Gold Sinks and the Volatility Surge Leaves Bulls Behind

Gold Sinks and the Volatility Surge Leaves Bulls Behind

What is driving gold prices lower?

- Gold volatility is surging as /GC sinks.

- Are GLD bulls capitulating amid higher rates?

- The technical outlook offers a chance for rebound.

Gold volatility surges

While the gold market has been up and down this summer, it hasn't had that much volatility over the past several months. Until now. Gold futures (/GCZ3) are on track for the largest weekly percentage decline since May 2022, with prices currently down 3.6%.

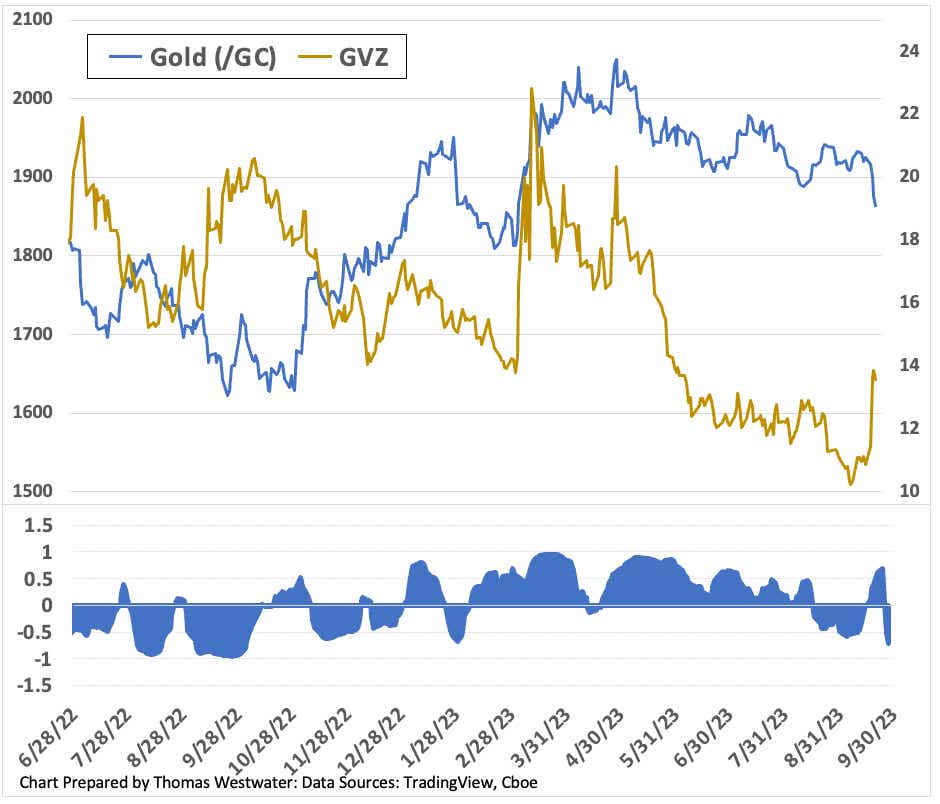

That move has naturally occurred with a surge of volatility. The Chicago Board Options Exchange (Cboe) tracks gold volatility through its Gold ETF Volatility Index (GVZ), which estimates expected 30-day volatility via SPDR Gold Shares ETF (GLD).

As of this afternoon, GVZ is up about 25%—its biggest weekly increase since March—which puts the index at its highest level since June. Gold is an asset that sometimes performs well when volatility increases. But not this time. The current 20-day correlation between gold and GVZ is -0.73, marking the weakest correlation since October 2022.

What is driving gold prices lower?

The threat of higher interest rates appears too much for gold bulls to handle. Up until this week, gold has been relatively resilient, considering the backdrop of rising Treasury yields and a stronger dollar. The depth of this week’s move may signal a capitulation by gold bulls and puts a dent in my view of $2,000 to $2,500 gold prices by the end of the year.

One factor likely helping prices over the last several weeks has evaporated overnight. Prices for gold in China have traded at a hefty premium vs. international prices, signaling strong demand in the country.

But prices sank in Shanghai overnight, and that premium was cut significantly. This behavior could signify waning demand for the metal, which is bad news for gold bulls because it could indicate a surge in demand is over in China.

Will prices around $1,860 be enough to entice a new round of buyers? That is a hard question to answer, but we can look to the gold chart to identify the next level of potential support where we could possibly expect those buyers to step in.

Gold technical outlook

The next level of support on the chart aligns with where prices are now around the lows last seen in February and March. If levels hold here and we avoid a weekly close below $1,883, it may invite bulls to start building a new base. A close below the support level could engage further selling.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.