Global Recession Fears May Strike Markets After Weak U.S. PMI Data

Global Recession Fears May Strike Markets After Weak U.S. PMI Data

By:Ilya Spivak

Is the day of reckoning for the global economy finally here?

- PMI data says global economic growth hit a 12-month low in January

- Unexpected weakness in the U.S. may revive global recession worries

- Bank of England guidance may mean more than a priced-in rate cut

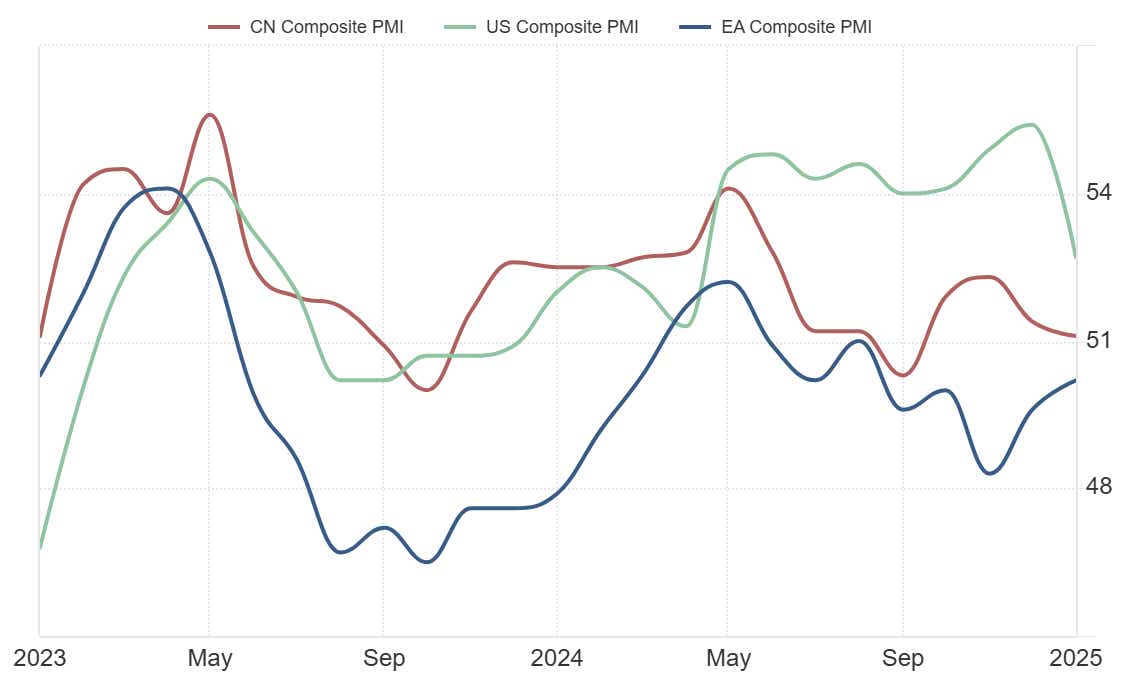

The global economy slowed in January, according to purchasing managers index (PMI) data from JPMorgan and S&P Global. The pace of manufacturing and service sector activity growth cooled to the slowest in 12 months. The culprit was a slowdown on the services side, the source of strength offsetting anemic industry last year.

Perhaps most troubling, a long-feared comedown in the U.S. service sector appears to have caused the most damage. While growth continued, the rate of expansion clocked in at the weakest since April. The composite PMI gauge that includes manufacturing likewise dropped to a nine-month low.

U.S. PMI data warns global recession risk is back in play

The U.S. together with the Eurozone and China account for 58% of global gross domestic product (GDP), a catch-all measure of the value of economic output. The PMI figures showed the currency bloc just barely avoided another contraction last month. China’s economy slowed, but only modestly relative to the already anemic 6-month trend.

On balance, this warns that the day of reckoning for global economic growth imbalances may finally arrive. The U.S. has overwhelmingly shouldered the burden for powering worldwide expansion since the middle of last year while Europe and China lost steam. The gap now looks to be closing at the expense of rising global recession risk.

Analog U.S. PMI data from the Institute of Supply Management (ISM) seemed to confirm the assessment from S&P Global, and the implied danger therein. It showed the sharpest service sector slowdown in two months, punctuated by weaker growth in new orders and dissipating price pressures.

Markets to look past Bank of England rate cut, focus on forecasting

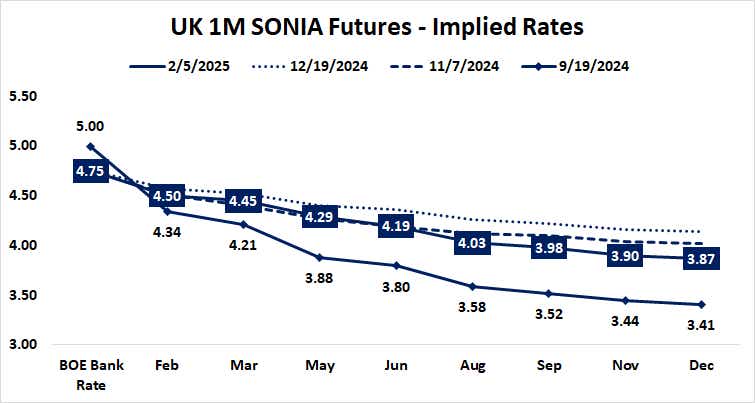

From here, a monetary policy update from the Bank of England (BOE) is in focus. Another interest rate cut is expected at the year’s first meeting of the policy-setting

Monetary Policy Committee (MPC). Benchmark SONIA futures reveal that markets have fully discounted a 25-basis-point (bps) reduction, bringing the target Bank Rate to 4.50%.

This is likely to put the spotlight on the forward guidance on offer in an updated quarterly Monetary Policy Report (MPR) as well as the press conference with Governor Andrew Bailey after the policy announcement. As it stands, 60bps in cuts are priced in for this year, implying two 25bps reductions and a 40% chance of a third one.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.