17 High Dividend Paying Stocks to Watch in 2023

17 High Dividend Paying Stocks to Watch in 2023

The financial markets have been unpredictable in 2023, and in such environments, dividend stocks usually draw extra attention. The income provided by dividends can help offset downward (or sideways) movement in one’s stock holdings.

One easy way to identify quality dividend stocks is to filter the largest stock indices in the United States, such as the Dow Jones Industrial Average and the S&P 500.

These indices are comprised of large companies with relatively stable balance sheets. Market participants can then filter by their preferred criteria, and identify possible candidates for inclusion in their portfolios.

For example, one can sort the Dow Jones Industrial Average and S&P 500 by dividend yield—and then filter from there.

Top 10 High Dividend Stocks in the Dow Jones

As of March 2023, some of the companies with the highest dividend yields in the Dow Jones Industrial Average include:

- Verizon (VZ), 6.71%

- 3M (MMM), 5.71%

- Walgreens Boots Alliance (WBA), 5.55%

- Dow Inc. (DOW), 5.11%

- IBM (IBM), 5.03%

- Chevron (CVX), 3.70%

- Amgen (AMGN), 3.52%

- JPMorgan Chase (JPM), 3.07%

- Goldman Sachs (GS), 3.06%

- Johnson & Johnson (JNJ), 2.92%

Top 10 High Dividend Stocks in the S&P 500

From the S&P 500, some of the companies with the highest dividend yields include:

- Verizon (VZ), 6.71%

- Simon Property Group (SPG), 6.43%

- Kinder Morgan (KMI), 6.34%

- ONEOK (OKE), 6.01%

- Williams Companies (WMB), 5.99%

- AT&T (T), 5.77%

- Walgreens Boots Alliance (WBA), 5.55%

- WP Carey (WPC), 5.51%

- LyondellBasell Industries (LYB), 5.07%

- IBM (IBM), 5.03%

Readers should keep in mind that dividend yields can fluctuate based on movement in the underlying stock and/or changes in the company’s dividend policy. For this reason, the dividend yields listed above may be slightly different than what is observed today.

There are some companies that pay higher dividend yields, but investors and traders should be careful when selecting a potential dividend stock because sky-high dividend yields can also be a potential red flag.

When dividend yields are at an extreme that can be a sign that the dividend in question could get cut at some point in the future, because extremely high dividend yields can be hard to sustain over the long-term.

That’s why many dividend investors stick with companies that have a long history of sustained, robust profitability that have consistently paid a stable dividend as it relates to frequency and amount.

17 Best High Yield Dividend Stocks of 2023

More details on the aforementioned dividend stocks is highlighted below:

1) Verizon (VZ)

Verizon Communications provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities around the world. Last year, Verizon distributed US$2.61/share in annual dividends.

2) 3M (MMM)

3M Company is a large conglomerate that operates through four primary divisions: Safety and Industrial, Transportation and Electronics, Health Care and Consumer. The company produces roughly 60,000 different products across those divisions. 3M is currently facing potential litiation liabilities that could affect the company’s ongoing dividend policy.

3) Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance is a pharmacy-led health and beauty retail company that operates through two primary segments—the United States and International. Currently, Walgreens pays a quarterly dividend of roughly $0.48.

4) Dow Inc. (DOW)

Dow is one of the three largest manufacturers of chemicals in the world. On February 9, Dow Inc. declared a dividend of $0.70/share, which was payable March 10, 2023, to shareholders of record as of February 28, 2023. That was the 446th consecutive dividend paid by the Company or its affiliates since 1912.

5) IBM (IBM)

IBM is an American multinational technology corporation that specializes in computer hardware, middleware and software. The company also provides hosting and consulting services in areas ranging from mainframe computers to artificial intelligence. The five-year dividend growth rate at IBM is roughly 3%, which implies a quarterly payout of roughly $1.70/share, or $6.80/share annually.

