Has the Dollar's Bull Market Played Out?

Has the Dollar's Bull Market Played Out?

The US Dollar in trouble after Tuesday's technical turnaround

- U.S. Treasury yields are quickly receding, undermining the U.S. dollar.

- Fed rate hike odds have pulled back for November, with markets discounting less than a 50% chance of another rate hike this year.

- Technical turns in the major components of the DXY Index suggest that the U.S. dollar’s bull run is finished.

The U.S. dollar’s strong August may have reached an abrupt turning point. While the DXY Index started off the day on a stronger footing, on pace for its highest close since March 16, the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) report for July changed everything.

Bond yields have tumbled across the curve, as rates markets have dramatically reduced their expectations of an additional 25-basis points (bps) rate hike by the Federal Reserve this year (odds for a November move have sunk from 54% yesterday to 40% today).

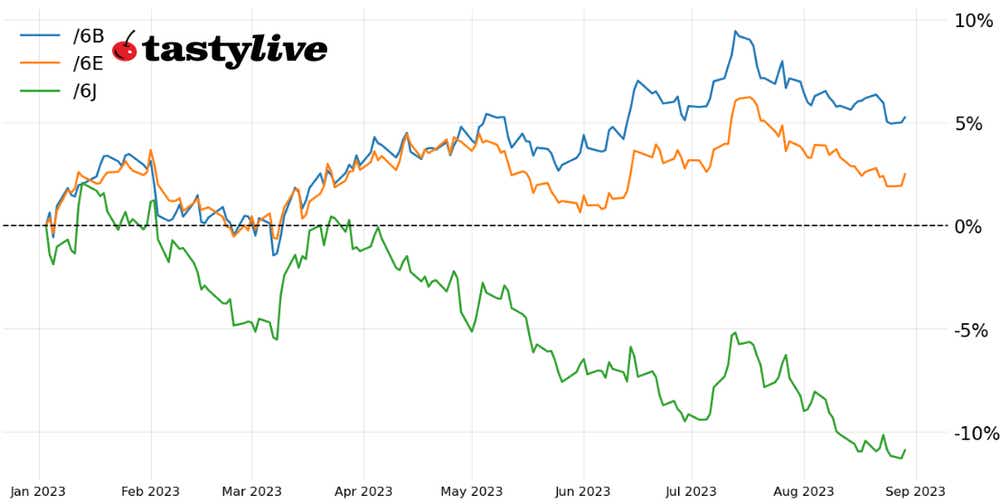

Thus marks the hallmarks of a technical turnaround Tuesday. New highs for the U.S. dollar, relative to Monday’s price ranges, versus the British pound, euro and Japanese yen have been met by new lows relative to Monday’s price ranges. The ensuing outside day reversals—or bullish key reversals in /6B, /6E, and /6J suggest that the U.S. dollar bull run of August is now finished.

/6B British pound technical analysis: daily chart (August 2022 to August 2023)

In the prior /6B futures update, we noted “it remains the case that a drop below 1.2600 by the end of August would be a strong confirmation signal that /6B has topped, potentially for the remainder for the year.” /6B fell as low as 1.2550, vindicating the notion that the yearly highs may be in place. However, the technical breakdown in /6B may be hitting the pause button with the arrival of the daily bullish key reversal. While momentum indicators remain largely bearish–from the EMA envelope to MACD and stochastics—it’s no longer appropriate to treat /6B with a directionally bearish bias, at least in the short-term. A rally back above 1.2800 can’t be dismissed.

/6E euro technical analysis: daily chart (August 2022 to August 2023)

Like for /6B, /6E has marked an important technical turning point with the daily bullish key reversal on Tuesday. Even though it may be the case that the Euro has topped out for 2023, the seeds are now planted for a short-term reversal higher. A return to 1.1000 may be in the cards, particularly if US Treasury yields continue their aggressive pullback – though that may hinge on the August US nonfarm payrolls report coming up this Friday.

/6J Japanese yen technical analysis: daily chart (November 2022 to August 2023)

/6J is easily the most interest rate-sensitive major currency, and now that U.S. Treasury yields are falling back, there is a legitimate case to be made that /6J may have carved out an important low on the same day that it hit a fresh yearly low. The bullish daily key reversal, arriving right around the level that produced the November 2022 "Yentervention," increases the odds that the Japanese Ministry of Finance will intervene now that it has technical tailwinds supporting a stronger yen. Time to strike while the iron is hot. An outright /6J long, as opposed to a long /6J, short /6A or long /6J, short /6E pairs trade may now be more appropriate.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.