Gold and Crude Oil Slide as Geopolitical Risk Premium Has Evaporated

Gold and Crude Oil Slide as Geopolitical Risk Premium Has Evaporated

The past month has produced a great deal of volatility across asset classes, but it’s fleeting

● A month has passed since Hamas’ attack against Israel, and a lot has changed in financial markets.

● Uncertainty over Federal Reserve policy has diminished, while traders have benchmarked the Israel-Hamas war.

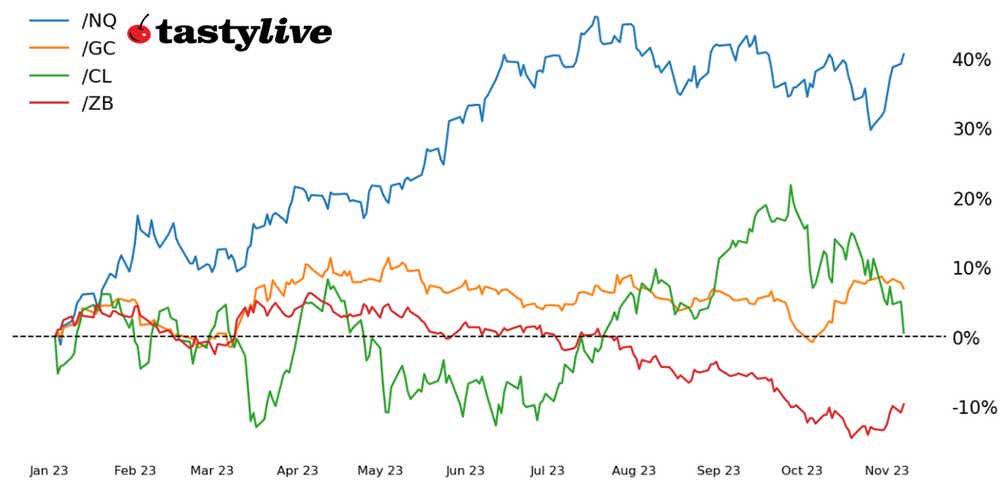

● Declines in gold (/GCZ3) and crude oil (/CLZ3) prices suggest geopolitical risks have moved out of the spotlight for traders.

Market Update: Crude Oil down 4.57% month-to-date

The past month has produced a great deal of volatility across asset classes, but it’s fleeting. One of the many catalysts in recent weeks was the Oct. 7 attack against Israel by Hamas, which injected geopolitical uncertainty into markets unseen since the Russian invasion of Ukraine in February 2022.

However, as with the Russian invasion (among other global conflicts in recent decades), the spike higher in volatility has dissipated quickly. Geopolitical events tend to weigh on markets for about a month, spiking around three weeks after the onset of conflict. Indeed, we can see that historical implied volatility (IV) ranks peaked around three weeks after Hamas’ attack on Israel, and while the war has raged ever since, volatility has declined dramatically:

Ticker | IV Rank High + Date | IV Rank Currently |

QQQ | 57.07 (10/26/23) | 10.53 |

USO | 84.81 (10/30/23) | 49.30 |

GLD | 77.50 (10/20/23) | 22.26 |

TLT | 97.49 (10/23/23) | 47.38 |

Our focus is on gold (/GCZ3) and crude oil (/CLZ3) prices (using GLD and USO as proxies), given that the Nasdaq 100 (QQQ, or /NQZ3) and the long bond (TLT, or /ZBZ3) are likely more sensitive to recent shifts in signaling by the Federal Reserve with respect to its rate hike cycle.

/CL Crude Oil Price Technical Analysis: Daily Chart (April to November 2023)

Crude oil (/CLZ3) prices bottomed at 80.20 on Friday, Oct. 6, just before the Israel-Hamas conflict broke out. /CLZ3 ultimately rallied 12.03% from Oct. 6 low to its high on Oct. 20 before breaking lower, but now finds itself trading below the Oct. 6 low, and below the rising trendline from the May and June swing lows.

Before the onset of the conflict, /CLZ3 was sinking like a rock; now that geopolitical risk has evaporated (absent other regional actors like Hezbollah or Iran getting involved), the previously scheduled programming has resumed. A drop below the late-August low of 77.04 would open up the chart for a deeper setback below 73.50.

/GC Gold Price Technical Analysis: Daily Chart (November 2022 to November 2023)

Gold (/GCZ3) had a sizeable push higher initially, and has thus far maintained its move higher than /CLZ3 in recent days. But technical damage is accumulating here as well: /GCZ3 dropped below its Sept. 1 high of 1980.2, and bullish momentum has been broken. Moving average convergence/divergence (MACD) is now trending lower, and slow stochastics have exited overbought territory.

Unlike at the start of the Russian invasion of Ukraine, when U.S. real yields were moving off of multi-decade lows as the Federal Reserve began its most aggressive rate hike cycle in history, U.S. real yields are now pulling back and the Federal Open Market Committee (FOMC) is signaling it is finished raising rates. In turn, /GCZ3 may have a higher floor underneath it now, and its pullback may not be as severe as what’s transpiring in /CLZ3.

Nevertheless, the same conclusion can be drawn for /GCZ3 as has been in /CLZ3: barring an expansion of the Israel-Hamas war, the geopolitical risk premium has been sucked out of the market.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.