6) Chevron (CVX)

Chevron Corporation is an American multinational energy corporation that is predominantly focused on oil and gas. The company is vertically integrated and operates in the following sectors: exploration, production, refining, marketing, transport, chemicals manufacturing and power generation. The quarterly dividend for CVX is currently $1.51/share.

7) Amgen (AMGN)

Amgen is an American multinational biopharmaceutical that discovers, develops and manufacturer therapeutics. The company primarily focuses on inflammation, oncology, bone health, cardiovascular disease, nephrology and neuroscience. Amgen recently announced that it would pay a dividend of $2.13/share for the first quarter of 2023, a 10% increase from the previous quarter.

8) JPMorgan Chase (JPM)

JPMorgan Chase is an American multinational financial services company headquartered in New York City. As of 2023, it is the largest bank in the United States and the world’s largest bank in terms of market capitalization. On March 21, JPM declared a quarterly dividend of $1.00/share that is payable on April 30, 2023, to stockholders of record at the close of business on April 6, 2023.

9) Goldman Sachs (GS)

Goldman Sachs is an American multinational investment bank and financial services company. The company operates through three primary divisions: Global Banking/Markets, Asset/Wealth Management and Platform Solutions segments. The current quarterly dividend for GS is $2.50/share.

10) Johnson & Johnson (JNJ)

Johnson & Johnson is an American multinational corporation that develops medical devices, pharmaceuticals and consumer packaged goods. It is one of only two U.S.-based companies that has a prime credit rating of AAA. The company has paid and raised its dividend for 60 straight years.

11) Simon Property Group (SPG)

Simon Property Group is an American real estate investment trust (REIT) that invests in shopping malls, outlet centers and community/lifestyle centers. It is the largest owner of shopping malls in the United States when measuring by square feet. At the outset of the pandemic, SPG was forced to halt payment of its dividend for one quarter. However, the quarterly dividend is now back up to $1.80/share, and has paid a dividend for the last 11 quarters.

12) Kinder Morgan (KMI)

Kinder Morgan, Inc. is one of the largest energy infrastructure companies in North America with a focus on owning and controlling oil and gas pipelines and terminals. In addition to its vast network of pipelines, the company also provides storage services for gasoline, jet fuel, ethanol, coal, petroleum coke steel. Over the previous 12 months the company paid an annual dividend of roughly $1.11/share, including its most recent quarterly dividend of $0.28/share.

13) ONEOK (OKE)

Oneok is an American energy company that is primarily focused on natural gas. In conjunction with its subsidiaries, Oneok engages in gathering, processing, storing, transporting, and marketing natural gas and natural gas liquids in the United States. In February, Oneok paid a quarterly dividend of roughly $0.96/share. Last year, the annual dividend for OKE was $3.74/share.

14) Williams Companies (WMB)

Williams is an American energy infrastructure company that is primarily focused on the production and transportation/shipment of natural gas and petroleum. The company owns and operates approximately 33,000 miles of pipelines, 29 processing facilities, and approximately 24 million barrels of natural gas storage capacity. Last year, WMB paid an annual dividend of $1.79/share, and its most recent quarterly dividend was $0.45/share.

15) AT&T (T)

AT&T is the world's largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S. One drawback for AT&T is its high long-term debt load, which stands at roughly $133 billion as of March 2023. The company’s most recent dividend payment was approximately $0.28/share.

16) WP Carey (WPC)

W. P. Carey is a real estate investment trust (REIT) that invests primarily in single-tenant industrial, warehouse, office, retail and self-storage properties. The company controls roughly 1,200 properties equating to over 142 million square feet. The company most recently paid a quarterly dividend of $1.07/share, which implies an annualized dividend rate of $4.27 per share.

17) LyondellBasell Industries (LYB)

LyondellBasell Industries is a multinational chemical company incorporated in the Netherlands with U.S. operations headquartered in Houston, Texas. LyondellBasell is one of the top-5 producers of chemicals in the United States. LYB’s last quarterly dividend payment was $1.19/share, and in the last 12 months, the company paid a total of $4.76/share.

What is a dividend?

