Futures Trading Cheat Sheet: All You Need to Know

Futures Trading Cheat Sheet: All You Need to Know

Futures cheat sheet, biggest winners and losers, highest volatility and two trade ideas

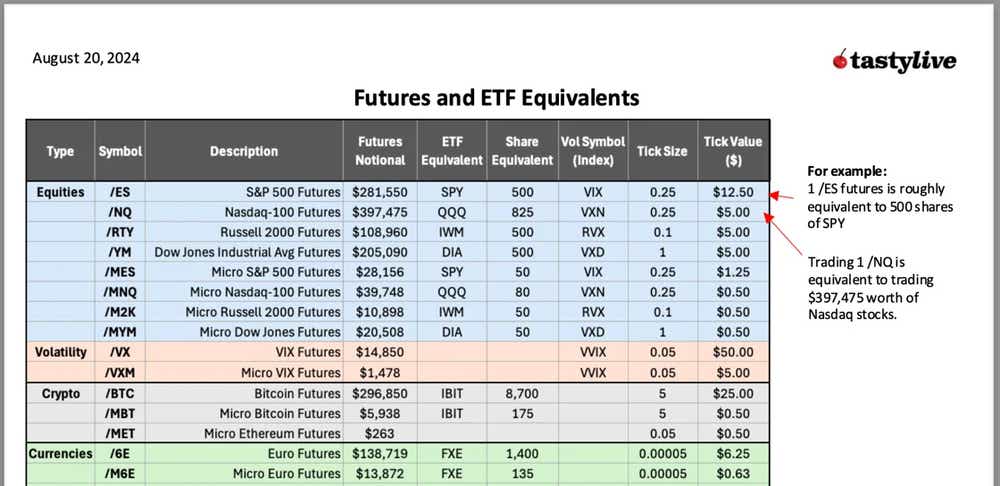

Interested in knowing how many shares of SPY are equivalent to 1 /ES futures contract? Or how big a Bitcoin futures contract is in U.S. dollars?

Use our Cheat Sheet to find out! Click here.

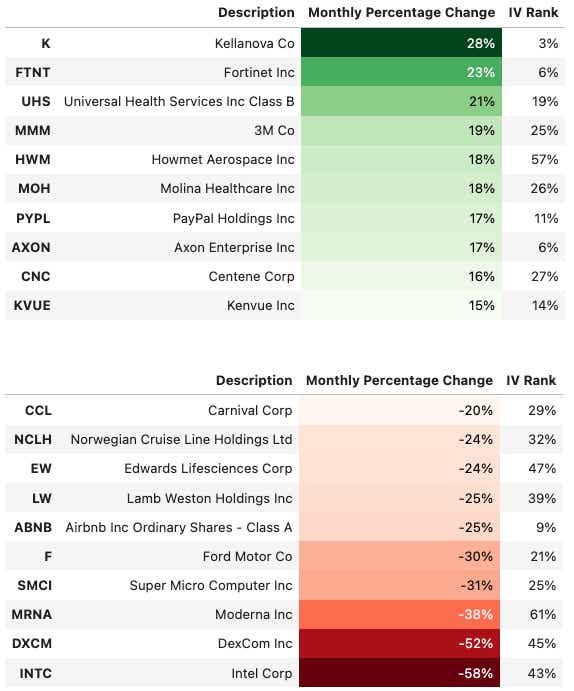

Biggest Gains and Losers in the S&P 500

Right now, 3M (MMM) and PayPal (PYPL) are among the biggest winners in the S&P 500. The biggest losers include Carnival Cruise Lines (CCL), Airbnb (ABNB), Ford (F) and Intel (INTC).

High historical and current volatility

These four symbols show the highest combinations of high historical and current volatility:

XRT (SPDR S&P Retail ETF)

SMH (VanEck Vectors Semiconductor ETF)

XME (SPDR S&P Metals & Mining ETF)

GDX (VanEck Vectors Gold Miners ETF)

These four exchange-traded funds (ETFs) are highlighted in a box in the upper right corner of the chart, indicating they have both high IV (implied volatility) and high IV rank.

