Gold Drags on as Fed Rate Risk Lingers

Gold Drags on as Fed Rate Risk Lingers

Gold slumps in front of Powell's remarks. Here are some thoughts on what lies ahead.

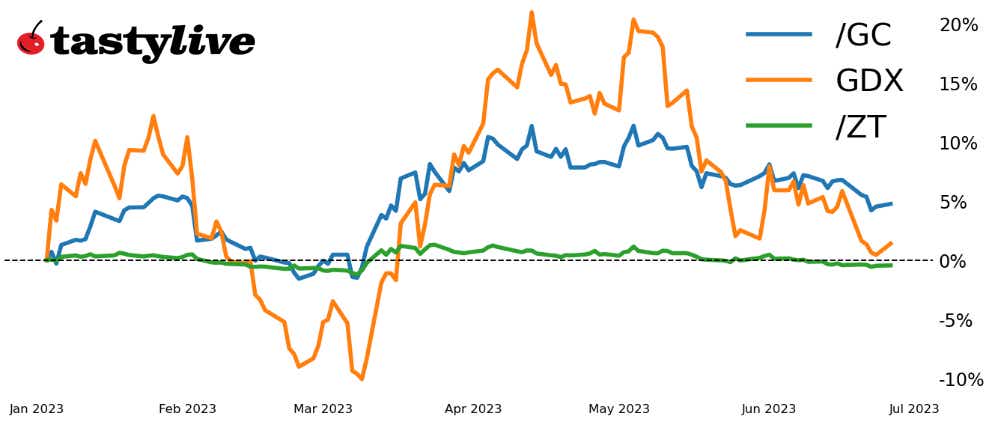

- After gaining as much as +14.2% year-to-date through early May, gold prices (/GC) are now up +5.83% in 2023.

- Gold prices are down -7.32% from their yearly high, while the VanEck Gold Miners ETF (GDX) is off by -17.06%.

- Technical indicators continue to suggest the path of least resistance remains to the downside for /GC and GDX.

The back-and-forth market that has defined 2023 for precious metals has continued through the end of the first half of the year. Gold prices, which had gained as much as 14.2% at their highs in early May, have slumped considerably over the past several weeks, falling 7.32% from their highs. The shift in focus away from the U.S. debt ceiling and potential default to the Federal Reserve’s ongoing efforts to defeat inflation has dramatically altered the underlying narratives helping drive price action in gold and related assets.

