Investors Expect a Strong Earnings Report Today from Alphabet

Investors Expect a Strong Earnings Report Today from Alphabet

By:Mike Butler

The company is trading at all-time highs despite the DeepSeek disruption

- Google will report quarterly earnings after the market closes today.

- The company has exceeded earnings-per-share (EPS) and revenue estimates three quarters in a row.

- EPS and revenue estimates are substantially higher than last quarter, and the stock is at all-time highs.

- After last week’s DeepSeek revelation, AI will be a topic of conversation during the earnings call.

Alphabet (GOOGL) is on deck to report earnings today, and the tech giant has a lot of pressure to post a strong earnings report. The Magnificent Seven stock is expected to report an earnings-per-share (EPS) of $2.13 on $96.67 billion in revenue. This is about a 15% increase in the EPS estimate, and a 10% increase in the revenue estimate, compared to last quarter. DeepSeek AI shocked the tech market last week, and GOOGL stock took a sizable hit although NVIDIA (NVDA) faced the biggest selloff when comparing tech stocks involved in artificial intelligence.

With that said, GOOGL stock is still trading at all-time highs today at a price of around $205 with a strong earnings report expected after the market closes. Alphabet has surpassed the $2.5 trillion valuation mark, and many analysts expect it to harness a bigger market share over time.

Alphabet CEO Sundar Pichai offered strong words in the last earnings call: “The momentum across the company is extraordinary. Our commitment to innovation, as well as our long-term focus and investment in AI, are paying off with consumers and partners benefiting from our AI tools.”

He went on to say that “in Search, our new AI features are expanding what people can search for and how they search for it. In Cloud, our AI solutions are helping drive deeper product adoption with existing customers, attract new customers and win larger deals. And YouTube’s total ads and subscription revenues surpassed $50 billion over the past four quarters for the first time.

“We generated strong revenue growth in the quarter, and our ongoing efforts to improve efficiency helped deliver improved margins. I’m looking forward to driving more advances for consumers, customers and creators globally.”

It's clear Sundar has strong positive sentiment for the future of Google, but these words were spoken before the monetary landscape shift when DeepSeek was announced.

Either way, we should expect to see a decent stock price move in Google in either direction after the close on today.

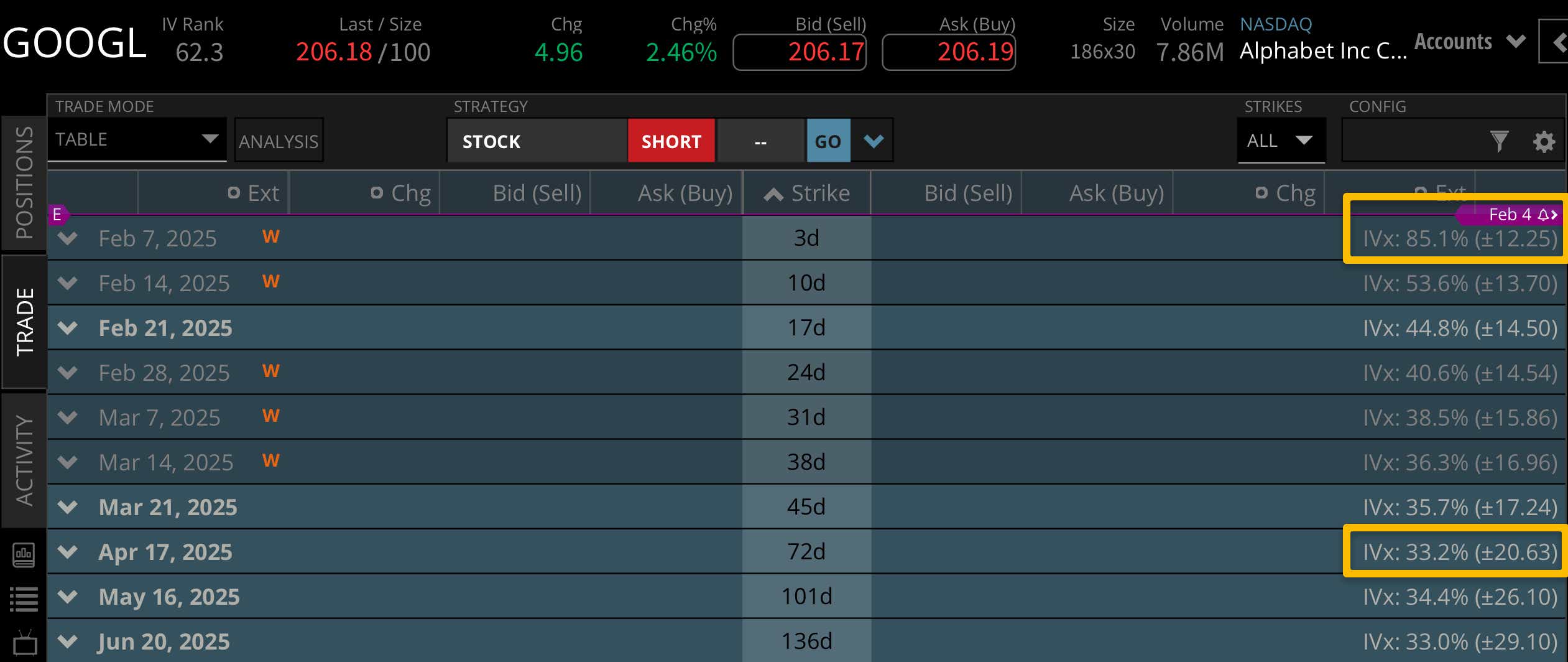

We look to the options market for more clarity on the expected stock price move for the earnings announcement. Current implied volatility levels are pricing in a +/- $12.25 expected stock price move for this week. This is just over 5% of the notional value of the stock price, which is on the lower end of the expected moves for other stocks reporting earnings this quarter.

Looking to the April options cycle, we can see a +/- $20.63 expected move over the next 72 days. Although the implied volatility is low for the earnings call this week, it still makes up for over 50% of the expected stock price range over the next few months.

Bullish on Alphabet stock for earnings

If you're bullish on GOOGL stock for earnings, you're looking for strong sentiment around AI and more clarity around the com pany’s competitive advantages. EPS and revenue expectations are much higher than last quarter, so exceeding these values will be important if you expect to see GOOGL surge to new all-time highs after the market closes.

Bearish on Alphabet stock for earnings

If you're bearish in GOOGL stock for earnings, you may think DeepSeek AI is a real threat to the big US tech companies and their ability to gain a huge marketshare in artificial intelligence. We've seen strong earnings reports for Google the past three quarters, so any sort of miss relative to estimates, or a weak forecast for 2025 could create a selling environment with GOOGL stock at all-time highs.

Tune in to Options Trading Concepts Live at 11 a.m. CST every day this week for options strategies for upcoming earnings announcements.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.