Has the Market Outperformed Implied Volatility This Year?

Has the Market Outperformed Implied Volatility This Year?

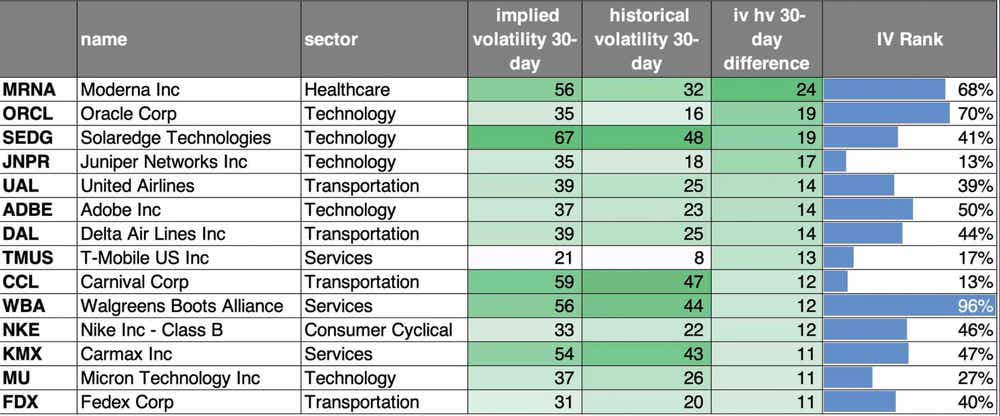

Here’s a look back at the SP500 to see which stocks currently have high implied volatility vs. historical volatility

- Let’s check out some of the highest-volatility underlyings vs. their historical volatility.

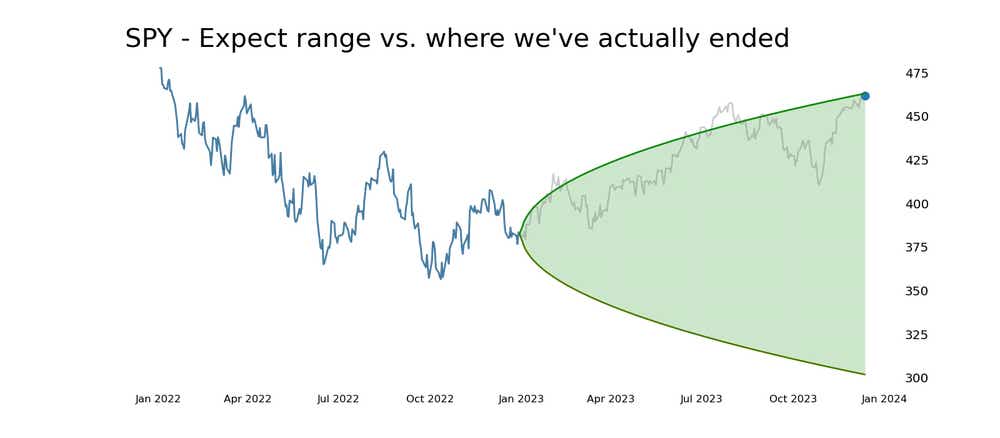

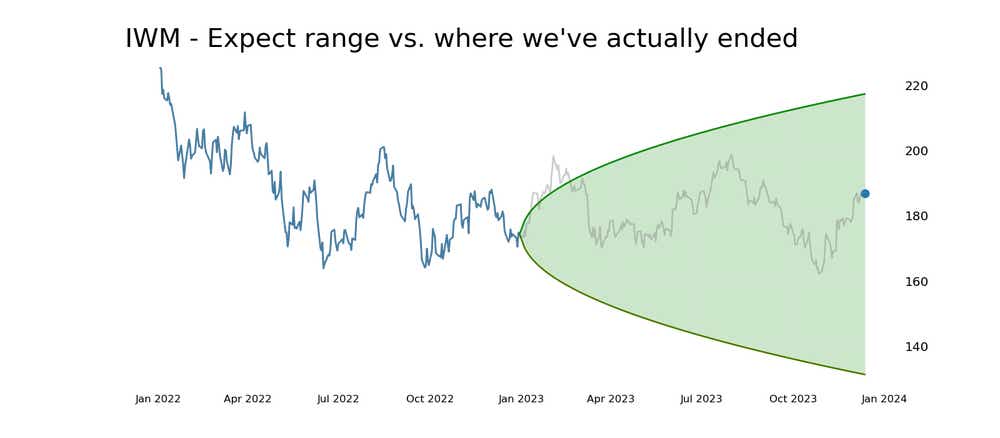

- Here’s a look back at the expected move in the major indexes based on 2022 end-of-the-year volatility.

- QQQ has outperformed and exceeded its expected move.

Check out the original Cherry Picks email HERE. Subscribe for future additions HERE.

Implied volatility vs. historical volatility

Implied volatility is the expectation of price movement based on the options pricing in that underlying. It is both a reflection of speculation and a hedge against uncertainty. Most time-implied volatility exceeds realized (historical) volatility. We took a look at the SP500 to see which stocks currently have high implied volatility vs. historical volatility. Check it out:

(IV table)

For more information on implied volatility, historical volatility and IV rank (all available in the tastytrade.com platform), CLICK HERE.

Expected vs. actual moves

The market as a whole tends to move inside the expected move—based on implied volatility—but that's not always the case. In 2023, the Nasdaq (QQQ) has far-exceeded the implied volatility it had at the start of the year, with the SP500 reaching its upper bound. The tech-focused exchange-traded fund (ETF) has seen far greater realized volatility on the backs of big name tech stocks like Apple (AAPL), Microsoft (MSFT) and Nvidia NVDA:

SPY, by contrast, is a much more diversified basket, leading to a bit more two-sided action, with sectors like energy and healthcare lagging behind the more heavily weighted tech sector. Still, a nearly 20% gain on the year is on the upper end of expected outcomes!

Small caps, on the other hand, have underperformed this year—well inside expectations from the start of the year. The Russell has more exposure to rates, compared to the larger cap stocks in the Nasdaq or SP500 and has a significant exposure to smaller cap banking stocks which have underperformed this year

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.