Gloomy PMI Data May Stoke Fear of Recession

Gloomy PMI Data May Stoke Fear of Recession

By:Ilya Spivak

But most of the major markets idled in familiar ranges after the dovish Fed meeting

- The markets extracted a dovish message from the Fed, and liked it.

- Tepid follow-through from key asset classes casts doubt on conviction.

- The global PMI data update threatens to bring back fear of recession.

Financial markets embraced the Federal Reserve as it commiserated with investors about fiscal policy volatility and signaled readiness to act if economic growth takes an unwelcome turn. “Uncertainty around the economic outlook has increased [and] the Committee is attentive to the risks to both sides of its dual mandate,” said a Federal Open Market Committee statement.

Speaking at the press conference following this week’s policy meeting, Fed Chair Jerome Powell said that “tariffs tend to bring growth down and inflation up,” adding that “sentiment has fallen off…partly due to due to big policy changes by the [Trump] administration.”

The markets welcomed signs of a more dovish Fed

However, Powell argued that officials are “not in any hurry to move on rates [and want] to focus on hard data” to see if the warning signs appearing in business and consumer confidence surveys carries over to realized outcomes. “The economy seems to be healthy,” he said, but “if soft data…becomes hard data, we will know very quickly.”

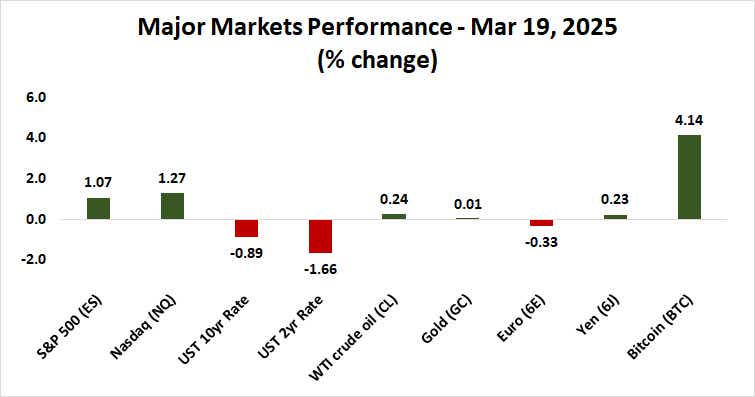

Wall Street seemingly got what it wanted to hear. Stocks rose, with the bellwether S&P 500 touching the highest level in a week. Treasury bonds turned higher as interest rates fell across the yield curve. The U.S. dollar weakened, erasing most of its intraday gains before Fed headlines crossed the wires. The “anti-yield” Japanese yen tellingly outperformed.

From here, the key question facing traders seems to be whether the markets can build on this apparently favorable steering from central bank officials. For now, follow-through has been lackluster. Most of the major markets idled in familiar ranges on the first trading day after the Fed meeting, implying weak conviction.

Fear of recession may return

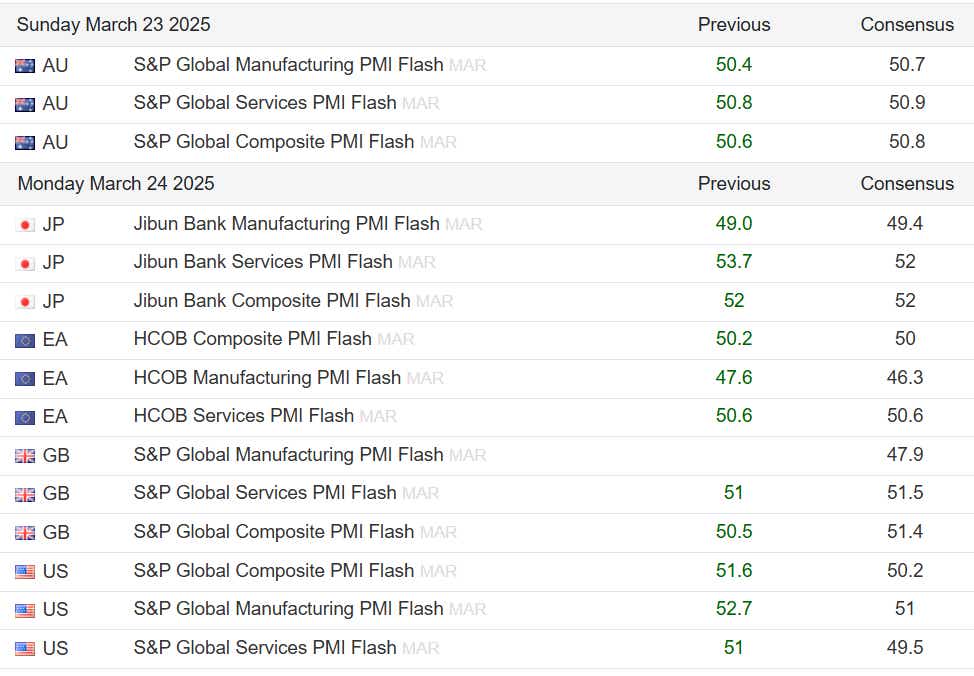

Meanwhile, a timely reminder is imminent about the fear of global recession that set the stage for the blistering risk-off washout since mid-February. S&P Global is scheduled to publish updated purchasing managers index (PMI) data. It is expected to show growth U.S. economic activity slowed for a third month straight, arriving at near-standstill.

Analytics from Citigroup suggest U.S. economic data outcomes continue to be biased toward downside surprises relative to consensus forecasts. That may foreshadow still gloomier PMI results. Bonds may rise as the U.S. dollar weakens if Fed rate cut speculation builds in such a scenario. Whether stocks will still cheer stimulus hopes remains to be seen.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.