Markets Look Shaky as They Await Nvidia Earnings and Data from CPI and PMI

Markets Look Shaky as They Await Nvidia Earnings and Data from CPI and PMI

By:Ilya Spivak

Last week, the S&P 500 shed 2.1%, while Nasdaq 100 lost 3.5%

- The Q3 earnings report from Nvidia amounts to a macro-level event risk.

- CPI inflation data from Canada, the U.K. and Japan may benefit the U.S. dollar.

- S&P Global PMI data may highlight risk to stocks from diverging growth trends.

Last week marked a potent setback on Wall Street. The S&P 500 shed 2.1% while Nasdaq 100 lost 3.5%. Those were the steepest losses in over two months. The selling came in the wake of a comparatively hawkish speech from Federal Reserve Chair Jerome Powell (as expected). Strong U.S. retail sales data then amplified the move (as seemed likely).

Treasury bonds fell as borrowing costs rose across maturities. The yield curve tellingly steepened, implying that traders moved to benchmark for fewer interest rate cuts from the U.S. central bank than previously envisioned. Gold prices tellingly fell, and the U.S. dollar rose against its major currency counterparts.

These are the macro waypoints likely to shape what comes next.

Will Nvidia lift the markets’ spirits once again?

The quarterly earnings report from chipmaker and AI sector darling Nvidia (NVDA) has transformed itself into macro-level event risk as the company has ballooned to become the biggest publicly traded enterprise in the world. This week, a lull in top-tier U.S. economic data might sharpen traders’ focus on the outcome still further.

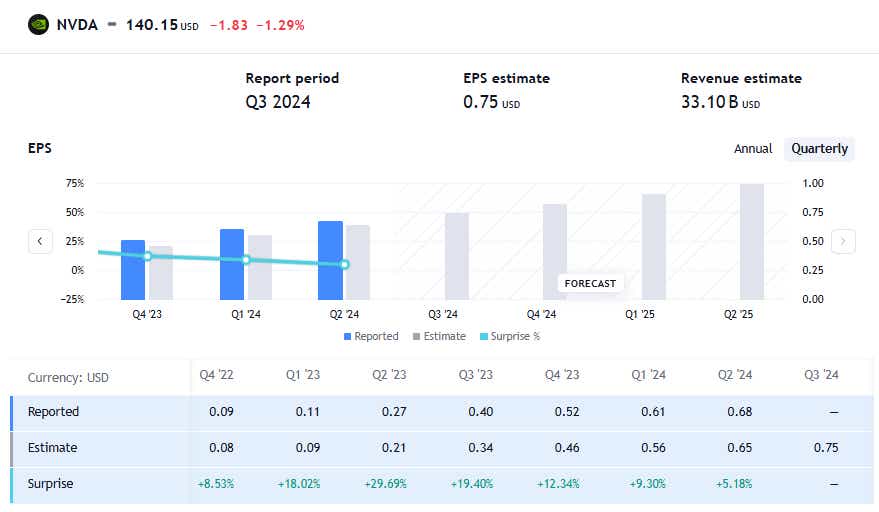

The company is expected to report earnings per share (EPS) of $0.75 in the third quarter, up from $0.65 in the previous period. Revenue is eyeballed at $33.1 billion, up from $28.74 billion previously. Nvidia has consistently topped expectations for nearly two years. However, the upside surprise quotient has been shrinking for the past four quarters.

This suggests markets are getting better at benchmarking the high-flying firm’s performance. That raises the bar for results that are potent enough to uplift overall market sentiment. It also increases the risk that a misstep—like the nearly 18% earnings miss the third quarter of 2023—turns into fodder for a broad-based sell-off.

Inflation data from Canada, the U.K. and Japan may boost the U.S. dollar

A steady stream of inflation data is due from some of the world’s leading economies, shaping expectations for how central banks outside of the U.S. will proceed on monetary policy.

