Alphabet Earnings: Can The Google Parent Beat Estimates Amid Legal Heat?

Alphabet Earnings: Can The Google Parent Beat Estimates Amid Legal Heat?

By:Mike Butler

Alphabet Earnings: Can The Google Parent Beat Estimates Amid Legal Heat?

- Alphabet will report quarterly earnings after the market closes on Thursday.

- The tech giant has had strong earnings history, but missed revenue estimates last quarter.

- The company is expected to announce earnings-per-share of $2.03 on $89.2 billion in revenue.

- It’s in a legal battle against the Justice Department over allegations of monopoly control, which could shake up the future of the company.

Alphabet (GOOG), the parent company of Google, will report quarterly earnings after the market closes on Thursday. The company’s stock has dropped over $50 from the high of 2025, with tariffs looming and a legal battle with the Justice Department. The court’s ruling could shake up Google search as we know it. But the courtroom drama will be a non-event for this earnings call because company executives will not be able to comment on active litigation.

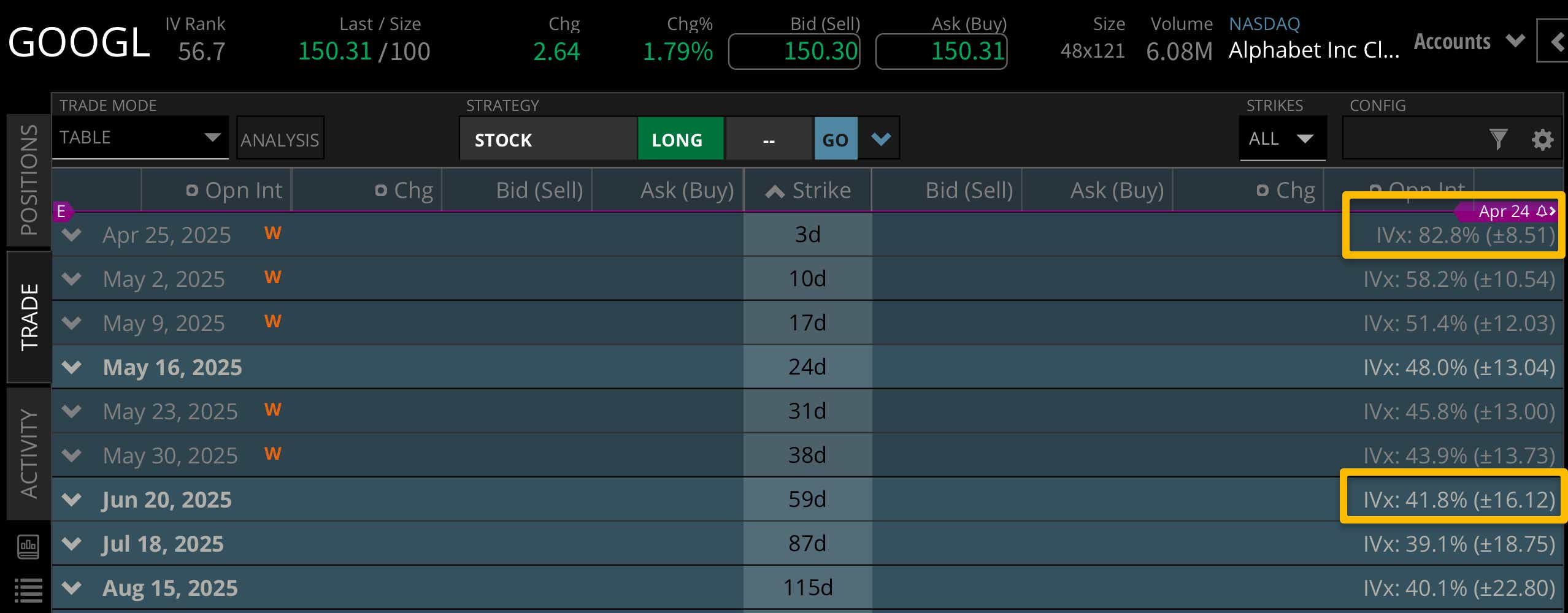

GOOG opened the trading year at $191.37 and currently sits at around $150 per share. With so much uncertainty around the company, it's shocking to see such a low implied volatility baked into this week's earnings announcement. Maybe it’s because of the lack of clarity around the Justice Department's decisions on what will change for Alphabet and the ripple effect for big tech.

The company is expected to report earnings-per-share of $2.03 on $89.2 billion in revenue. Last quarter, it missed revenue estimates slightly and the stock dropped over $15.

Sundar Pichai, Alphabet CEO, offered words of encouragement for 2025 performance in the last earnings release: “Q4 was a strong quarter driven by our leadership in AI and momentum across the business. We are building, testing, and launching products and models faster than ever, and making significant progress in compute and driving efficiencies. In search, advances like AI Overviews and Circle to Search are increasing user engagement. Our AI-powered Google Cloud portfolio is seeing stronger customer demand, and YouTube continues to be the leader in streaming watchtime and podcasts.

Together, Cloud and YouTube exited 2024 at an annual revenue run rate of $110 billion. Our results show the power of our differentiated full-stack approach to AI innovation and the continued strength of our core businesses. We are confident about the opportunities ahead, and to accelerate our progress, we expect to invest approximately $75 billion in capital expenditures in 2025.”

The amount of $75 billion in capital expenditures is a big number for 2025, and it will be interesting to see if that figure changes or the intent to spend changes with tariffs now affecting many global trade relationships.

Looking at implied volatility of the options market helps us put context around the earnings call ahead. For GOOG stock, we're looking at a +/- $8.51 expected stock price range for this week. This is just over 5% of the notional value of the stock price, which is low for a company going through a legal battle and tariff uncertainty.

Looking ahead, we can see a +/- $16.12 expected stock price range for the June options cycle 59 days to expiration. Normally, we see a much bigger chunk of the expected move in the earnings cycle relative to the next few months, but the fact that this week accounts for only half of the expected move for June confirms that more weight is being put on the fallout of the Justice Department antitrust case than on this earnings announcement.

Bullish on Alphabet stock for earnings

If you're bullish on GOOGL for earnings, you're looking for a performance recovery in the EPS and revenue numbers, and a great outlook for 2025 growth. You're also looking for a minor impact from the antitrust case because that could relieve a lot of pressure from hesitant bullish traders and investors.

Bearish on Alphabet stock for earnings

If you're bearish on GOOG stock for earnings, you're looking for more weakness in EPS and revenue figures and questionable forecasts for 2025, given the tariff implications that still loom. If the Justice Department decides to make an example of Google, that could send shockwaves through the entire search engine system as we know it which likely wouldn't be good for GOOG stock.

Either way, we're in for a volatile earnings season over the next few weeks with many big name tech stocks yet to report. Tune in to Options Trading Concepts Live at 11 a.m. CDT for a deeper look at strategies ahead of Alphabet’s announcement.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.