Gold Loses Luster as Fed and BoE Comment on Precious Metals

Gold Loses Luster as Fed and BoE Comment on Precious Metals

The markets reprice assets as view shifts on interest rates.

- Gold trades lower as bond yields rise.

- BoE surprise dents precious metals view.

- Worries around Fed tightening dulls gold outlook.

Gold prices (/GC) were down nearly 1% in afternoon trading, pushing its weekly loss over the 2% mark following a hawkish move from the Bank of England (BoE) and Federal Reserve Chair Jerome Powell’s suggestion that more rate hikes are on the way.

Meanwhile, sentiment remains subdued across the market as rising bond yields drag on stock prices. While technology stocks are recovering, the benchmark S&P 500 (/ES) is treading water, and small-cap stocks are down about 0.8% (/RTY).

High U.K. inflation forces BoE’s hand on rate hikes

The BoE on Thursday hiked its benchmark interest rate by 50 basis points to 5%, the highest in nearly two decades. That move surprised expectations of a quarter a percentage point hike. And rate traders are pricing in another 100 basis points of tightening, which would put the terminal rate around 6%.

Rising rates threaten precious metals, which do not pay interest. Hardened inflation expectations pose a potential problem despite the larger-than-expected hike.

If that were to happen, it could devastate the U.K. economy, which is already likely heading toward a recession. The British pound reflects the pessimism, falling about 0.3% versus the U.S. dollar despite its rate hike. The dollar is also gaining against most of its peers, making gold more expensive for foreign buyers and thereby reducing demand.

U.S. rate outlook bodes poorly for bullion prices

Powell reiterated his view on higher rates in his second day of testimony before Congress. Rates would have to increase at a “careful pace,” he said, but it wasn’t much consolation to bond traders who sold Treasuries and drove yields higher, another headwind for bullion.

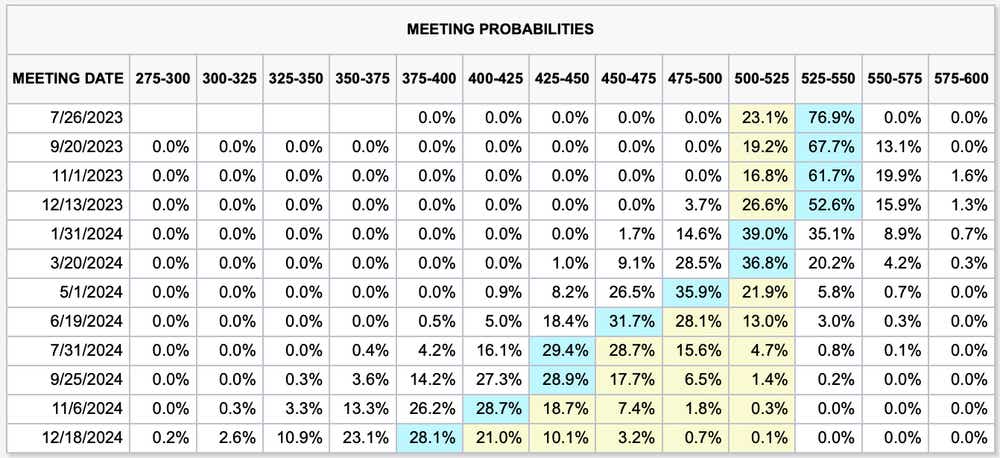

Before this week, there was a small chance, ~5%, that the Fed would cut rates later this year. Now, however, according to the CME’s FedWatch Tool outlined in the chart below, markets don’t expect a rate cut until 2024, which is more in line with Powell’s view. That could keep gold prices capped over the short term. For now, markets will be watching incoming economic data.

Gold technical analysis

Gold prices have retreated from the 100-day simple moving average (SMA) after consolidating around the SMA over the last month. Now, prices are tracking toward the 200-day SMA. A break below that closely watched level could boost bearish sentiment.

Meanwhile, the relative strength index is threatening the 30 oversold level, and a break below it would also likely introduce some bearish sentiment. The best-case scenario, although unlikely given the recent trend, would be a quick rebound above the 100-day SMA.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.