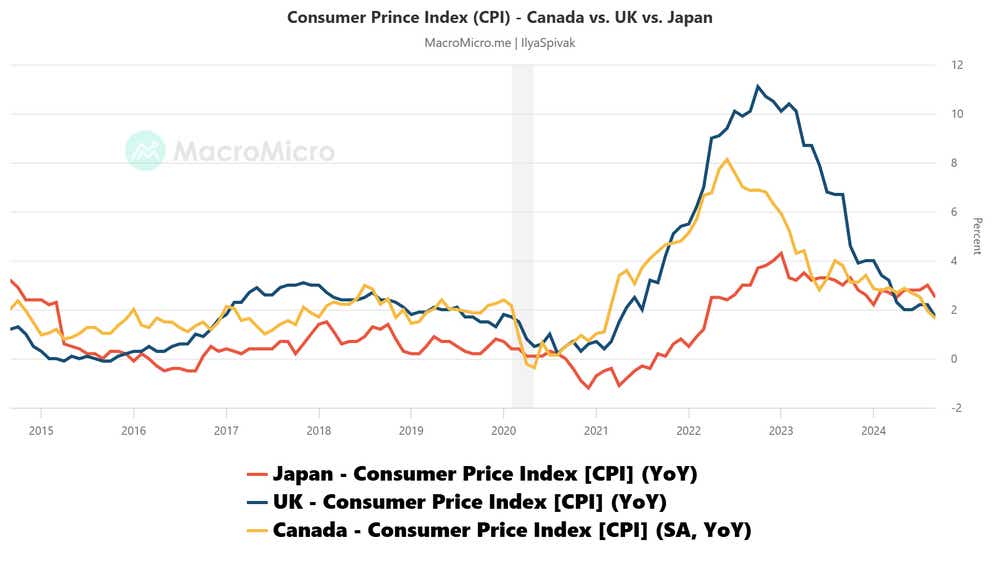

Canada’s consumer price index (CPI) is expected to rise 1.9% year-on-year in October, a pickup from the previus month’s 1.6% and the first acceleration since May. Analog data from the U.K. is penciled in at 2.2% year-on-year, up from 1.7% in September. That would be the first uptick since July.

Citigroup analytics are pointing to increasingly disappointing data outcomes relative to forecasts for both economies. If that sets the stage for weaker than expected CPI readings, a dovish shift in Bank of Canada (BOC) and Bank of England (BOE) rate cut bets might hurt the Canadian dollar and the British pound.

Finally, Japan is seen showing that CPI growth cooled to 2.2% after falling to 2.5% in September from the 10-month high at 3% in August. A soft result may cool rate hike speculation following a hawkish speech from Bank of Japan (BOJ) Gov. Ueda this week, pressuring the Japanese yen.

Stock markets at risk as PMI data flags global growth gaps

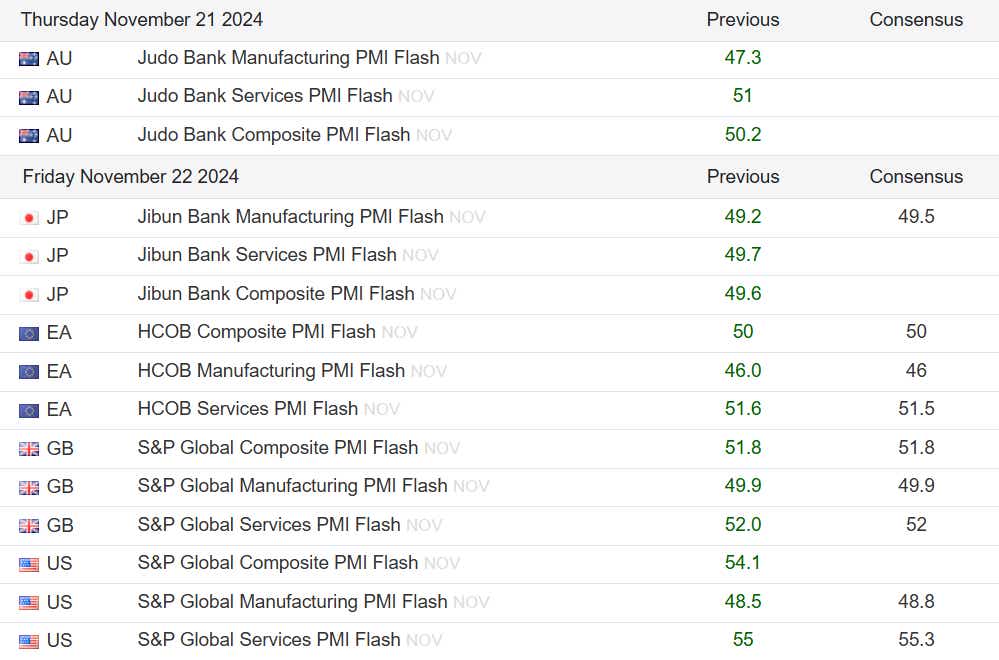

Purchasing managers’ index (PMI) data from S&P Global will offer a timely view of business cycle trends in the world’s leading economies. The punchline appears in comparing expectations for a quicker pace of economic activity growth in the U.S. with calls for another month of standstill in the Eurozone.

This might put a spotlight on the widening disparity between the world’s powerhouse economies, its negative implications for overall growth, and the risks posed by rising interest rates in such an environment as markets reprice for a less-dovish Federal Reserve next year. That may not sit well with stock markets.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.