Gold and Silver Retain Bullish Breakout Setups

Gold and Silver Retain Bullish Breakout Setups

Precious metals are benefitting from the prospect of the Fed’s interest rate cuts and from tension in the Middle East

- Precious metals are edging higher in thin conditions today, even as U.S. Treasury yields nudge higher alongside the U.S. dollar.

- Elevated tensions in the Middle East, coupled with the onset of a Federal Reserve interest rate cut cycle, are helping to buoy precious metals.

- Gold prices (/GCZ4) are holding above resistance in a multi-month range, while silver prices (/SIZ4) are approaching the downtrend from the May and July swing highs.

Market Update: Gold prices up +3.2% month-to-date

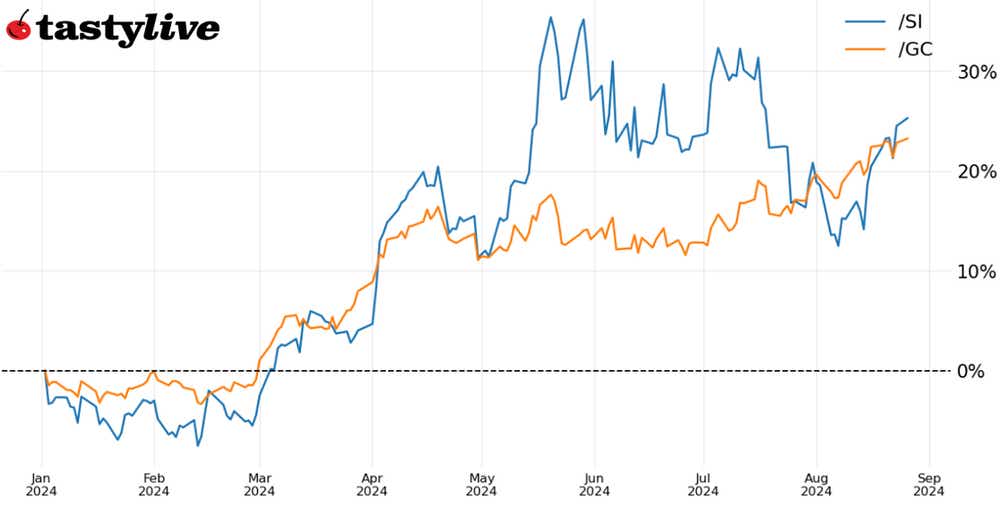

Precious metals continue to have a stellar year, with August continuing the bullish trend. While silver (/SIZ4) is outperforming gold (/GCZ4) year-to-date, the latter is at levels that would constitute a fresh all-time closing high. With both metals up by over 20% in 2024, it may be difficult to envision further gains; and yet the fundamental and technical backdrops suggest just that.

Geopolitical tensions aside—of which there are many, from Russia-Ukraine to China-Taiwan to Israel-Iran-Hezbollah-Hamas—the beginning of the Federal Reserve’s rate cut cycle next month is a tantalizing enough prospect to keep metals bid in the short-term. Falling real yields, historically, have been a driver of positive returns for gold and silver. Technically speaking, it’s difficult to justify fading metals when they’re exhibiting increased bullish momentum.

/GC Gold Price Technical Analysis: Daily Chart (September 2023 to August 2024)

Gold prices (/GCZ4) are trading above its daily 5-EMA (exponential moving average), daily 21-EMA and daily 34-EMA; the EMAs are in bullish sequential order. Slow stochastics holding in overbought condition, a while MACD (moving average convergence/divergence) continues to trend higher above its signal line. Given the volatility profile (IVR: 71.6), selling put spreads is the prudent way to express a bullish bias in the short-term. Likewise, pure volatility sellers may find the call skew in /GCZ4 caters to iron condors, so long as the call spread side is set further out than the put spread.

/SI Silver Price Technical Analysis: Daily Chart (August 2023 to August 2024)

Silver prices (/SIZ4) are now back above their daily 5-, 21-, and 34-EMAs, but the EMA cloud is not yet in bullish sequential order. Slow stochastics are trending higher into overbought condition, a positive sign for momentum, while MACD is trending higher through its signal line. Volatility remains elevated (IVR: 65.9), which favors selling put spreads as opposed to buying call spreads to express a bullish bias. Moreover, given that /SIZ4 is near the mid-point of its range since April, iron condors or short strangles may prove appropriate as well.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.