_(11)-2.webp?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

ETFs like XLI, XLP and XLV have high IV rank but lower IV compared to the top four.

QQQ, SPY and DIA are positioned toward the lower left, suggesting lower volatility overall.

IYR has the lowest IV Rank among the displayed ETFs. Meaning it's volatility is historically low.

Two trade ideas

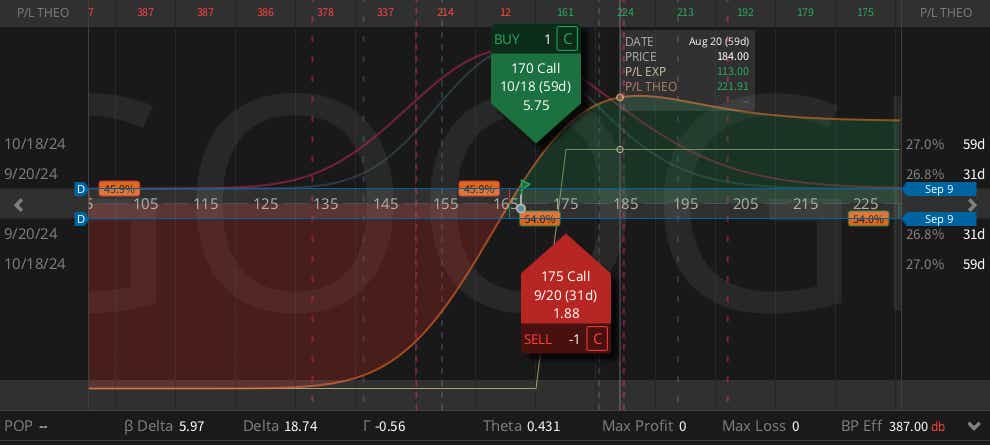

1. GOOGL ($167) Call Diagonal (OCT/SEP)

GOOGL hasn't participated as much as the rest of the Magnificent Seven in this last weeks rally. Maybe there is a catchup trade there. If you want to lean bullish but stay small, the diagonal spread long 170 call (OCT) and short the 175 call (SEP) provides around 18 long delta for just a $3.87 debit.

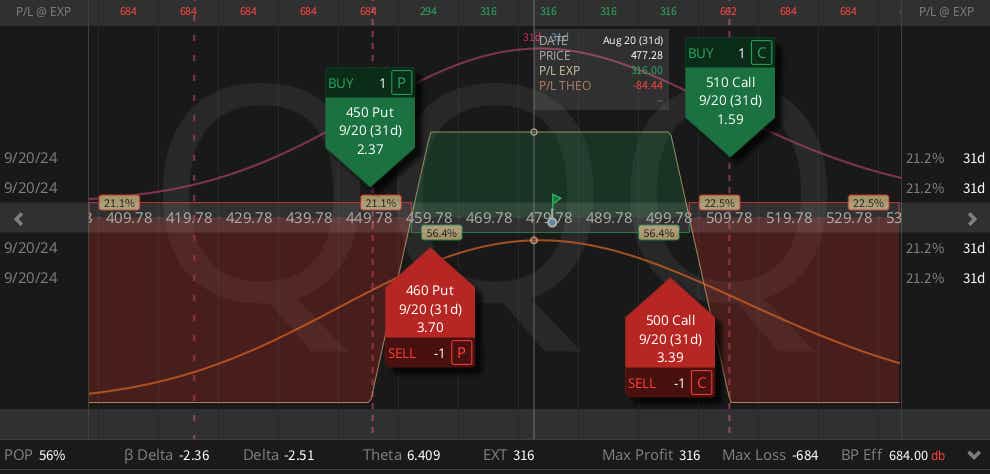

2. QQQ ($479) Iron Condor (SEP)

We've got JPOW (Federal Reserve Chair Jerome Powell) on deck, and Nvidia (NVDA) earnings reporting next week—eight straight up days and a volatility crush of epic proportions. Maybe we trade sideways for a couple weeks? Short the 460/450 put spread and the 500/510 call spread in SEP trades at roughly one-third the width ($316) of the spread with around $6 in theta decay.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.