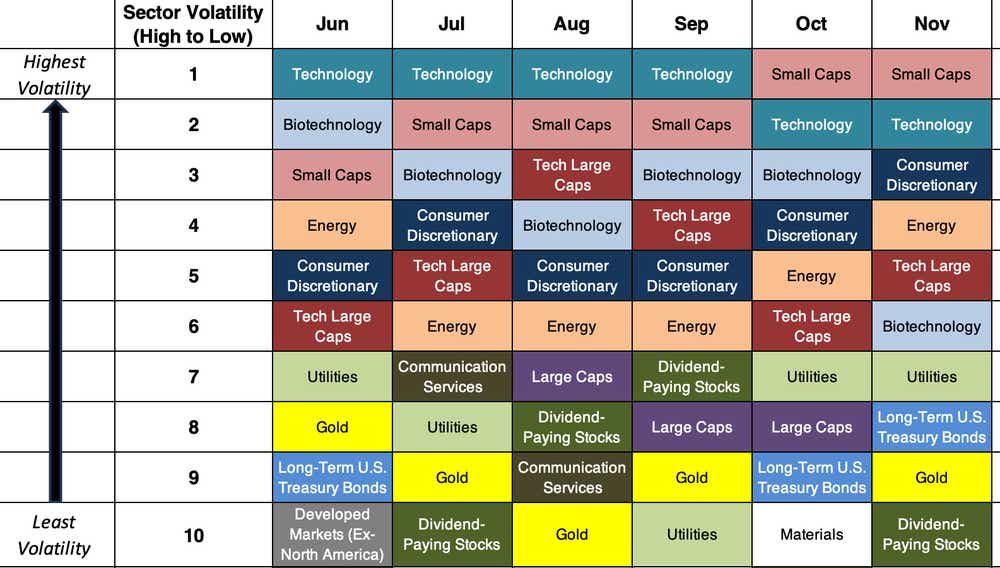

Ranking the Volatility of Exchange-Traded Funds

Ranking the Volatility of Exchange-Traded Funds

How to trade small caps and tech ETFs ahead of Nvidia earnings, plus two options trade ideas

We pulled the implied volatility for some of the biggest exchange-traded funds (ETFs) and ranked them from the highest volatility to the least. Small caps and tech have been the most volatile. If you're considering investing in either of these indices, you might want to sell a put option instead—that approach enables you to earn a premium while potentially entering the position at a lower cost! Or consider a covered call, which is buying the stock and selling a call.

Earnings this Week

NVDA is the biggest one.

Symbols we’re watching this week:

- Today (Wednesday) after the close: Nvidia (NVDA), Palo Alto Networks (PANW)

- Tomorrow (Thursday) before the open: John Deere (DE), Baidu (BIDU)

- Tomorrow (Thursday) after the close: Gap (GPS)

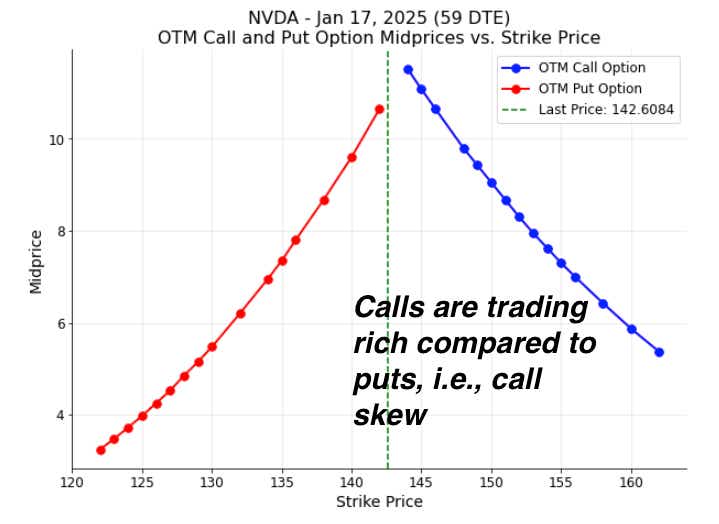

NVDA is trading with Call Skew. If you go 5% away, the OTM put is 7.23 and the OTM call is 9.03. And if you look at the Strikes that are 10% away, the OTM put is $4.75 and the OTM call is $6.4. This is inferring that people are considering the "risk,” or velocity of the move, to be the upside.

