Gold Price Outlook: Gold Drops into Pivotal Support- XAU/USD Levels

Gold Price Outlook: Gold Drops into Pivotal Support- XAU/USD Levels

GOLD TECHNICAL PRICE OUTLOOK: XAU/USD NEAR-TERM TRADE LEVELS:

- Gold price updated technical trade levels – Daily & Intraday Charts

- XAU/USD plunges into key lateral support at 1729/38- critical near-term resistance 1829

- New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

Gold prices have plunged more than 5.1% off the September highs with the sell-off taking XAU/USD back into key technical support. We’re on the lookout for a near-term breakout as price carves the weekly opening-range just above this major pivot zone. These are the updated targets and invalidation levels that matter on the XAU/USD technical charts. Review my latest Strategy Webinar for an in-depth breakdown of this gold technical setup and more.

GOLD PRICE CHART - XAU/USD DAILY

Chart Prepared by Michael Boutros, Technical Strategist; Gold on Tradingview

Technical Outlook: In my last Gold Price Outlook we highlighted a reversal off confluent resistance while noting that, “the threat remains for a deeper pullback while below 1814 but we’re on the lookout for an exhaustion low in the days ahead.” Gold registered a high at 1808 the following day before reversing sharply lower with the decline rebounding off confluent support at 1729/28- a region defined by the August low-day close and 61.8% Fibonacci retracement of the August advance. Note that the lower parallel of a proposed pitchfork off the March / August lows further highlights this threshold heading into the close of the month.

GOLD PRICE CHART - XAU/USD 120MIN

Notes: A closer look at Gold price action shows XAU/USD trading within the confines of a descending pitchfork formation we’ve been tracking off the monthly highs. The weekly opening-range is taking shape just above key support and we’re looking for the breakout to offer guidance in the days ahead.

Initial resistance stands at 1767 with a breach / close above the 38.2% retracement at 1774 needed to suggest a more significant low is in place. Subsequent topside objectives eyed at 1795/97 and the September open / 100-day moving average at 1812/13- look for a larger reaction there IF reached with a close above 1829 ultimately needed to mark resumption of the broader uptrend. A break below this key support zone would threaten another run at the yearly lows with such a scenario exposing the lower parallel near ~1717 and 1707/12. Critical support remains unchanged at 1670/82.

Bottom line: Gold is trading just above confluent support at 1729/38 – from a trading standpoint, a good zone to reduce short-exposure / lower protective stops. Losses should be limited this support zone IF price is indeed heading higher with a breach / close above 1774 needed to clear the way for a larger rally. Respect this zone – ultimately, a break lower would likely fuel another bout of accelerated losses, so stay nimble here. Review my latest Gold Weekly Price Outlook for a closer look at the longer-term XAU/USD technical trading levels.

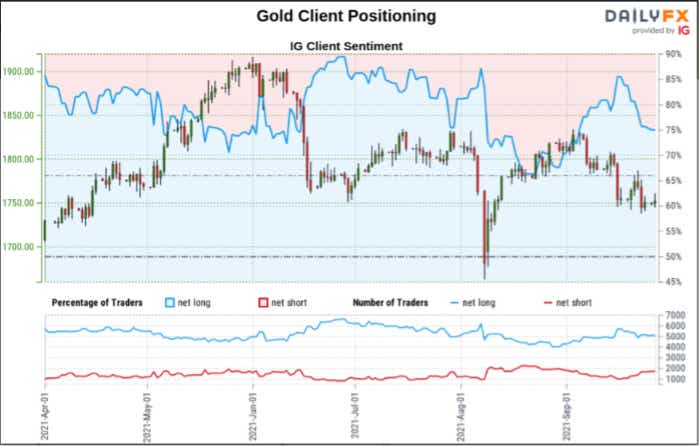

GOLD TRADER SENTIMENT – XAU/USD PRICE CHART

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +2.96 (74.72% of traders are long) – typically bearishreading

- Long positions are2.23% higher than yesterday and 5.50% lower from last week

- Short positions are2.69% higher than yesterday and 36.23% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.