Will Gold and Silver Shine Again?

Will Gold and Silver Shine Again?

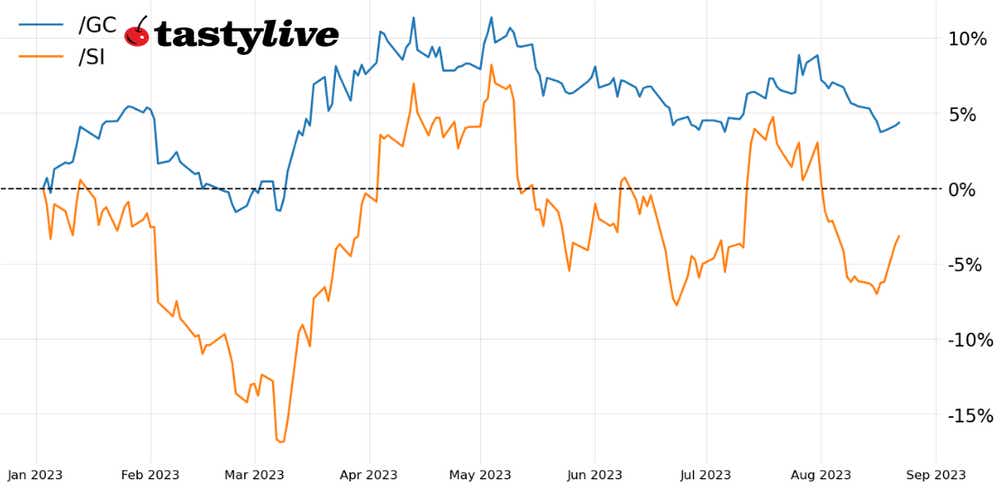

Gold prices are down 3% month-to-date

- As August winds down to a close, precious metals are trying to claw back their losses.

- Gold prices are attempting to return to a multi-month sideways consolidation.

- Silver prices have rebounded off the rising trendline from the September 2022 and March 2023 swing lows.

Higher U.S. Treasury yields and a stronger U.S. dollar have been a toxic mix for gold and silver prices in recent years, and August is not proving any different. And yet, something feels different about gold and silver prices right now.

While the U.S. Treasury 10-year yield hit a 16-year high this week and the U.S. dollar (via the DXY Index) hit a two-month high, gold and silver prices have traded to their lowest level since mid-March–but not the March lows, which is a meaningful distinction. All of this comes against the backdrop of multi-year highs in U.S. real yields across the curve.

Why does all this matter? Because these are close to the worst possible circumstances, in terms of cross-asset relationships, for precious metals (the only scenario worse would be a financial meltdown, whereby traders would sell everything not nailed to the floor to raise cash levels). Despite their losses, gold and silver prices aren’t down by nearly as much as one might expect—personally, new yearly lows should be in play from my perspective. But they’re not, and that speaks to a certain degree of resiliency that can’t be ignored.

/GC gold price technical analysis: daily chart (August 2022 to August 2023)

Gold price’s vicious downtrend in August may finally be abating. /GCV3 has closed below its daily 5-EMA (one week moving average) every session since August 1, but today’s price action is shaping up to break that streak. Coupled with a return above the June 29 low at 1919.60 in /GCV3, there would be viable technical evidence of a bottom having formed. Until then, however, the momentum profile remains pointedly bearish, plain and simple.

/SI silver price technical analysis: daily chart (August 2022 to August 2023)

Silver prices may have failed in fulfilling their bullish falling wedge reversal earlier this month, but price action in recent days has been nothing short of a relief for bulls. The breakdown below the rising trendline from September 2022 and March 2023 has been reversed, and in the process, the bearish momentum profile has been neutralized.

Now back above its daily 5-, 13-, and 21-EMA envelope for the first time since August 1, daily MACD has issued a bullish crossover (albeit below its signal line) and slow stochastics have jumped out of oversold territory. While the series of lower highs and lower lows since May remains, we may now be on the verge of a more significant swing higher towards 24.500 in the coming weeks.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.