Soaring Stocks in Hong Kong May Signal China's Weakness, Not Its Strength

.png?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Soaring Stocks in Hong Kong May Signal China's Weakness, Not Its Strength

By:Ilya Spivak

Data suggests mainland investors are seeking escape instead of opportunity

- The stock market in Hong Kong has enjoyed a blistering rally so far in 2025.

- Markets in mainland China have lagged, and the economy remains anemic.

- Funds flow data suggests capital flight may be boosting Hong Kong markets.

Are investors finally daring to dream about a recovery in China? The world’s second-largest economy has been stuck in the doldrums since officials in Beijing begrudgingly scrapped “zero COVID” lockdowns in late 2022, unable to find growth of demand at home or abroad. Now, a surging stock market in Hong Kong has fueled hopes for a turnaround.

To be sure, mainland economic data remains grim. The last three months of 2024 marked the seventh consecutive quarter when nominal gross domestic product (GDP) growth lagged behind the rate of “real” output expansion, where inflation has been factored out. This implies economy-wide deflation, which speaks to near-total absence of demand.

China’s economy remains anemic

Timelier figures are not any more encouraging. The headline consumer price index (CPI) measure of inflation remained weak in January at just 0.5% year-on-year. The producer price index (PPI) gauge of wholesale price growth has remained negative since October 2022. It has printed losses in excess of 2% year-on-year for five consecutive months.

Purchasing managers index (PMI) data tells a similar tale. In fact, the government’s version of the figures looks somewhat gloomier than analog private-sector results from S&P Global and Caixin, despite officialdom’s penchant for rose-tinted statistics. All the same, both series point to flat-lined economic activity growth since September 2023.

.png?format=pjpg&auto=webp&quality=50&width=1920&disable=upscale)

Nevertheless, Hong Kong’s Hang Seng Index (HSI) equity market benchmark has added a blistering 17% since the beginning of the year and nearly 27% from the lows mid-January. The Chinese mainland’s bellwether CSI 300 index has notably lagged. It is up just 3.25% since the calendar turned to 2025, and 6% from last month’s bottom.

It may be tempting to chalk up the rally to the appearance of China’s impressive DeepSeek AI model. Indeed, the HSTECH index—Hong Kong’s answer to the Nasdaq 100—has significantly outperformed HSI. However, it is tougher to make the argument that this implies a tailwind for China’s beleaguered economy.

Are traders misreading the Hong Kong stock market rally?

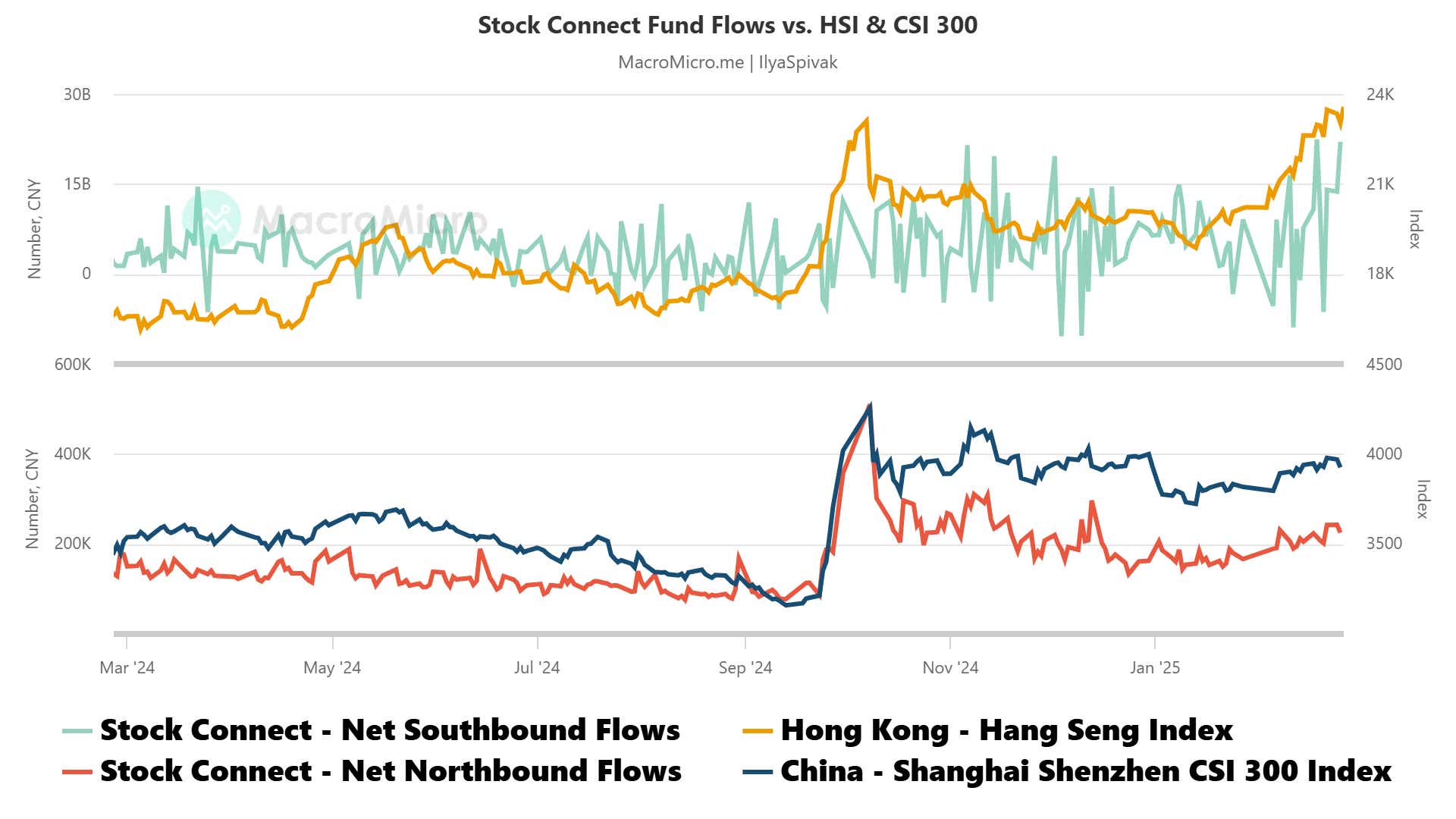

Tracking capital flows across the Hong Kong Stock Connect system—a setup that enables investors with access to Hong Kong markets to transact directly on Shanghai and Shenzhen bourses, and vice versa—appears most telling. This suggests the HSI rally may speak to pessimism instead of optimism about China’s economic outlook.

“Southbound” capital flows from mainland to Hong Kong have notably picked up as HSI has moved higher. “Northbound” flows going the other way have drifted lower alongside CSI 300 since October 2024. That’s hardly a vote of confidence in China’s economic prowess from offshore investors.

Further still, the influx of mainland money into Hong Kong over the Stock Connect has come alongside shifting capital from less liquid “time deposits” typically used to accumulate savings to more liquid “demand deposits.” From here, these funds are easier to deploy for spending and investment.

This hints that recent HSI gains may speak to a desire on the part of mainland depositors to move their money offshore and using stock purchases as a way to circumvent capital controls. This echoes the lost confidence of overseas investors. Foreign direct investment in China has fallen every month since June 2023.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.