Dividends are cash or stock distributions to shareholders, and are determined by the company’s board of directors. Dividends are commonly distributed to shareholders quarterly, though some companies may pay dividends monthly, semi-annually or annually.

Some companies elect to pay out profits in the form of dividends, while others choose to retain their earnings and reinvest them back in the company.

Market participants that gravitate toward dividend-paying stocks are generally focused on the relatively consistent income stream provided by the dividend. However, dividends aren’t guaranteed. During hard times—whether it be a recession or some other obstacle—companies are sometimes forced to lower, or altogether cut their dividends.

For this reason, investors and traders need to be careful when selecting a potential dividend stock for their portfolio. One of the most important characteristics of a dividend-paying stock is a long history of consistent profitability. A long history of consistently strong earnings can translate to increased stability in the dividend, in terms of amount and frequency.

When selecting a dividend stock, most market participants, therefore, focus on the following criteria:

- Dividend history (stability/consistency of dividend frequency and amount)

- Minimal debt (low debt-to-equity ratio)

- Strong balance sheet

- Strong cash flows

- Dividend growth (increasing the dividend over time)

How Do Dividend Yields Work?

In general, yield refers to the amount of earnings produced from a given investment over a set period of time, and is expressed in percentage terms.

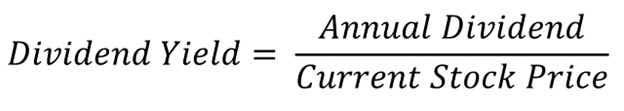

When it comes to dividends, the term "dividend yield" therefore refers to the earnings generated from dividends relative to the price of the underlying shares. Dividend yield is calculated by summing together all dividends received in a fiscal year, dividing that figure by the current share price, and then multiplying by 100.

For example, a stock paying a quarterly dividend of $0.20 ($0.80 annually) with an underlying share price of $20 would have a 4.00% associated dividend yield. That figure is calculated by simply dividing $0.80 by $20 and then multiplying by 100 ($0.80/$20.00 = 0.04 x 100 = 4.00%).

Investors and traders should be aware that yields fluctuate based on two primary forces—the dividend amount and the underlying price of the shares. Ultimately, any changes to the dividend or the share price will affect the dividend yield.

Going back to the previous example, imagine a company's stock is trading for $20 and the company pays an $0.80 annual dividend—equating to a 4% dividend yield. Now imagine that stock rises from $20/share to $30/share. The new dividend yield would be 2.66% ($0.80/$30 = 0.0266 x 100 = 2.66%).

Alternatively, if the stock price in the company dropped from $20/share to $15/share, the dividend yield would increase from 4% to 5.33% ($0.80/$15 = 0.533 x 100 = 5.33%).

Looking at another example, imagine that the size of the dividend increases, but that the underlying share price remains the same. So if the company increased the annual dividend from $0.80 to $1.00, then the dividend yield would increase from 4.00% to 5.00% ($1.00/$20 = 0.05 x 100 = 5.00%).

As illustrated by these examples, rising dividend yields can be deceptive. This may be due to an increase in the amount of dividend paid out to shareholders, but it can also be due to a decline in the underlying shares.

And the same can be said for a declining dividend yield, which may be due to a reduced dividend payout, or an increase in the value of the underlying shares.

It should be noted that conservative dividend investors tend to prefer dividend stocks with long track records. Moreover, it can be a red flag if a stock’s dividend yield is too high.

To better analyze a company’s dividend policy, market participants can also review the dividend payout ratio. This metric provides insight into the amount of money paid out in dividends relative to the company’s profits.

The dividend payout ratio is calculated by simply taking total dividends paid and dividing that figure by net income. So if a hypothetical company paid out $80 million in dividends and had a net income of $80 million, the dividend payout ratio would be 100% ($80 million/$80 million = 1 x 100 = 100%).

For more background on dividends and dividend yields, readers can check out this installment of The Skinny on Options Data Science on the tastylive financial network.

To follow all of the latest developments in the financial markets, readers can also tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.