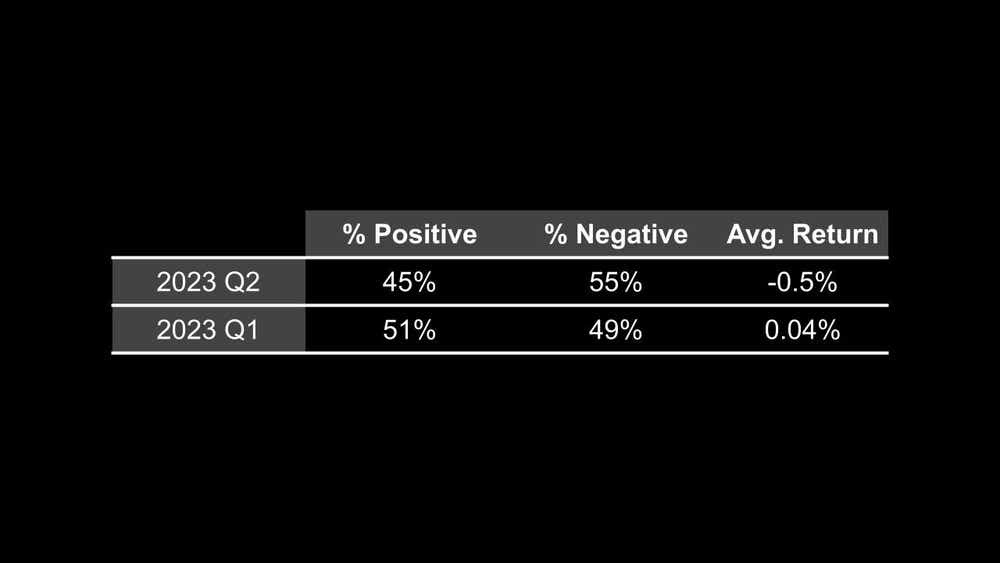

In this past earnings season, more than 3,000 companies have reported their earnings. Fewer than half, or 45% to be precise, reported a positive return after earnings.

As Q2 earnings season draws to a close, the results hold particular significance. Investors and policymakers alike will use these outcomes to inform key decisions.

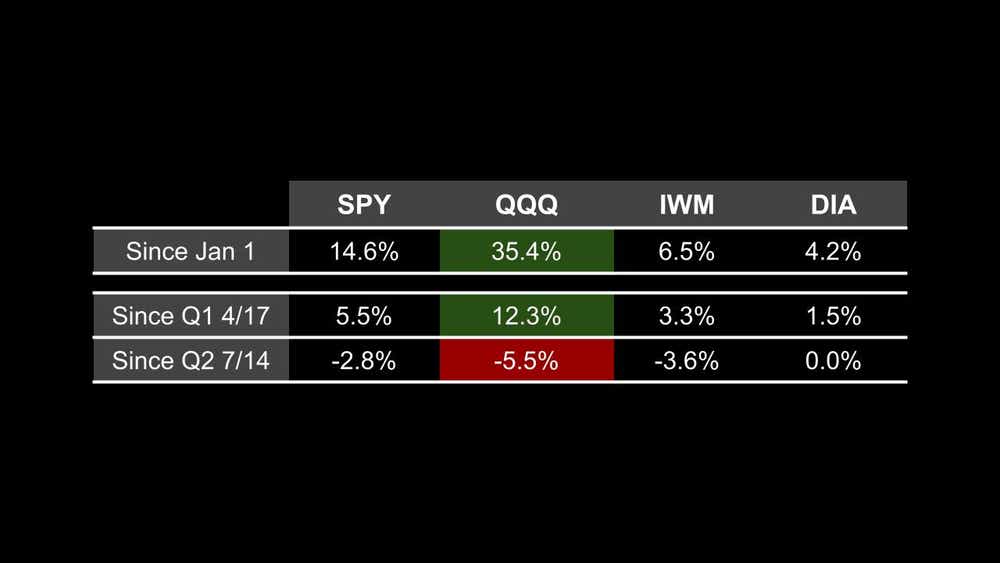

First, let’s look at how the indices perform during the earnings reports. The exchange-traded fund (ETF) QQQ, which tracks the NASDAQ 100 Index, has emerged as the top performer this year among the four major indices, despite experiencing the most significant price drop since the beginning of the second quarter. QQQ has been the most volatile index, in contrast to DIA, the ETF that tracks the Dow Jones Industrial Average, which was the least volatile.

Next, let's dive into the statistics and examine the Q2 performance of various companies. In this past earnings season, more than 3,000 companies have reported their earnings. Fewer than half, or 45% to be precise, reported a positive return after earnings. The average post-earnings return was -0.5%, which is notably worse than the first quarter, which was +0.04%. The post-earnings return is the percentage difference between the opening price after the earnings and the closing price before the earnings announcement.

This past quarter was the first time a second quarter experienced a negative return since the onset of the COVID-19 pandemic and demonstrated the worst quarter-over-quarter performance.

Furthermore, this quarter registered the poorest return in the past three years. However, 2022 still holds the record as the worst year overall. There are still two more quarters before the end of the fiscal year. Anything can happen, but based on the current macro environment, the results won’t be too promising.

While it may seem disheartening that fewer than half of the companies generated positive earnings returns this quarter, traders should not lose faith in the probability game we play by using options. If we look at the historical data over a longer period, the probability of having a positive return is extremely close to 50%. This underlines the inherent unpredictability and risk associated with trading, but also the potential for significant gains for premium sellers, especially the one without directional bias.

In conclusion, it's crucial for traders to remain resilient and patient in these challenging market conditions. While the recent quarter has seen some of the lowest post-earnings returns in the last three years, the historical data provides a silver lining, showing a 50/50 split between positive and negative returns. This serves as a reminder that, in the world of trading, fortune favors the brave and the patient. Despite the ups and downs, the potential for positive returns remains, providing motivation for traders to stay the course and keep a long-term perspective.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.