U.K. CPI Preview: The British Pound May Fall on Soft Inflation Data

U.K. CPI Preview: The British Pound May Fall on Soft Inflation Data

By:Ilya Spivak

The British pound has been badly beaten by the U.S. dollar, and more may be ahead on U.K. CPI data.

- U.K. CPI inflation data may register cooler than the markets are expecting

- A soft result may shift Bank of England rate cut bets to a more dovish setting

- The British pound may fall against the U.S. dollar, extending a deep decline

From a seminal shift in Federal Reserve monetary policy to a historic presidential election, financial markets have understandably spent most the past month obsessing about the United States. This week, with many of the big inflection points now in the rearview and a lull in top-tier U.S. event risk, the spotlight has time to shine elsewhere.

The release of October’s U.K. consumer price index (CPI) data stands out as one of the key line items on tap. The figures are expected to show that headline inflation ticked higher to 2.2% year-on-year last month, up from the three-year low of 1.7% recorded in September.

U.K. inflation may be cooler than markets anticipate

Core CPI growth – a measure that excludes volatile food and energy costs, which are mostly set on global markets, where central bank policy has limited agency – is seen inching down to 3.1% year-on-year. That would be its slowest pace since September 2021.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

U.K. economic data outcomes have increasingly disappointed relative to the markets’ consensus forecasts, according to analytics from Citigroup. This implies that the economy appears to be softer than what has been reflected in asset prices. That may translate into a weaker upward pull on prices than expected, as well as make room for a market rethink.

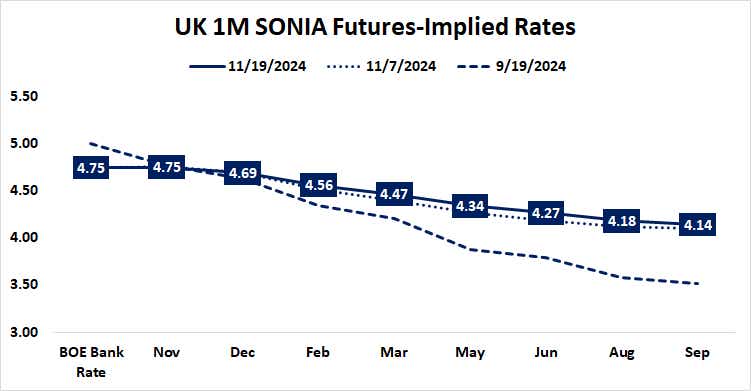

As it stands, benchmark SONIA interest rate futures envision no more rate adjustments from the Bank of England (BOE) this year. For 2025, traders have penciled in 61 basis points (bps) in easing. That amounts to two standard-sized 25bps reductions and a 44% probability of a third one.

The British pound may fall on rising BOE rate cut speculation

The next cut is seen happening by March, and another by August. If CPI data prints cooler than anticipated, a dovish shift in expectations may dial up scope for rate cuts, bringing next year’s total tally closer to the 75bps needed to discount a full three cuts. It may likewise push up the timeline for the next step lower, perhaps to February.

The British pound stands out as the primary casualty in such a scenario. The currency suffered steep losses over the past seven weeks at the hands of a resurgent U.S. dollar, where a hawkish rethink of Fed monetary policy has inspired gains alongside a sharp rebound in Treasury bond yields.

The pound began this week in digestion mode, licking its wounds after hitting the lowest level in nearly five months. Selling pressure may gather steam anew if it breaches support marked by June’s low just above the 1.26 figure after a miss on CPI. That may set the stage for a slide to April’s bottom at the 1.23 mark.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.