Global PMI Data, Japan CPI and BOJ Meeting, ECB President Speaks: Macro Week Ahead

Global PMI Data, Japan CPI and BOJ Meeting, ECB President Speaks: Macro Week Ahead

By:Ilya Spivak

Europe and Japan now in the spotlight for global financial markets

- The euro hangs in the balance as ECB President Lagarde speaks in Davos

- The Bank of Japan (BOJ) is expected to raise interest rates again this week

- S&P Global PMI surveys may show U.S. outperformance margin widening

The mood on Wall Street brightened last week as U.S. inflation data turned in benign results, arresting a relentless rise in interest rates that pressured equities at the start of the year. The bellwether S&P 500 stock index added 2.9%, while the tech-tilted Nasdaq 100 trailed a hair behind with a gain of 2.8%.

Treasury bonds rose as borrowing costs fell across the yield curve. The long end underperformed as 10-year rates fell 2.9%, while yields on 2-year paper shed 2.3%. The U.S. dollar lost ground, giving up 0.2% against the euro and 0.8% against the Japanese yen. Gold prices traded higher, adding 0.8%.

The Bureau of Labor Statistics (BLS) reported that core U.S. inflation unexpectedly ticked lower to 3.2% year-on-year in December. Economists were expecting a hold at 3.3% for the fourth consecutive month. That helped put to bed concerns that the Federal Reserve may be limited to no more than a single interest rate cut in 2025.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

ECB President Lagarde speaks at the World Economic Forum

European Central Bank (ECB) President Christine Lagarde is due to speak on a panel at the annual meeting of the World Economic Forum (WEF) in Davos, Switzerland. She will participate in a session titled “Beyond Crisis: Unlocking Europe’s Potential.” The conversation seems likely to offer ample room for guidance on the trend for monetary policy.

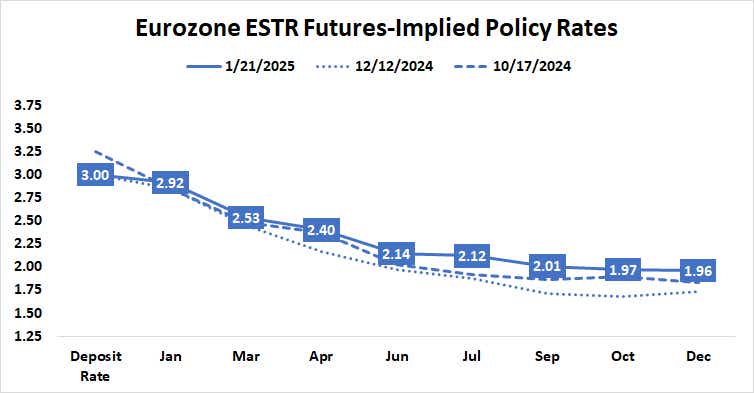

As it stands, the markets are pricing in 104 basis points (bps) in rate cuts for 2025. Benchmark ESTR interest rate futures reflect a double-sized 50bps reduction in March, followed by standard 25bps adjustments in June and September. Rates are expected to remain on hold in 2026.

Bank of Japan (BOJ) interest rate decision

Japan’s central bank is expected to raise its target interest rate from by 25bps from 0.25% to 0.5% at this week’s policy meeting. Interest rate futures are pricing in two hikes in 2025. The second adjustment is expected to appear early in the second half of the year, and perhaps as soon as July.

Consumer price index (CPI) data will precede the BOJ conclave. It is penciled in to show that headline inflation accelerated to 3.2% year-on-year in December. The core measure excluding food prices is seen at 2.9%. These would amount to the highest readings since October 2023.

.png?format=pjpg&auto=webp&quality=50&width=756&disable=upscale)

S&P Global purchasing managers index (PMI) data

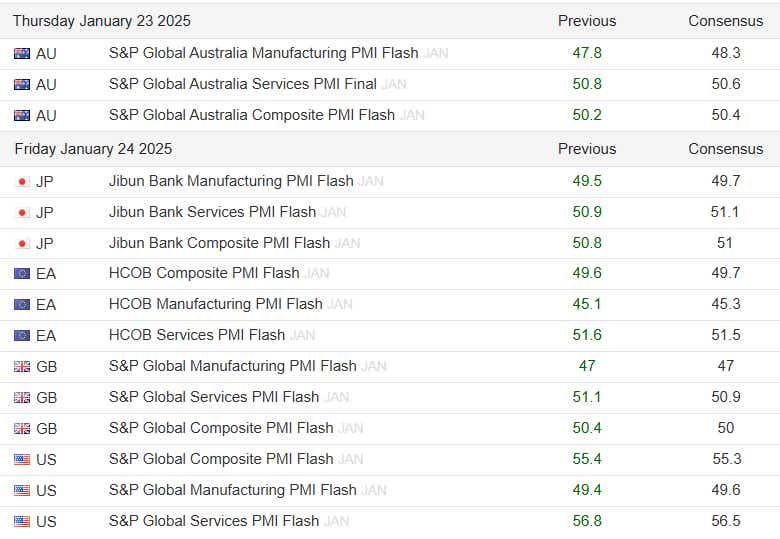

January’s preliminary set of purchasing managers index (PMI) data from S&P Global is expected to show a familiar picture of global growth. The U.S. is marked for continued outperformance while the Eurozone is on course for economic activity to contract for third consecutive month.

Analytics from Citigroup suggest that U.S. economic news flow is increasingly outperforming relative to baseline forecasts since the beginning of the year. The trend for Eurozone releases has pointed in the opposite direction. On balance this suggests that the markets may be surprised with a wider U.S.-favoring disparity than anticipated.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.