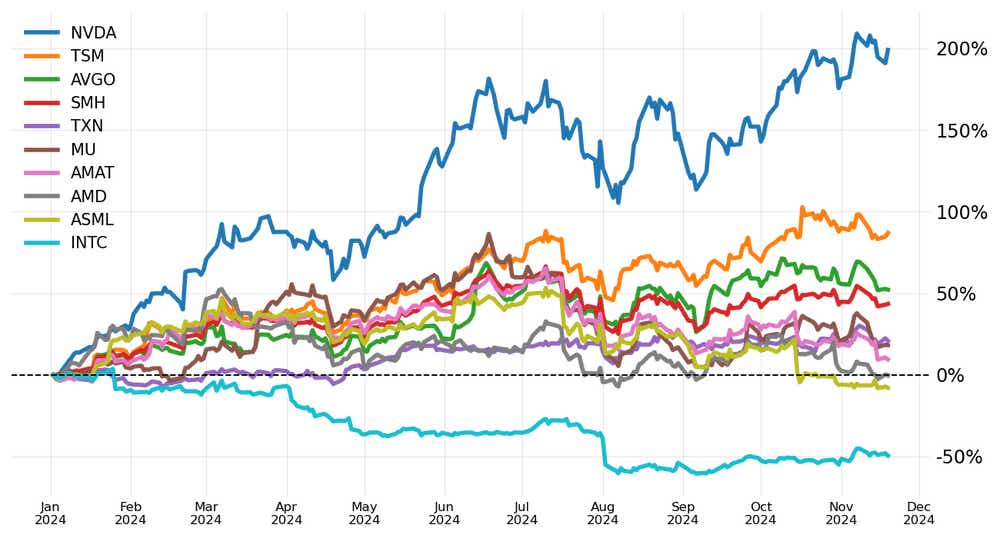

Check this out. The Semiconductor ETF (SMH) biggest components are below. NVDA is holding up the index the most.

Two Trade Ideas

1.IBIT ($52) Call CRAB Trade (JAN/DEC) $2.04 Debit

IBIT options launched today! We finally have a way to trade options on spot bitcoin! Volatility should remain high here—likely in the 60%-80% range, which allows for interesting trades to play into the upside skew. A CRAB trade is a calendarized butterfly, long a closer ATM option further out in time (55 call JAN) and short 2x calls in a shorter duration (60s in DEC) with a wing to define the risk. It plays for a sideways/up move with some positive gamma up to 60.

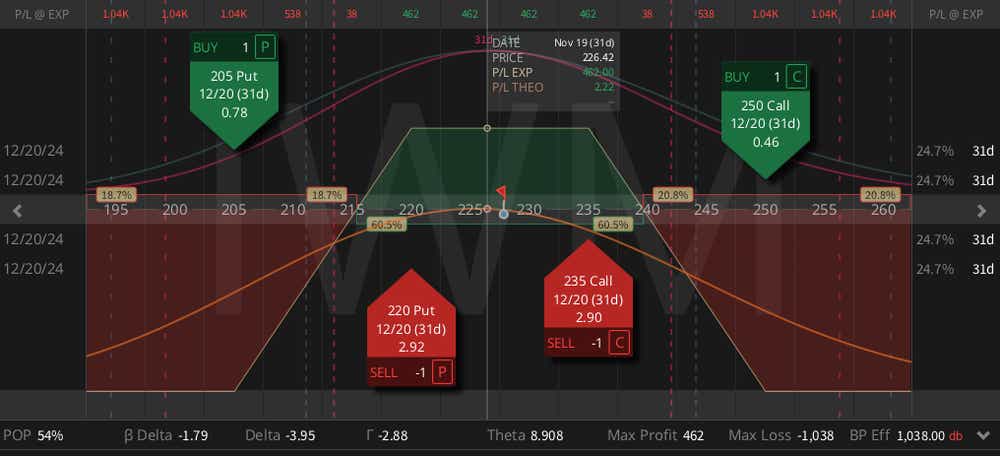

2. IWM ($227) Iron Condor (DEC) $4.62 Credit

IWM (small caps) have remained the highest vol sector on the board, even into what has been a historic contraction in vol post election. If you think we might chop between this recent 220-240 range, an iron condor would fit the assumption. Short the 220/205 put spread and the 235/250 call call spread trades at $4.62 credit roughly 1/3 the width of the strikes.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.