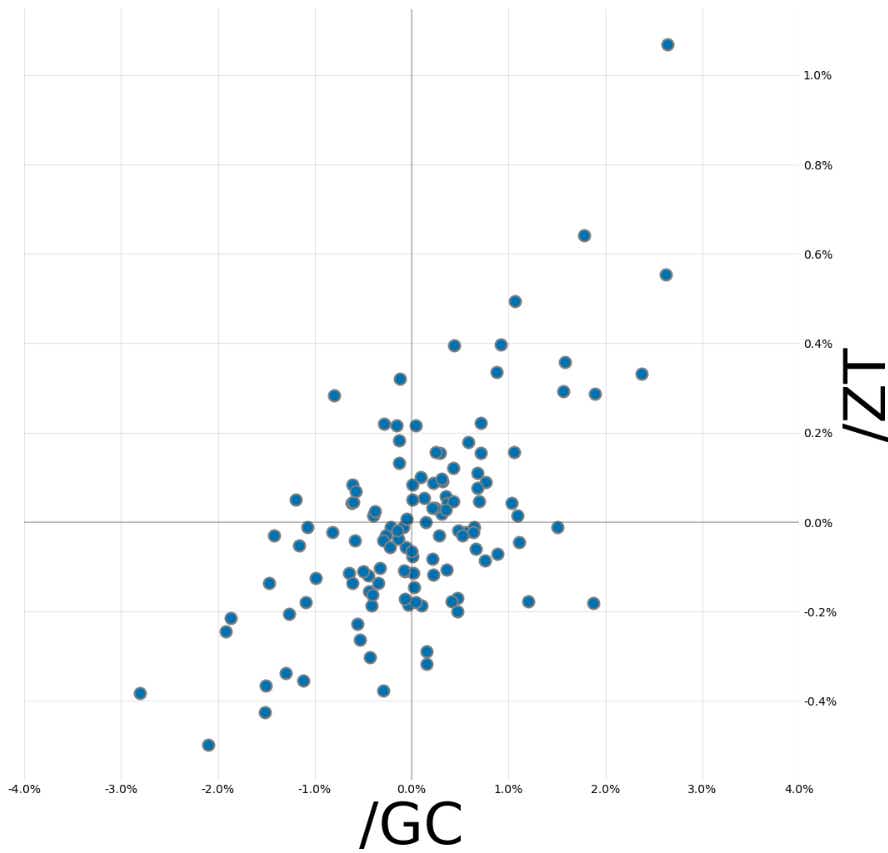

Gold prices under pressure as two-year notes weaken

In 2023, gold prices have proved sensitive to shifts in interest rates. The one-month rolling correlation between /GC and /ZT is currently +0.71, but has spent many weeks this year when the correlation has been above +0.8. In fact, /GC and /ZT have moved in the same direction 67.5% of all trading days in 2023:

In a world where the Federal Reserve is keeping interest rates higher longer and the prospect for additional rate hikes persists, it’s difficult to envision an environment whereby /ZT is able to sustain a significant rally and to this end, for /GC to trade meaningfully higher in the near term before the July Federal Open Market Committee (FOMC) meeting (set to conclude Wednesday, July 26). Fed rate risk will need to be alleviated—or the market’s focus will need to shift away from the Fed—for /GC to reverse course.

/GC gold price technical analysis: daily chart (October 2022 to January 2023)

Consistent with the fundamental view, the technical remains bearish. Gold prices are still below their 5-, 8-, 13- and 21- day exponential moving averages (EMAs) and the EMA envelope is in bearish sequential order. Daily moving average convergence/divergence (MACD) is trending lower below its signal line. Daily slow stochastics are holding in oversold territory. The uptrend from the November 2022 and March 2023 lows has been broken, while the 1,950-2,000 range in /GCQ3 has broken to the downside. A return to the March lows below 1,900 can’t be ruled out in the near term.

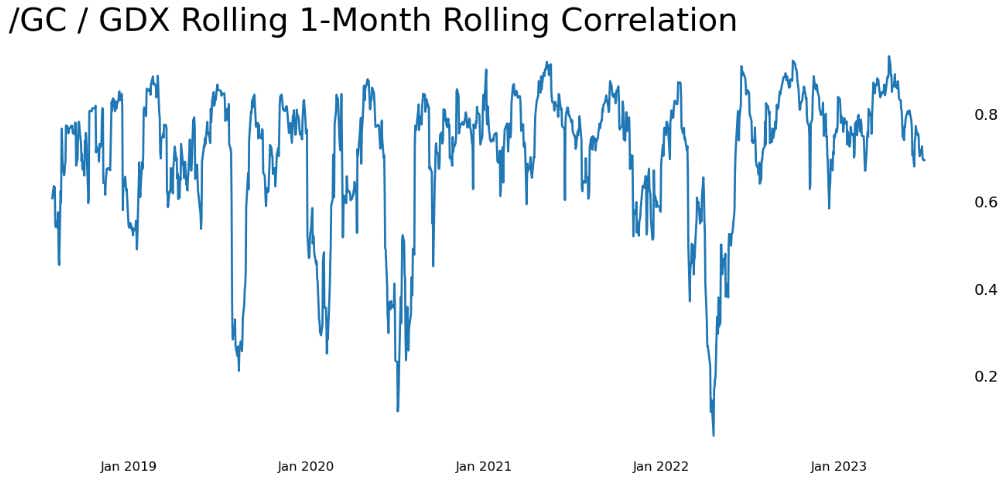

Gold miners likely to struggle alongside gold prices

The weakness in /GC has spilled over to related equities. The VanEck Gold Miners Exchange-Traded Fund, which had gained as much as 26.5% at its yearly high, is now up by a mere 4.92% in 2023. The sharp reversal, a 17.06% decline from the May high, reinforces the view that the precious metals space is facing difficulties across the board. /GC and GDX have retained a tight one-month rolling correlation this year, holding above 0.6 since the start of the year:

While correlation does not speak to causation, it stands to reason the impact is flowing from /GC to GDX; that is, GDX will not be able to trade higher until the underlying commodity does.

For precious metal bulls, the past few weeks have not been fun. Unfortunately, the next few weeks might not be that much better.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.